How to Figure Out the Context of the Market - Trading with Wingz #2

One of the most important skills to have as a trader is being able to read the context of the market, then structure it into an opportunity and execute the trade.

In my last post we covered what an 'edge' is in the markets.

But what is context?

Let's take a completely random example - going for a night out. Let's say we have two options we can either go to a warehouse rave or an opera. Two very different environments. There are different dress codes, behaviours and expectations of these environments. We know that on average we can expect two completely different experiences.

This is the 'context' of the environment and it's similar in trading, once we can figure out what the context of the market/environment is we can better position ourselves to take advantage of the opportunities presented. Some trading environments are as different as a rave is to an opera.

The Bulls and the Bears

In any market there are buyers and sellers, they're referred to as the bulls and the bears. Bulls are the buyers in the market, while bears are the sellers. There are constant battles between the two, the charts show the signs of those battles. It's these 'battle scars' we can use to determine the context of the market going forward.

The Three Market States

Markets generally reside in three states - Trends, Ranges or Reversals. You can get combinations, such as a trending range, but for simplicity let's keep them independent. I'll also give examples from the perspective of an uptrend for simplicity, it's the same in reverse for a downtrend.

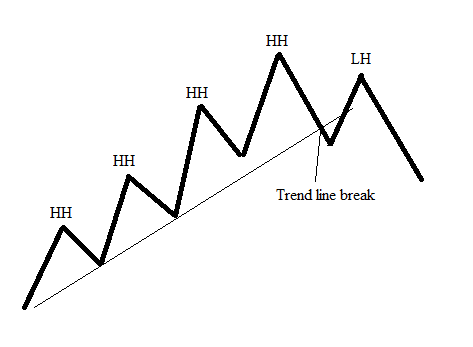

Trends

A trend is where markets are trading higher, they do this in a sort of upward zig-zag shape where the price makes higher highs and higher lows. If you look at a chart and its relatively higher on the right than it is on the left then chances are you're looking at an uptrend.

Ranges

Markets are ranging when they fluctuate between two similar areas, like between 5 and 10. When the market is at 5, bulls go long (buy) while bears buy back (their shorts), when the market is at 10, bulls sell and bears put on a short (take a position where they profit from price decreases). This creates an up and down movement that will eventually break out and resume trending or start reversing.

Reversals

A reversal is when a trend change occurs, if the market had been trending up the reversal marks the point when it starts going down. A reversal is 'reversing' what came before, a transition period.

The Inertia of Markets

Markets have inertia. They either trend or range. When they're trending or ranging they like to stay in that state. It takes energy and effort to pull or push a market out of state. All the books you read about patterns or trading strategies revolve around taking opportunities within the states or taking opportunities during the transition of the states.

When markets are trending, they usually like to keep trending, when markets are ranging they usually like to keep ranging. The states have inertia, there are however, signals that identify what state the market is in and when its moving out. At a basic level that's all trading is, taking advantage of opportunities within the states and when they transition out.

Moving on

In my last post we talked about looking at trades from the perspective of a mathematical edge, in this post we talked about the structure and potential context of the markets. Very broad strokes. These are both pretty abstract concepts, but a requirement for going forward. In my next posts I'll break down each state individually and share some of the strategies I've developed over the years to have an edge.

How I trade trends, ranges and reversals.

I'm looking forward to it. If there's any clarification needed or gaps in my explanation please comment. If there's anything else you want to know, comment too :P

This should have moar votes

This post has been ranked within the top 80 most undervalued posts in the second half of Jan 07. We estimate that this post is undervalued by $5.57 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Jan 07 - Part II. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

Not time to read right now....But just know its gonna be a goodun!

Thankyou

Thanks for touching base

Awesome post, you explained this very well bull and bear with the rave and opera analogy! Thank you for taking the time to help me learn.