An introduction to Crypto ALT: WAVES

WAVES is a blockchain that helps you easily and economically construct customized blockchains, decentralized exchanges, create proprietary tokens to facilitate fundraising, create tools for trading. WAVES can create tokens similar to those of Ethereum (ERC20) at an economical price (only 1 WAVES, presently selling for about $10): this can be used to help manage a community or raise funds.

The cost for each transaction to transfer assets is also very low (equal to 0.001 WAVES) and can be paid in WAVES or in token, if accepted, by the network nodes.

The platform roadmap for 2018 is appealing, you can check it out for yourself by clicking here.

Where can I store my WAVES?

You can create a WAVE wallet directly from your computer by adding the corresponding Chrome APP or by using the web version. In addition to being able to view, receive, and send your assets, the wallet gives the ability to create your own token, to trade assets using the decentralized Exchange and to lend your WAVES in order to gain interest.

Why should I lend my WAVES?

The WAVES Blockchain is validated by the nodes using the LPOS concept (Leased Proof of Stake). In summary, a node can generate blocks based on the percentage of WAVES that the node holds on the wallet attached to it divided by the total WAVES held on all nodes and it is possible for each WAVES holder to lend his WAVES to a node. For example, if the total of WAVES on wallets linked to nodes is 1,000,000 and a node has 1,000 WAVES, this node will have 1/1000 chance to generate a block.

By lending your WAVES to a node, you help contribute to make the blockchain decentralized by increasing the chance of small nodes to forge blocks. In return, the node will give back a dividends based on the number of WAVES you lent to the node. For example, if the node has a total of 10,000 WAVES, you have lent 1,000, and the node forges a block and the block contains 20 WAVES of fee, you will be entitled to 1,000/10,000 * 20 = 2 WAVES.

An important thing to keep in mind is that your WAVES are not at risk if the node is hacked. Your WAVES never leave your wallet when you lend them, and you can close the loan whenever you want. So if you intend to keep your WAVES as a long-term investment, it is better to lend them to a smaller node, in order to decentralize the blockchain as much as possible.

How much do I expect to get by lending my WAVES?

Although on the official website it shows as 5% per annum, however, the real percentage, from what is understood within the community, is about 1% per annum, but it is envisioned to rise with the growing use of the network.

Why should I lend my WAVES to a small node?

As previously mentioned, this is useful for decentralizing the blockchain. It is true that a node that has few WAVES is less likely to forge blocks than others that have more, but you have to consider that the dividend share is much greater as you have to divide it with less users.

If you have decided to lend your WAVES, we advise you to lend them to this node that needs to grow: Waves Lease.

OK, I already have some WAVES, how can I lend them?

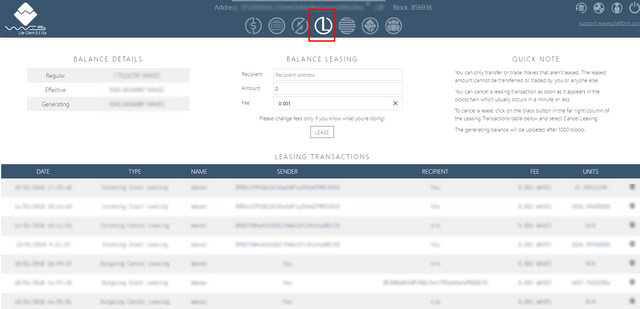

a) Enter your wallet and click the L symbol

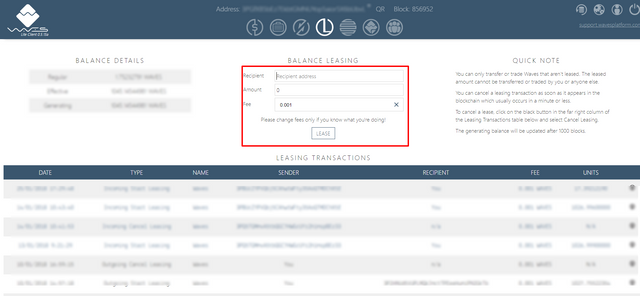

b) Enter the amount you would like to pay (minus 0.001 WAVES of fees) and type the address: 3PGfXB5bEz7EkbtGMNUYop5aior5X6bUbvL

c) Click LEASE

Done! The loan will be activate after 1000 blocks.