What Economists Either Dont Know Or Wont Tell You About TECHNOLOGICAL DEFLATION (Part1)

Last week I wrote a post about Technological Unemployment. In it I explained how the world is going to see millions of jobs eradicated over the next ten years. The reason for this is the speed at which technological breakthroughs are being implemented and embraced. What use to take decades is now done in a matter of years. It would not surprise me, over the next 5 years) to see revolutionary innovations implemented in a matter of month. The pace of technological innovation is something that we have never seen, at least to the degree it is going now. The employment sector is going to see a massive change and, depending upon how we handle it, this could be beneficial or brutal. Only time will tell how we approach it.

That said, I want to focus now on the idea of technological deflation. This is a concept that is misunderstood by the masses. As a technologist, someone who followed technological trends, I see this as a major component to what is taking place. Economists warn that deflation is a very bad thing and central banks all over the world struggle to combat it. I guess you could say that preventing massive long term deflation is their main focus. Their reasoning is simple. Deflation is terrible for those who provide debt because when asset prices go down, people tend to default. Also, from an overall economic perspective, things tends to slow since prices fall. When this happens, people put off purchases since they will be less expensive in the future. For the most part, under the normal conditions in the past, I would tend to agree with this. However, in this era I do not find it to be true.

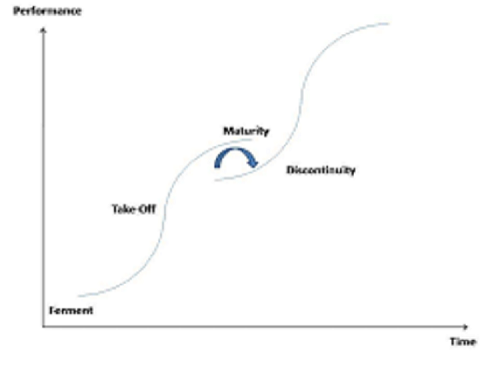

To begin this understanding, we need to first focus upon the technological S curve. If you are not familiar with it, here is a chart.

Basically there are three phases that a technology goes through which is very similar to any product or business cycle. It starts off being introduced. After that, it goes through a growth stage where sales take off. Ultimately, it reaches a maturity stage where things level off. In the technology arena, the is usually an overlap in the maturity stage where a new technology is introduced which is going through its own S curve and ultimately sends the first technology into obsolescence. Now, bear in mind, this process can go on for a shorter time period measured in years or take decades.

The aspect of this S curve that makes it unique is the progress of the technology and how it affects its pricing. When something new is introduced, it is clunky and expensive. We start out with version 1.0 which is full of bugs. It costs a lot of money so only the biggest of geeks or the wealthy jump on board. A prime example of this is cell phones. When introduced, the service was terrible, the phones big, and both were expensive. Over time, rates and prices came down which led to more people using cell phones. This in turn fueled more R&D which further led to more phones sold which pushed prices down again. We saw this cycle continue until a new technology emerge called the smartphone.

To further emphasize this point, let us go through the smartphone life cycle. I will use the introduction as being the first IPhone. When it was introduced it was the only game in town. It costs a lot of money and, while being revolutionary, was not very good. It was basic compared to today. Nevertheless, it was version 1.0. Over time, not only did Apple improve, but other companies entered the market. Thus, we saw a huge explosion in smartphone placements with 70% of the US getting on board in under 8 years time. Prices came down, features grew not only in the phone but in the app stores. In short, smartphones became our personal computers. Today, you can get a smartphone for as little as $30 in the states (even less in third world nations). This is a radical difference from the first smartphones which cost near $1000.

While we saw this explosion, an interesting thing happened in the smartphone industry. It stopped. Around the 2014 time period, innovation basically ceased. This mirrors what happened in the PC market. It shows that in under a decade, the smartphone reached maturity. Today, you get a lot more phone for the same money as a couple years earlier in terms of processing speed and memory. However, the basic phone itself in terms of the technology is the same. The new phone is not that remarkably different from the previous ones. As I said, this is akin to the laptop world. A $300 laptop is very similar to the one you bought 3 years ago with the exception of a few bells and whistles. This is a sign that maturity is reached in both these industries and they are just waiting to be disrupted. Of course, it must be mentioned that this progress can take a long time so do not conclude that I am saying the smartphone market is dead. Apple, as an example, will most likely sell a ton of IPhones before the transition to newer technology takes place.

Which brings us back to our trusty friend, deflation. Remember we are told by economist that when the price of something drops, sales will slow down since the price of the item will be less expensive than it is today. If this is indeed true, then why does almost everyone over the age of 6 have a smartphone? Didn't we just cover the fact that as prices drop, growth (sales) take off? It seems the economists have it backwards. What is going on here?

The answer to that question lies in the fact that anything that is under the Laws of Informational Technology will see growth in proportion to the decrease in price and increase in performance. Before going any further, I feel compelled to explain what falls under the Law of IT. Basically there are three areas: software, memory, and processing. Anything that has any of these three things in it is operating under the Law of IT. When this happens, we see massive deflation while also seeing increased adoption. This happens simply because each of these components has its own deflationary cycle.

Basically, you will see a doubling of the capability for the same money in these intervals:

Processors 18-24 months 50%-67% deflationary rate

Memory 36 months 33% deflationary rate

Software 72 months 16% deflationary rate (this is about to be increased due to AI)

These rates are astounding when you think about it. Keep in mind that the US Federal Reserve as an inflationary target of 2% in their mandate (yes their goal is to basically take 2% of your purchasing power away each year). The high inflation era of the late 1970s/early 1980s saw a rate of like 12% and catastrophic. Yet for 40 years the price per performance of chips has been operating at a 50% deflationary rate. Over this time, we witnessed the number of chips explode reaching the point were there will be a trillion of them in a few years. Prices plummet, performance increases, and usage explodes. Remember this since it is the new model.

Now that you understand technological deflation and the laws of informational technology, let me as you a question: do you think that we witnessed horrific economic events over the last 20-30 years because of this? I know we had a lot of bad stuff happen but none of it was due to technological deflation. In fact, most of what we witnessed was due to deflationary aspects as a result of bubbles: the housing market, dot com boom, $140 barrel of oil, etc. Nothing over the last few decades was due to the collapse in pricing of chips, memory, or software. Yet those areas exploded. Consider how many items had these components in them in the 1990s in your house and compare that to today. I bet if you thought about it, you could come up with 20 items in your house that have these components in them. Think about tvs, phones, cameras, routers, laptops, thermostats, coffee makers, cars, security systems, alarm clocks, Alexa, and gaming consoles. In the near future, this list will also include appliances, light bulbs, counter tops, walls, toilets (yes the smart toilet is coming), clothing, and furniture. My point is that the portion of the economy that is operating under the Laws of IT is growing and, hence, is subject to these deflationary forces.

So what does that mean for society in the future? You will have to read the next part to find out.

If you found this informative, please help me out with an upvote and a resteem. I know how precious those votes are so it is greatly appreciated.

Images provided by the evil empire (Google Images)

I've been going through a number of YouTube videos documenting the introduction of the iMac and iBook along with the rise and fall of Blackberry. I like to watch the Orson Welles's documentary on Future Shock when it feels like things are moving too fast.

I am just amazed at how fast neural networking is moving. That is one area that really just opened up a year or so ago. The progress they made is really incredible. Give it 5 years and you will see that tech so far advanced that it will performing tasks we can only imagine.

Society is getting better in spite of what the MSM says.

I'm middle aged. I look back at what we had back in the early 1980s before satellite tv and vcr's went mainstream. I remember my Dad bought us a vcr for Christmas back in 1983 and bought one videocassette with it. It was An Officer and a Gentleman. I still remember the price tag on it. It cost my Dad $99.99. Imagine having to pay $100 in 1984 Canadian dollars for one movie compared to what you could buy with $100 in 2017 devalued Canadian dollars? It's insane. We had a huge tv that weighed a ton and only had about 12 channels available at the time before anyone who wasn't rich could buy into satellite tv. We didn't even have a portable converter to change channels. We had to go up to the tv to change channels on the metal knob. Now I literally have thousands of channels on my satellite and have thousands of movies available to me at the click of my tv converter.

Progress, baby!

My dad had a remote control...it was me.

Something kids dont here today... "get up and change the channel".

I was also the one to fetch a beer for him.

I didnt have cable until I was a Junior in HS...before that, had 7 channels.

We've come a long way, baby!

You want to see how far we have come.

It took GE how many decades to become a billion dollar company? Instagram went from nothing to sold for over $1B in 18 months.

That is what is happening today....disruption at the speed of light.

He'll, look at how far cryptocurrencies have come in only the last year. People are in denial of how powerful blockchain technology is!

Thanks for the resteem. It is greatly appreciated.

No problem I'm all about spreading the word.

heyy

please follow me and give me your valuable upvote and comments i will to you, lets do this chain to earn some money.

Good stuff, write more!

Hey there @tara-decrypting.

I am glad you liked it....anything in particular that caught your attention?

you're making steemit a great community with your content taskmaster4450! keep it up!

A great read and well written,i sometimes struggle for the correct words to explain this to people. Well done !

Actually no economist will tell you that. It is even called the law of demand. If the price falls, the quantity demanded will increase.

There is more controversy with changes to the aggregate price level, that is indeed inflation or deflation, which has different consequences than changes to the price of single goods.