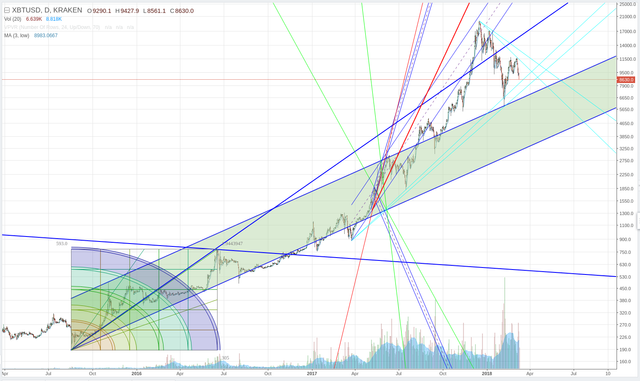

RE: Bitcoin to $15k in March, $8.5k by June, then $30+k by Q1/2019?

click to zoom

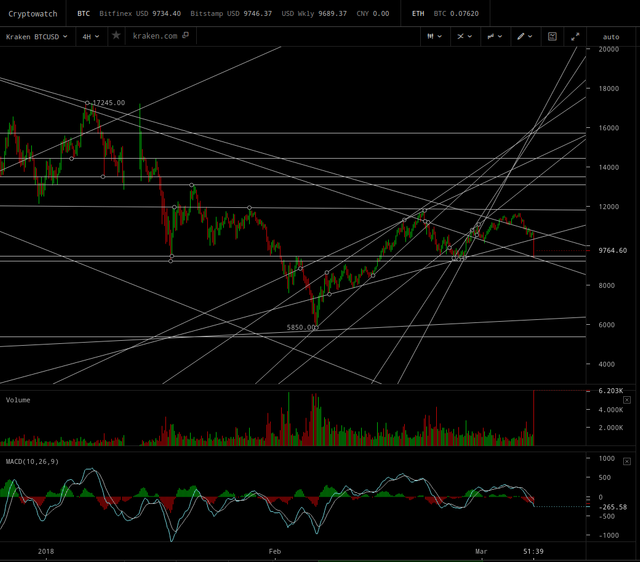

Potentially perfectly symmetric inverted H&S forming. This spike down is way oversold and necessary to shake the tree of weak hands before the move up to break through $12k resistance on the way to $15k.

The blog wasn’t intended to say that we wouldn’t possibly have choppiness along the way. I was thinking it might form the right inverted shoulder at the trendline resistance above $10k as shown, but instead we still have so much downside pressure fear (weak hands to slaughter) that get the fully symmetric right shoulder instead. This extreme volatility and choppiness is indicative of the uncertainty which can delay the move to $30+k until Q1/2019.

Anything is possible. I’m writing about the scenario which I think is most probable. Btw, Armstrong’s Socrates GMW has also shifted to bullish in “In Breakout Mode”. Yet it also warns that we still have bearish Cyclical Trend Support, with a possible change in trend (to bearish?) in April.

If we’re in a crypto winter already, of course it’s possible to crash further from here…there won’t be support at $8500 until June. The current support below $9k is ~$6.2k.

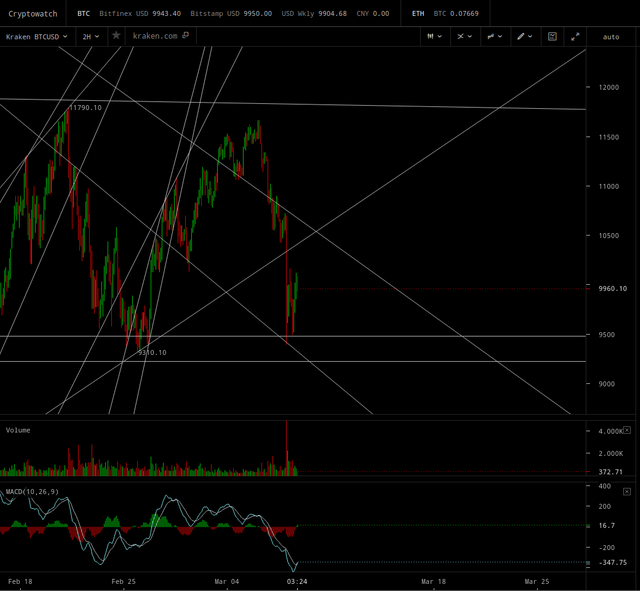

UPDATE 17 hours later: Still turning back up:

click to zoom

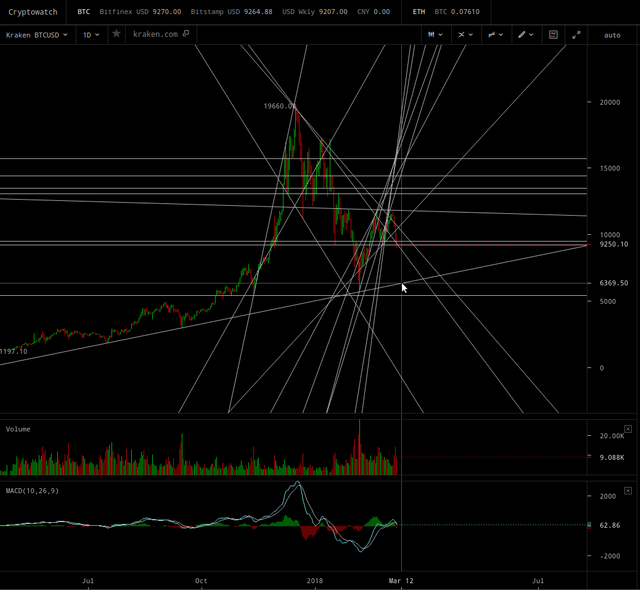

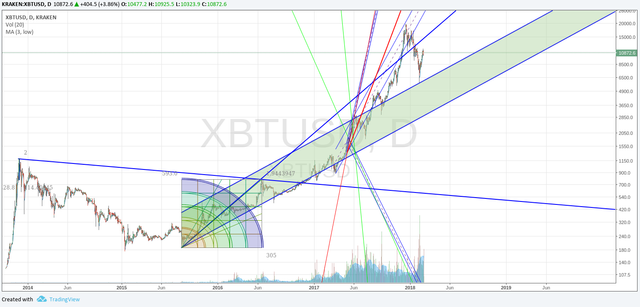

UPDATE 23 hours later: So the potential inverted H&S pattern has been entirely invalidated and instead appears to be a double-top just below $12k. Zooming out to a wider perspective reveals that it’s not that oversold. No support until we hit ~$6300! Looks like we’re headed down to test the top of the blue line channel on one of the charts in the blog. If we don’t bottom above the channel at ~$6300, then the bottom of the channel is ~$3500. Entering the channel would warn that a crypto winter is possible or that the price will not rebound quickly back to the $10+k level. However, I’m reluctant to chase it and panic sell.

click to zoom

click to zoom

UPDATE 24 hours later: This bounce over the past hour might be the opportunity to sell. I have new blog coming about the ICO crackdown and it looks like a bloodbath ahead for ICOs. The total crypto market capitalization chart from the blog is as I had noted indicating that Bitcoin will resume nearly 100% of the total crypto market capitalization chart before Q1/2019. Looking at the prior trend, looks like we will come back down now to ~$200B total crypto market capitalization from the $350B level (with Bitcoin’s at $150B) as of now. Looks like a drop to ~$6300 could be imminent. This would allow for Bitcoin to rise again to $30+k, while the ICO-issued tokens continue to crater towards zero throughout this year as enforcement widens over time. The key insight that should have generated an early warning from this blog came 5 day after I wrote it, when I added that last section about potential for ICO-issued tokens to crash based on what that chart was portending. I should have paid more attention to the possibility that crash could be underway already due to recent SEC subpoenas. Details coming in my next blog.

In hindsight, when the price declined below $10k, that clearly shows breaking a trendline I already had on my chart as shown, and warning that the posited inverted H&S pattern was invalidated. I was so busy researching and composing my new blog, that I wasn’t monitoring the chart carefully and didn’t pay attention to that change in the outlook. Should have been able to sell above $10k, instead of $9400. Also I entirely screwed up by being so distracted that I failed to remember that H&S patterns imply a move of the height of the head from the shoulder, which means the price would have had to move to a new ATH and not only $15k, which I obviously was not expecting and would have caused me to be rule out the H&S pattern! Opportunity missed due to being too overworked.

Also I had not been paying attention lately to the rapid acceleration in the enforcement in the USA of FinCEN and SEC regulations which will be detailed in my upcoming blog. Tying that together with the revelation in this blog showing that Bitcoin is likely to return to near 100% of the total crypto market capitalization before the end of this year (it’s already back up to 42% from a low of 32%), it seems that the ICO-issued tokens are about to have a significant portion of their market capitalization erased.

Although it’s not yet clear if the coming actions will be limited to what the U.S. regulations can impact in their jurisdictions, and to what extent that is a limitation with for example the expansion of exchanges in Japan recently. Although I read that Japan and Russia are also working on new regulations for ICOs:

http://fintechnews.sg/12836/blockchain/the-state-of-icos-around-the-world/

https://hackernoon.com/state-of-cryptocurrency-regulation-february-2018-a316c291320

https://www.coindesk.com/russia-eyes-summer-deadline-new-cryptocurrency-laws/

And let’s remember that Asia’s crackdowns followed the SEC’s The DAO actions in July 2017. So perhaps again the USA will lead on this issue, and Asia will follow. So perhaps the outcome will be mixed and choppy result for the remainder of this year at least. I think it’s folly to assume this will all be over and done with within a few months, because the number of global jurisdictions that also have to make their decisions. This looks like a long period of uncertainty. Yet the new regulated ICOs and exchanges (e.g. tZero and the Goldman Sachs’ Poloniex) will be a new fledgling source of liquidity ramping up.

Perhaps the crypto winter if it starts in 2019, could be driven by another factor such as Tether failure or miner driven SegWit donations theft, both of which could impact the UNREGULATED exchanges significantly. Whereas, the regulated exchanges that are forming within the USA now would be unaffected because they presumably will not accept Bitcoin directly! IOW, SegWit and Tether could be the means by which to destroy the exchanges which refuse U.S. lead on regulations. A way to spank the rest of the world for gambling on centralized copycoin proof-of-stake shitcoins and their scams. How befitting that would be if true.

I’m contemplating the plausibility that possibly Goldman Sachs after luring the EU and the PIIGS into their current sovereign debt collapse morass, is again tossing out a bait for the future victims. Again this should once again may be another evidence to help understand who created Bitcoin and a potential motivation for their master plan.

It’s important to remember that my first quip (at the Martin Armstrong thread at BCT) when this decline accelerated in January was I would expect a drop to $7000 – $8500, and I quipped privately that I would sell if it rebounded to $15k. Then in February after some chart analysis during the crash to $5850 intraday low, I wrote that the maximum bounce appeared to be $12k. I seemed to get swayed by the potential inverted H&S pattern (because trying to multitask too many tasks and not even finding enough time to sleep) and also I was being influenced by Armstrong’s Socrates system which had written “In Breakout Mode” for Bitcoin. I need to stick with my initial insights and intuition. I’ve been warning about ICOs since last year.

click to zoom