The philosophy of technical analysis

So you want to chart? But don't quite understand them or you don't want to get so messy and complicated or you simply don't know where to start. Well before you decide to embark in the technical analysis journey, you should understand its philosophy.

Well before we jump in drawing lines and insert indicators here and there and clog the chart with nonsense, we must simply use two key fundamental concepts: Price action and volume.

When we just take in consideration these two important concepts, then we can simplify what is technical analysis based on.

There's 3 core premises for the technical analysis approach.

- Market action discounts everything.

- Price moves in trends.

- History repeats itself.

Market action discounts everything.

The statement “market action discounts everything” is the cornerstone of technical analysis. This means that anything that can possibly affect the price wether fundamentally, politically, psychologically or otherwise, is actually reflected in the price of that market. This does not mean that charts cause markets to move up or down. They simply reflect the bullish or bearish psychology of the marketplace.

Price moves in trends

This concept is absolutely essential to understand the technical approach. The whole purpose of charting the price action of a market is to identify trends in early stages to effectively take advantage of the direction of those trends.

History repeats itself

Most of the technical analysis concepts are based in the study of human psychology. Chart patterns reflect the bullish or bearish psychology of the market. This behaviour is studied through this approach to assume that they will continue to work in the future because they have worked in the past.

Fundamental Analysis vs Technical Analysis

Fundamentals examine all relevant macroeconomic factors affecting the price of the market in order to determine the intrinsic value of that market. If the intrinsic value is under the current market price, then the market is overpriced and should be sold. If the market price is below the intrinsic value, then the market is undervalued and should be bought. They both solve the same problem, taking a different perspective. The fundamentalist studies the CAUSE of market movement, while the technician studies the EFFECT.

Market price tends to lead to known fundamentals, acting as a leading indicator of these. while the known fundamentals have already been discounted, price action in the present is reacting to unknown fundamentals. by the time those changes became known, the new trend was well underway. Being a technical analyst will make you confident to be sure about your decisions even when the market movement disagrees with the so called fundamentals. The technician knows that market actions will become common knowledge. That’s why many traders choose technicals over fundamentals because technicals already include fundamentals, but not vice versa. Personally I prefer technicals over fundamentals any time.

Analysis vs Timing

In the analysis or forecasting process, both technical and fundamental approaches are very welcomed. But timing a right entry or exit is purely technical. For example, in margin trading, timing is crucial. It's possible to be correct on the general trend by analysing through fundamentals, but you can still lose money because low margin requirements expose you to high dependancy on small price moves,so when you trade the wrong direction, they can force you out of the market loosing all or most of all your margin. That’s why, inevitable, in your trading decisions you will have to rely on the technical approach at some point of the process of opening and closing a position.

Flexibility of technical analysis

There is no market that you can’t apply this approach. You can easily follow as many markets as desired, one thing you can’t do with fundamentals because of the vast amount of data you have to deal with, fundamentalists tend to specialise. Markets go through cycles, and there’s hot trends that are followed by cool periods. This is were the technical trader can take advantage of rotating markets. Fundamentalists can’t have this flexibility, at least not as easy.

Critiques for the technical approach

The self-fulfilling prophecy

This often involves arguments such as: the use of chart patterns has been widely publicized in the last several years so many traders around the world are familiar with them and act in an on them collectively because waves of buying and selling are created in response to this patterns. This assumes that everyone entered the market the same way at the same time and the truth is, is that charting is very subjective. There’s is always an element of doubt and disagreement. Even if most technicians agree on a market forecast, they won’t necessarily enter the market the same way and at the same time. Some would try to anticipate the move, some would buy the breakout, others will wait for the pullback, some are aggressive, some are conservative, some use stop orders to enter while others use market orders, some trade long term, short term, so the possibility of everyone acting at the same time self-fulfilling a prophecy of a chart pattern is actually quite remote.

The random walk theory

This theory claims that price changes are serially independent, in other words, price movements are unpredictable and random. This theory is based in the efficient market hypothesis, which holds that prices fluctuate randomly about their intrinsic value. This goes along to the buy and hold strategy instead of trying to beat the market by trading its movements. While there is certain randomness or noise in the markets, we can’t assume that all price movement is random. Defining the price as random only implies that there’s a lack of understanding of how systematic patterns work. the fact that many people are not able to discover the presence of these patterns does not prove they don’t exist. How can you explain a trend then if price action is purely random?

So there you have it, an objective explanation of the philosophy behind technical analysis to help you understand what this is really all about, at the most core level so you can always keep focus and not get overwhelmed by all the tools, techniques and technical strategies you can encounter. To me, the technical approach has been proven very useful and reliable over the years of my trading and is a field that you can’t ever stop learning, there’s always something new to take advantage of in the technical analysis world.

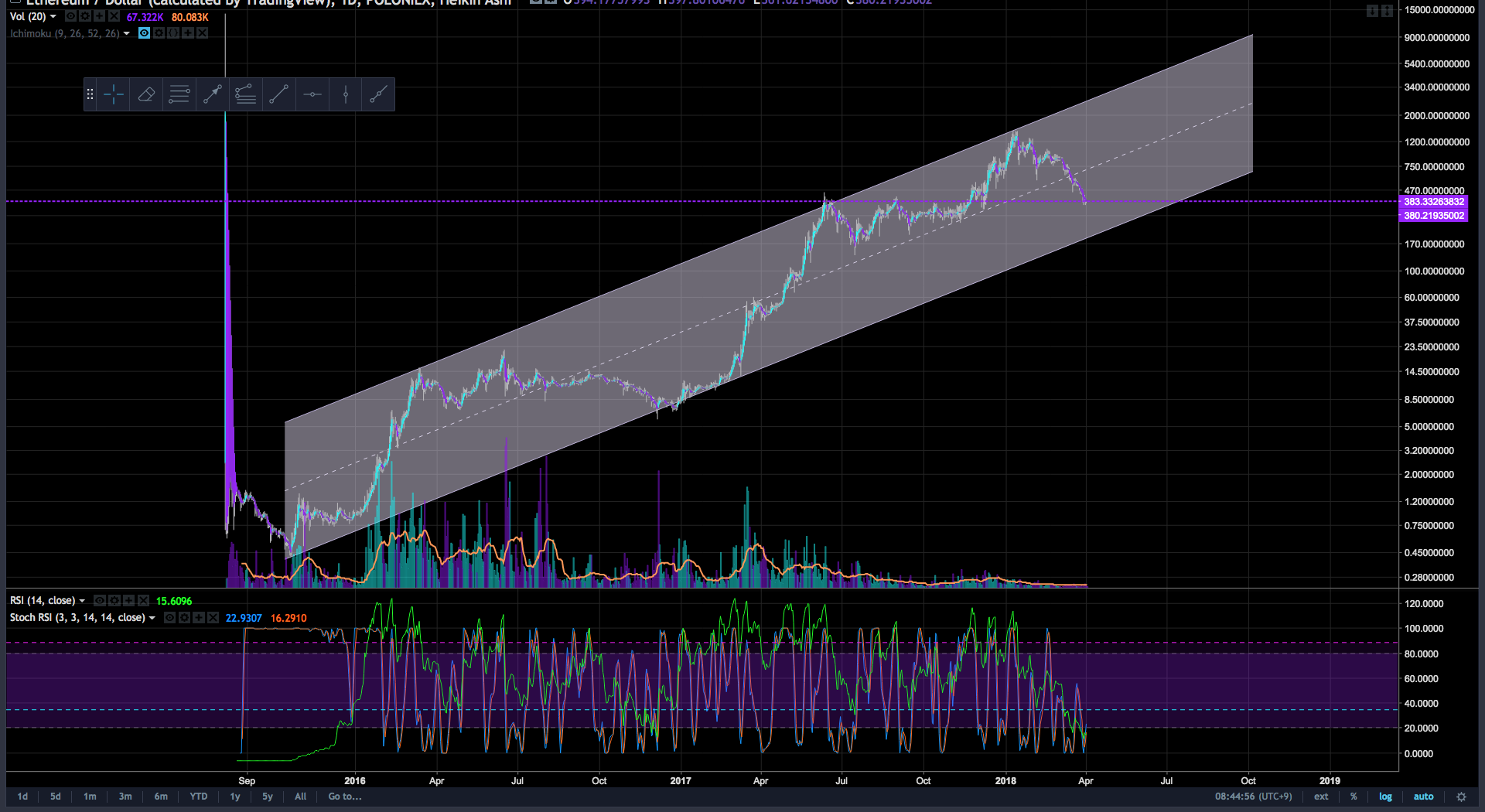

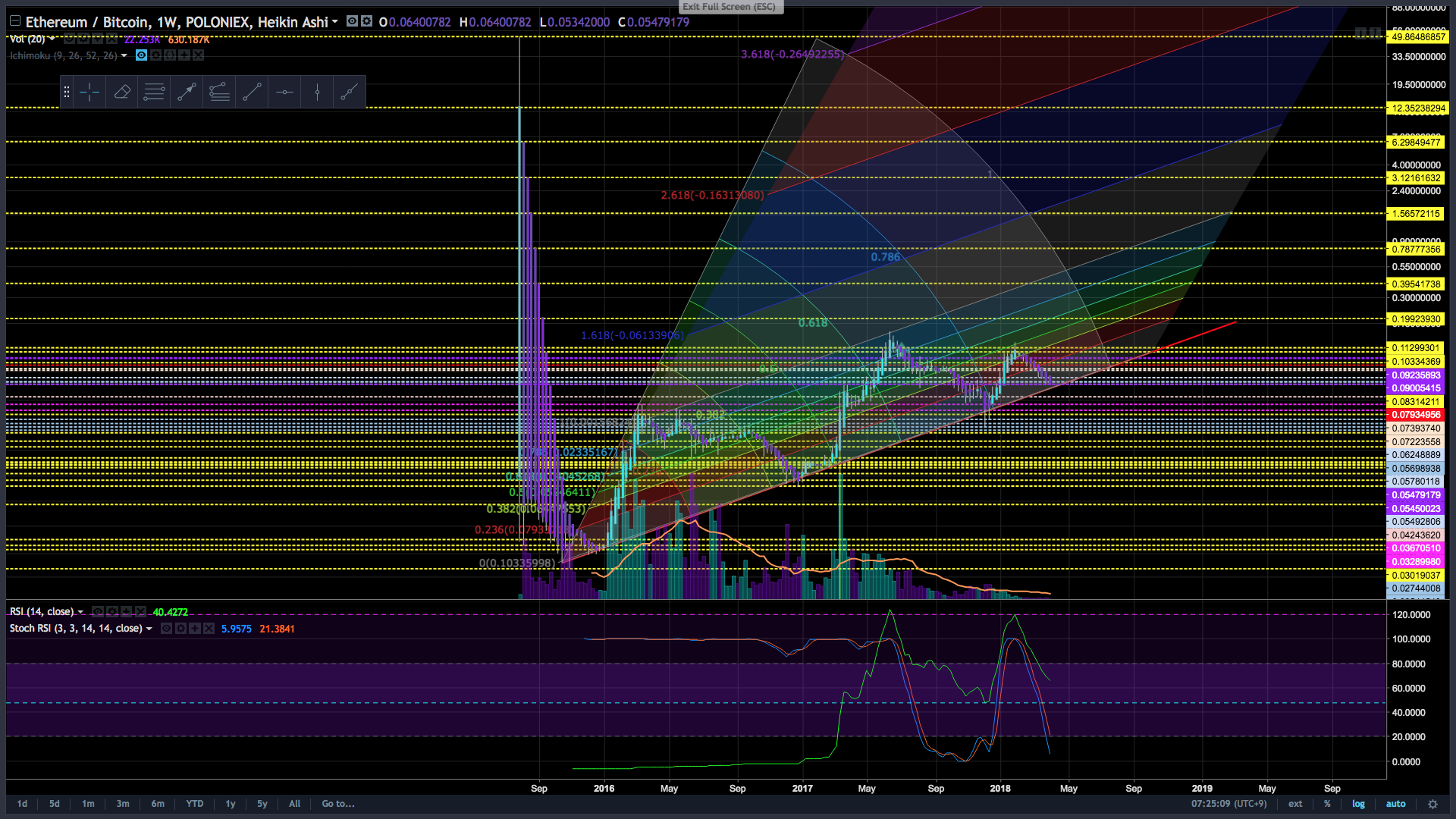

PS: if you guys are wondering what's going on with ETH, things aren't looking that good to be honest. It seems that the price wants to touch the bottom of that channel, and in the short term, the middle of it will act as resistance. If you look at december 2016 and january of 2017, the RSI was oversold, just as this time, the difference is that before, the price touched and created that bottom channel, now we are not touching the bottom of the channel yet, and we are already oversold, which makes me think a bounce to the middle of the channel is more likely to act as resistance to later on search that bottom again once there's more room in the RSI.