Crises in Puerto Rico: How big government destroyed the island long before any storm

The following is text from the coming Expat Newsletter, which will be found at Expatservices.org - a website currently in development set to launch soon, Enjoy.

For years the commonwealth of Puerto Rico, a Caribbean Island territory of the United States, has been struggling with insolvency. Although it is part of the Union, Puerto Rico has its own constitution and is allowed to create its own budget and tax laws. For the past decade it has funded its budget with unsustainable amounts of debt. Unlike independent island countries, it cannot simply ease its way out of debt obligations by issuing more printed money the way the US mainland did after the 2008 financial crisis. The reason it cannot print money is because Puerto Rico uses the US Dollar as legal tender, money which it has no authority to print. In early May of 2017, Puerto Rico’s debt amounted to over $70 billion dollars as the commonwealth declared bankruptcy. [1]

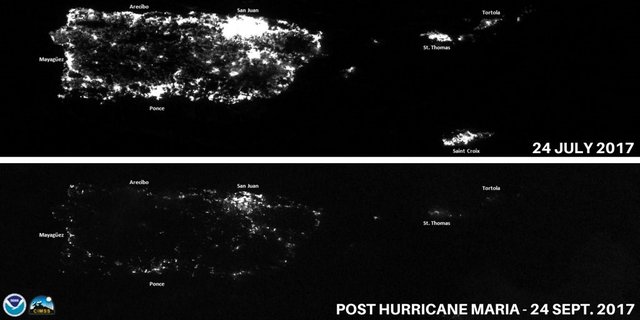

Now that the island has been hit directly with two hurricanes Irma and Maria, the people are left without power. It is estimated now that power will not be regained for another 6 months. [2] So far this year the Atlantic has been hit with four devastating hurricanes, Harvey (CAT 4), Irma (CAT 5), Jose (CAT 4), and Maria (CAT 5). This series of storms is said to be the worst since Hurricanes Karina and Wilma in 2005, the physical and economic damage of which the state of Louisiana is still recovering from. With both of these crisis arriving at the same time, it is hard to imagine that Puerto Rico will recover for many years.

A satellite picture of power coverage in Puerto Rico before and after the hurricanes

It is sad to declare Puerto Rico as dead-in-the-water on just the first issue of the Expat Newsletter. Puerto Rico has long been enjoyed by US mainlanders as a tropical climate vacation spot, as well as a tax haven for those looking to escape US mainland income tax. It is unclear who, if anyone will come to the aid of Puerto Rico after its recent insolvency. Which institution would be willing to lend at a reasonable rate?

The Puerto Rico Debt Crises in Depth

It started in August of 2015 when Puerto Rico had announced that it would default on a bond payment of $58 million. [5] Another payment then was missed in May of 2016, this time for $422 million, and again in July 2016 for $911 million. [6][7] This series of defaults would continue into the next year. The majority of the debt burden was incurred by Puerto Rico’s public utility companies.

Under US Chapter 9 bankruptcy; municipalities, as well as their public utilities, can declare bankruptcy only with the state’s permission. Since Puerto Rico is a commonwealth and not a state, it could not declare bankruptcy and receive protection from its creditors. Congress has since passed PROMESA; an act, which under its Title III, would let Puerto Rico declare bankruptcy.

However, a federally appointed oversight board was created as the only authority to structure this bankruptcy. [8] This means that neither the people nor the leaders of Puerto Rico are allowed to control any aspect of the debt restructuring. Puerto Rico’s governor has asked the board to bring the talks to court rather than settle. It is obvious that Puerto Rico would like bond holders to take as much loss as possible. The board has already rejected a plan to allow for bond holders to recover 85 cents on the dollar. [9]

Also obvious is the fact that Puerto Rico would much rather become a State which would allow it more control over its bankruptcy proceedings. On June 11th, 2017 the people of Puerto Rico voted on whether or not the island should become a state of the US; only 23% of the population turned out for the vote. The vote was almost unanimous for statehood, which would most likely protect Puerto Rico with US mainland bankruptcy laws enjoyed by the other 50 states. At this point, the island had $49 billion in unfunded pension liabilities. It is unlikely that Puerto Rico will receive statehood since both Congress and the President of the US would need to approve of the action. Both the Whitehouse and the Congress are occupied currently by protectionist Republicans who do not want the US taxpayer to be burdened with Puerto Rico’s debt. [3] However, the average US citizen is still on the hook for the debt of Puerto Rico since its bonds are mostly held in US investment funds.

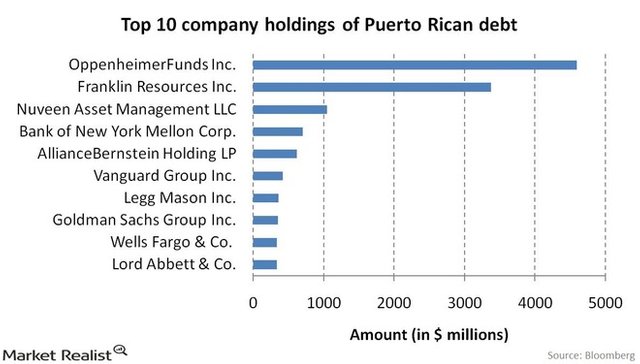

Above is a chart of the current holdings of Puerto Rican debt by company. All of which are US banks or investment firms. The top two, OppenheimerFunds and Franklin Resources, are based in New York and invest money for mainland US citizens.

Founder of Euro Pacific Capital - Peter Schiff, who lives in Puerto Rico, explains how the island got to this point. Fund managers, who invested in this “toxic junk” did so because of tax incentives and high yield with absolutely no concern of risk. Instead they were only interested in chasing yield in an environment of 0% interest rates set be the Federal Reserve. This was an excellent opportunity for the Puerto Rican government. Politicians act the same all throughout the world; in order to get elected, these politicians bribed their voters with the borrowed money from the bonds. This led to a very bloated budget for the government of Puerto Rico. Let’s hear Schiff discuss in his own words big government’s effect on Puerto Rico:

“…the minimum wage law, all you guys that want 15 dollar minimum wage, Puerto Rico has had it for years on an equivalent basis, because the per capita income in Puerto Rico is basically less than half of what it is in the United States. So at $7.25, minimum wage in Puerto Rico is like a $15 minimum wage. And that’s why hardly anybody in Puerto Rico has a job… and then of course we crippled them with the Jones Act, which makes it also expensive to ship goods in and out of Puerto Rico. That requires the Puerto Ricans to have goods transported on US flagged ships which cost a fortune... That means everything in Puerto Rico costs so much more than on any other Caribbean Island. Not only does that make it harder for the Puerto Rican residents to live, but think about Puerto Rico in terms of a tourist destination. Puerto Rico has a tiny percentage of its GDP from tourism, I mean the lowest of any Island in the Caribbean (~3%). Puerto Rico should be the biggest tourist destination in the Caribbean. Why? You don’t need a passport, you can go there with a driver’s license, [they speak] English, the dollar is legal tender, it’s very close… When you go to Puerto Rico with a US cellphone, it’s not even roaming… So you should have middle class Americans flocking to Puerto Rico for vacation. Why aren’t they going there? Why are they going to other islands? It is a beautiful island, it’s got great beaches, they have some of the best surfing in the Caribbean… They’ve got stuff going on, they’ve got night-life, they’ve got a rainforest. Why doesn’t Puerto Rico have a bigger tourist industry? It’s because of the minimum wage law and the Jones Act. [4]

With suffering tourism, Puerto Rico’s prospects for income continue to dwindle. If Puerto Rico cannot restructure its debt, it will need its reconstruction financed by outside sources. But whether it is a federal bailout, which seems unlikely at this time, or if bond holders take substantial losses, it will be the average US citizen who loses since they hold the majority of the bonds through these investment funds.

Notes:

[1] https://www.bloomberg.com/news/articles/2017-05-03/puerto-rico-governor-wants-board-to-file-bankruptcy-like-case

[2] http://uk.businessinsider.com/puerto-rico-power-outages-2017-9/#that-means-rebuilding-the-islands-electrical-infrastructure-will-be-an-even-longer-process-san-juan-mayor-carmen-cruz-says-it-could-take-up-to-6-months-to-revive-the-electric-grid-2

[3] https://www.youtube.com/watch?v=wIpwKZBAy1Y

[4] https://www.youtube.com/watch?v=zgC-2QEFOgg

[5] https://www.usatoday.com/story/money/business/2015/08/01/puerto-rico-missed-debt-payment-default-looms/30983671/

[6] https://www.nytimes.com/2016/05/02/business/puerto-rico-to-miss-largest-payment-to-date.html

[7] https://www.bloomberg.com/news/articles/2016-07-01/puerto-rico-governor-says-he-will-sign-budget-after-defaulting

[8] http://www.businessinsider.com/3-main-reasons-why-puerto-rico-cant-declare-bankruptcy-2015-7

[9] https://www.bloomberg.com/news/articles/2017-09-27/prepa-bondholders-offer-1-billion-loan-to-restore-electricity