V For Vampire Squid

"Well, Goldman Sachs are Scum"

"They’re all Goldman Sachs Scum. Whether it’s Hank Paulson, Geithner..."

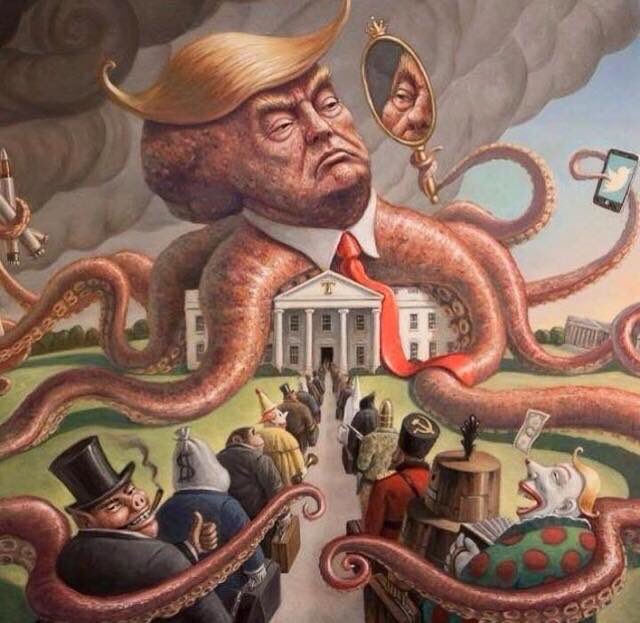

Goldman Sachs Vampire Squid

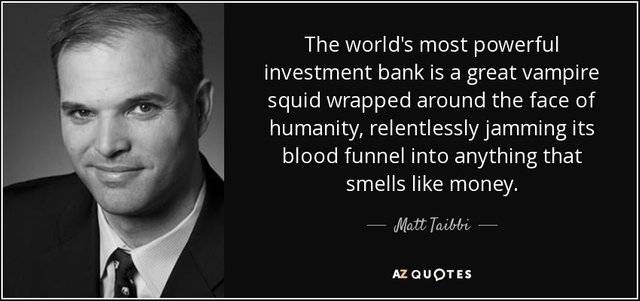

The brilliant an hilarious American author and Rolling Stone contributor, Matt Taibbi, first coined the term "Vampire Squid" to describe the investment bank in his 2010 offering Griftopia. The highly imaginative phrase perfectly captures the parasitic nature of Goldman Sachs and it's predatory behavior. The banking crisis of 2008 exposed a financial system run amuck, years of deregulation resulted high risk casino capitalism that almost destroyed the world economy. The same people who fiercely railed against any form of government regulation in the financial sector held the economy hostage and demanded hundreds of billions in taxpayer bailouts.

In his dissections of Wall Street in Griftopia and The Divide (which I wholeheartedly recommend), Taibbi explores the 2 tier system emerging in contemporary American society with incredulity and fascination. Griftopia helps the average person make sense of an ever increasingly complex financial universe complete with intricate mathematical formulations and mind bending terminology. One thing is clear, law is applied very differently depending on if your a 'Main Street' citizen or a Wall Street' denizen.

Griftopia Audiobook Part 1 via Youtube

Matt Taibbi on Goldman Sachs

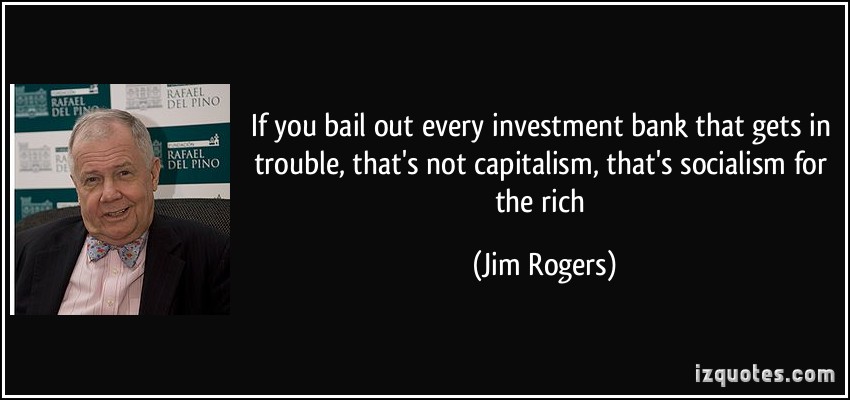

Government Goldman

"They've Coopted the US government, the Treasury Department and the Federal Reserve functionality...

They’ve coopted the Obama administration.

You know Barack Obama dances to Goldman Sachs' tune"

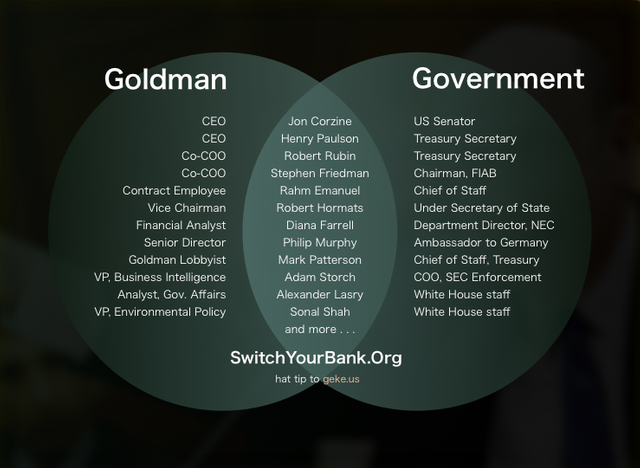

The Revolving Door

Like clockwork, In and out they march. One year they're the CEO of a Wall Street bank and the next year they're the Treasury Secretary.

Though this Venn diagram is almost a decade old, it still illustrates the significant infiltration of Goldman Sachs into every facet of the US federal government financial structure.

To the names featured on this list we can add:

- Henry Paulson - US Treasury Secretary (Bush/Obama Administrations) - Former Goldman Sachs CEO

- Timothy Geithner - US Treasury Secretary (Obama Administration 2009) - Closest advisor Goldman Sachs Lobbyist

Although former Goldman Sachs officials consistently occupy key financial and economic positions in consecutive administrations, they're joined by a long list of their Wall Street counterparts. The following Venn demonstrates the continuous revolving door.

Goldman History

For those interested in a more indepth and comprehensive look at the origins of the Vampire Squid @corbettreport produced this video in March 2017 about the bank.

The Corbett Report

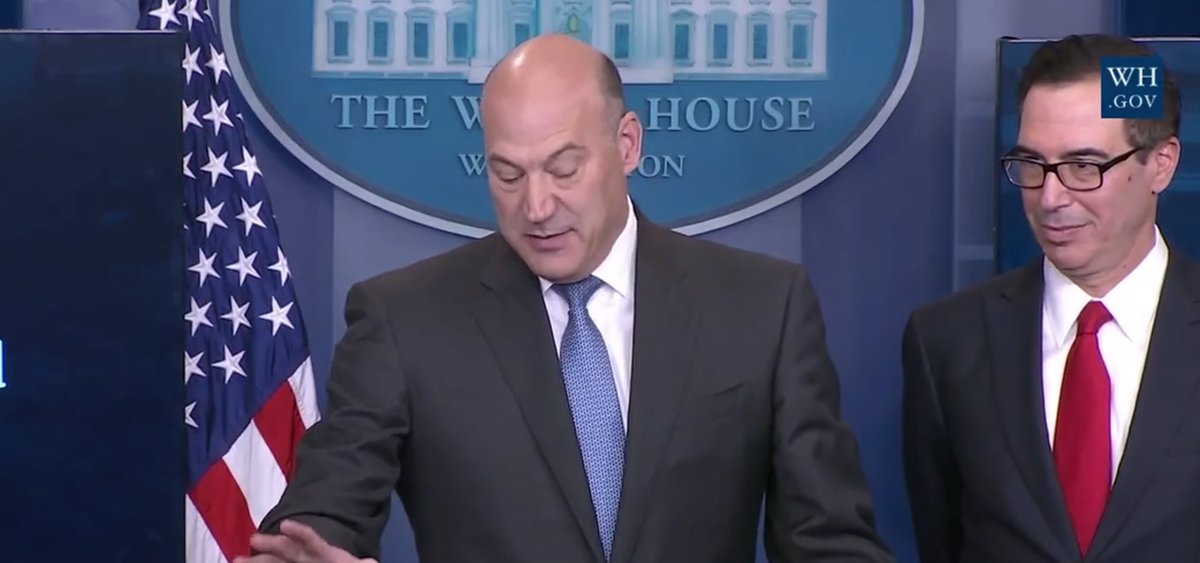

Drain the Swamp (and refill it with fresh Vampire Squids)

During the presidential race Democratic nominee Hillary Clinton was paid more than $250,000 dollars for a single speech by the Goldman brass which inevitably contributed to her failed campaign. Meanwhile, Mr. Trump said he could not be bought by Wall Street since he claimed to be self-funded.

However, despite pledging to 'Drain the Swamp' while campaigning for president, Donald Trump has filled his administration with Swamp Monsters including, but coming as no surprise, several prominent former officials from Goldman.

Steve Mnuchin US Treasury Secretary

- Former executive at Goldman Sachs

Gary Cohn - National Economic Counsel

- Former Chief Operating Officer at Goldman Sachs

James Donovan - US Deputy Treasury Secretary

- Former managing director at Goldman Sachs

Stephen Bannon - White House Chief Strategist

- Former executive at Goldman Sachs

Dina Powell - W.H. senior counselor for economic initiatives

- Former Head of Impact Investing at Goldman Sachs

Jay Clayton - Chairman of the SEC

- Former Goldman Sachs lawyer

It's important to see past the sensational news headlines that distract us from what's going on behind the scenes. Of course, a Goldman administration is completely 'normal'. The financial behemoths have expertly executed a 'silent coup d' Etat', as Max Keiser describes it. The banksters manage, (de)regulate, and enrich themselves in the process.

While the world keeps spinning, so does the never ending Vampire Squid carousel ride...

Is it a coincidence that most of those bankers are as bald as squids ?

I want to eat that squid lol. In Korea we eat squid a lot! ;)

Careful of the blood funnel!

First you need to tenderise it like the Greeks by smashing them against the rocks....

All the people in the world need to stop buying the corporations products for 2 months at the end of 2 months Banksters and big business become weak and broke. Then no bailouts the people can come together and take back the control of this out of control ........problem..

I'd love to see that. A sustained boycott would rattle them. We have more power than we are aware of.

But they do a fine job keeping us focused on wedge issues and the left/right divide.

More like Goldman Sucks amiright?

lol, I was going to title it Goldman Scum but i did not want to besmirch your good name, fine sir.

Haha, thank you very kindly for the thoughtfulness!

100%. Thanks for the post.

No worries...