THORChain

This episode of ICO101 was a paid ICO preview conducted by host Aaron Paul. The following blog is the accompanying write up by CRYPTO101 writer Ryan LaMonica and reflects his own assessment of the project in question.

“Why should you trade your trustless assets on a trusted platform?”

- John-Paul Thorbjornsen, THORChain Advisor-

The team at THORChain is working hard to deliver what they envision to be a truly decentralized exchange (DEX) alternative that can match the flexibility, performance, and features of centralized exchanges while preserving the core tenets of financial and security sovereignty. How will they achieve this? Let’s take a look at the project’s namesake blockchain protocol.

THORChain

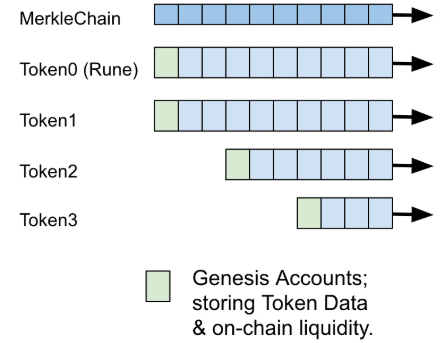

This multi-blockchain protocol has several features that are intended to facilitate the high performance of future DEXes built upon it. Because one of their goals is to facilitate transactions between other token protocols and exchanges, THORChain is comprised of discrete side chains (one for each external token) and a master “Merkle” chain. The master chain will serve to synch the entire state of the network while the side chains will exist as genesis accounts to archive the individual token characteristics. Enjoying equality in the eyes of the protocol’s Validator pool, each sidechain will track transactions for their respective token and hold on-chain liquidity.

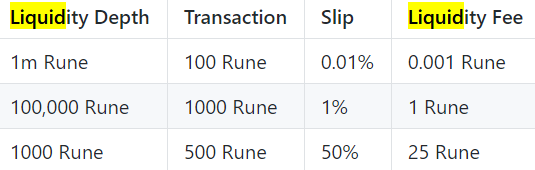

Liquidity is a major feature of the THORChain protocol and any DEX it will eventually support. Existing DEXes and lower-tier, centralized exchanges are prone to trading pair unavailability that can frustrate participants and limit fungibility in some scenarios. To counter this, the protocol employs Continuous Liquidity Pools (CLPs) and on-chain order-book liquidity multiplication (adapted from the Komodo blockchain). CLPs provide the following benefits:

- Delivers “always on” trustless liquidity for all token in the ecosystem

- Improves the user experience for low-liquidity tokens

- Functions as source of trustless on-chain price feeds

- Generates arbitrage opportunities

- Allows trading at trustless prices

- Provides trustless price-anchors for instant trading (at Layer 2 level)

To encourage participants’ support of the CLPs, e.g. stake their own tokens in an effort to boost that token’s liquidity, a sliding scale for fees has been designed to favor self-interested users who boost CLPs with the highest need (high volume, low liquidity).

And what about those tokens? The THORChain protocol will have native cross-compatibility with UTXO, Account, and contract-based cryptocurrencies. Using trustless two-way-pegs (2WP) and multi-signature accounts, the validator pool will meet the 2/3 signatory threshold and allow for the seamless migration of BTC, ETH, and ERC-20 tokens onto and off of THORChain. This can create some challenges for Cryptonote coins (Monero, Loki), because a reorganization of the validator pool may remove one of the signatories and inadvertently lock the tokens (albeit safely) into place until the required signature returns. Another option in this case is to trade out of the token and safely exit via another bridge.

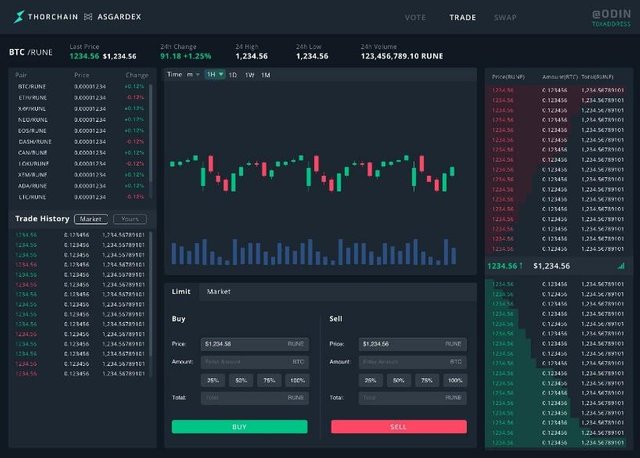

ASGARDEX

While THORChain will ultimately support any number of exchanges with all liquidity deployed to the pool being shared by all participants, ASGARDEX will serve as the first user interface to demonstrate the protocol’s capabilities. Users will be able to:

- Trade/swap any token or coin

- Enjoy unlimited account control

- Experience sub-second transaction speeds beyond current DEX capability

- “out-of-box” 10,000 TPS

- goal: 1M TPS

- Earn a return from staking in liquidity pools

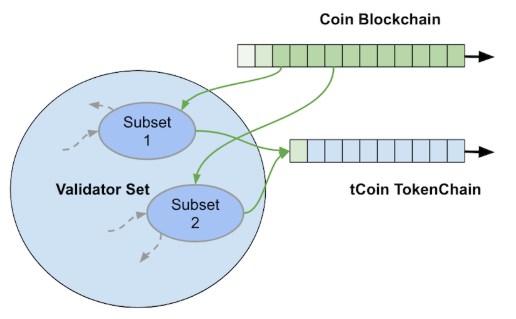

Bifrost Protocol

The Bifrost protocol is another feature of THORChain, allowing support of all tradeable assets, regardless of the originating chain. Categorized as a chain-agnostic, trust-minimizing, bridging protocol, it uses the security of THORChain’s ecosystem to ensure that assets never congregate in such a way so as to present a “honeypot” target for bad actors. Multiple bridges can be in place at optimal performance levels – transaction speeds - while the validation pool maintains signatory supervision over these access points.

Individual CLP price feeds can help to identify the risk of any particular bridge and make real-time adjustments to signature requirements. There is even protocol in place to seize rogue validators who may attempt to spend locked assets and appropriately restore those funds. All of this ensures that attacking nodes will always lose more than they gain.

RuneRune is the native token of THORChain that validators will bond for two purposes:

- Earning block rewards (via a proof-of-stake model)

- Voting for continuous protocol governance

Anyone can participate in the staking, as Rune can be delegated to the pool of Top 100 validators in order to share in the reward. Fees for contributing to liquidity can be earned in both Layer 1 CLPs and the hubs of Layer 2. Here is a summary of how Rune will be distributed:

- 50% public distribution

- 30% liquidity fund allocation

- 20% development fund allocation and paid to developers through

- Contracts

- Public grants

- Open bounties

THORChain’s approach for token distribution is very unique. It’s timing will be based upon milestone progress, of which there are ten. In a way, this differentiates the project from many others who proceeded with their own distributions regardless of protocol development or use-case viability. This feature alone provides some unique assurances for Rune value, even as a utility token.

Summary

There’s a lot to like about the THORChain protocol, with plenty of features and aspirations that go beyond the scope of this review. At its core, the project seems to address a real problem and propose some reasonable solutions. Questions remain on full compatibility with all external tokens (see the Monero and Loki examples above) and a lot of this will come down to the UI and end-user convenience. But there are also some non-technical attributes that can give you a good feeling about the team.

- Their timed-release for Rune distribution is based on project progress. This is very admirable and gives everyone a skin in the game, in pursuit of its ultimate value-creation.

- The project’s roadmap is thoughtfully paced, laying out nearly a dozen milestones over almost two years (Q3 2018 – Q2 2020)…an eternity in a crypto space dominated by instant gratification

- The governing Foundation is non-profit, with volunteer members and a sunset mechanism whereby the power of governance is transferred to participants after the protocol is proven and released for users to adopt and build upon

- An impressive spectrum of academics and industry veterans fill the rosters of the management, development, research, strategy, and advisory teams; developers and engineers are listed at the top of the list and are first to appear on the project’s homepage – strengthening a technical-driven approach

It will be very interesting to track the progress of THORChain over the next year as they prepare to unleash ASGARDEX upon the masses and drop their proverbial hammer upon the DEX landscape.

Learn more about THORChain on their website and follow their progress socially on LinkedIn, Telegram, Twitter, GitHub, and Reddit.

About the author: Ryan LaMonica is a management consultant and blockchain enthusiast with a background in engineering, energy, marketing, and risk management. The views reflected in this article are his own and do not reflect those of his employer. He currently resides outside of Atlanta, Georgia where he and his wife manage the energy and risk of their four amazing children.You can follow Ryan on Twitter, @ryanlamonica.

Hi, @crypto101podcast!

You just got a 0.01% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.