Short Swing Setup in ETHUSD 1:4 Risk to Reward Ratio

ETH has setup nicely for a short swing with a solid 1:4+ risk to reward ratio. For the newbies... the risk to reward ratio is EVERYTHING. As a trader you have two main metrics that best indicate whether you are on the right track or not... 1: win % 2:R/R ratio. The lower your win % the higher your R:R needs to be and vice versa. Swing trades like I am posting here on steemit work about 55% of the time... so you need at least a 1:2 risk to reward ratio to be profitable over the long haul with these setups. (Standard R:R is typically close to 1:3 because most profitable systems lose more than they win.... read that again.) Notice I said "long haul"... if you are looking to get rich quick on the crypto gold rush then my posts are not what you are looking for.

The entry and exits for this trade will be dynamic which will skew the R:R and I will update as they trigger. I want to be all in at 318 but it will depend on the price action.. I might only get 310's avg or 305's which would be fine. The first target will be the bottom of the volume range (blue line). This will adjust as volume flows through the trading day.

Things I don't like about this trade:

1- We pushed hard up through the 200 SMA (pink line) on the bounce off lows then stuck right on in on the first 240 candle down. The 200 is typically a really strong area of support or resistance. But we did blow through it to the down side before bouncing hard right back through it.. this can indicate a chop zone around the 200, which would be a positive for this setup.

2- I'm bullsih crypto's in general so shorts are difficult for me to take from a psychological perspective... but usually the harder the trade is to take... the better.

Things I like about this trade:

1- downtrend out of a nice cosolidation

2- violent sell right on the POC, point of control (dynamic red line not the horizontal red line) on the first real bounce off the move down out of the upper consolidation.

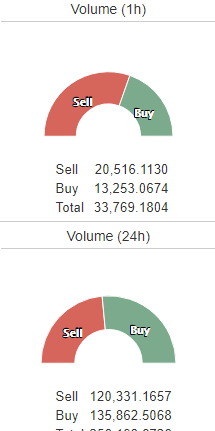

3- Order flow has recently shifted to the down side

Data/image from Bfxdata.com

4- bottom pickers are all singing praises and glory after the bounce on twitter and the Steem... picking bottoms is really difficult to do, and usually gives you a stinky finger. As a trader you are in competition with other traders... when you find overly charged emotions that should make you salivate... trade into the loud mouths, ALWAYS.

Disclaimer: This is NOT trading or investment advice. This is simply my opinion to be used for educational purposes only. If you decide to trade you are doing so at your own risk.

If you found value in this post, please upvote and resteem. Let me know what questions you have.

Happy Hunting

Interesting. I have always traded between BTC/ETH instead of USD/ETH. It's less risky?

Well... in my opinion, risk is better defined by the plan the trader uses to trade, not the instrument itself. I will say ETH/USD is more volatile than ETH/BTC due to the correlation differences of the pairs... and that [volatility] is misunderstood by alot of folks to be risk. But volatility is a trader's paycheck. Yet volatility is an investor's hell.

For updated R:R ratio after real time fills visit:

https://www.tradingview.com/x/LsFCbFKV/

stop moved down close to breakeven on average price.. -2.3 % is all that is at risk now.

Stop moved down to lock in 1.9%

stop moved down to +5.7 %

1st Target hit: +46. 43 or 15.3% on 1/3, stop moved down to +6..6% on remaining 2./3