History shows Netflix and Facebook are the FAANG stocks to own to start 2018 with a bang

Netflix and Facebook could be the best so-called FAANG stocks for investors at the start of the year

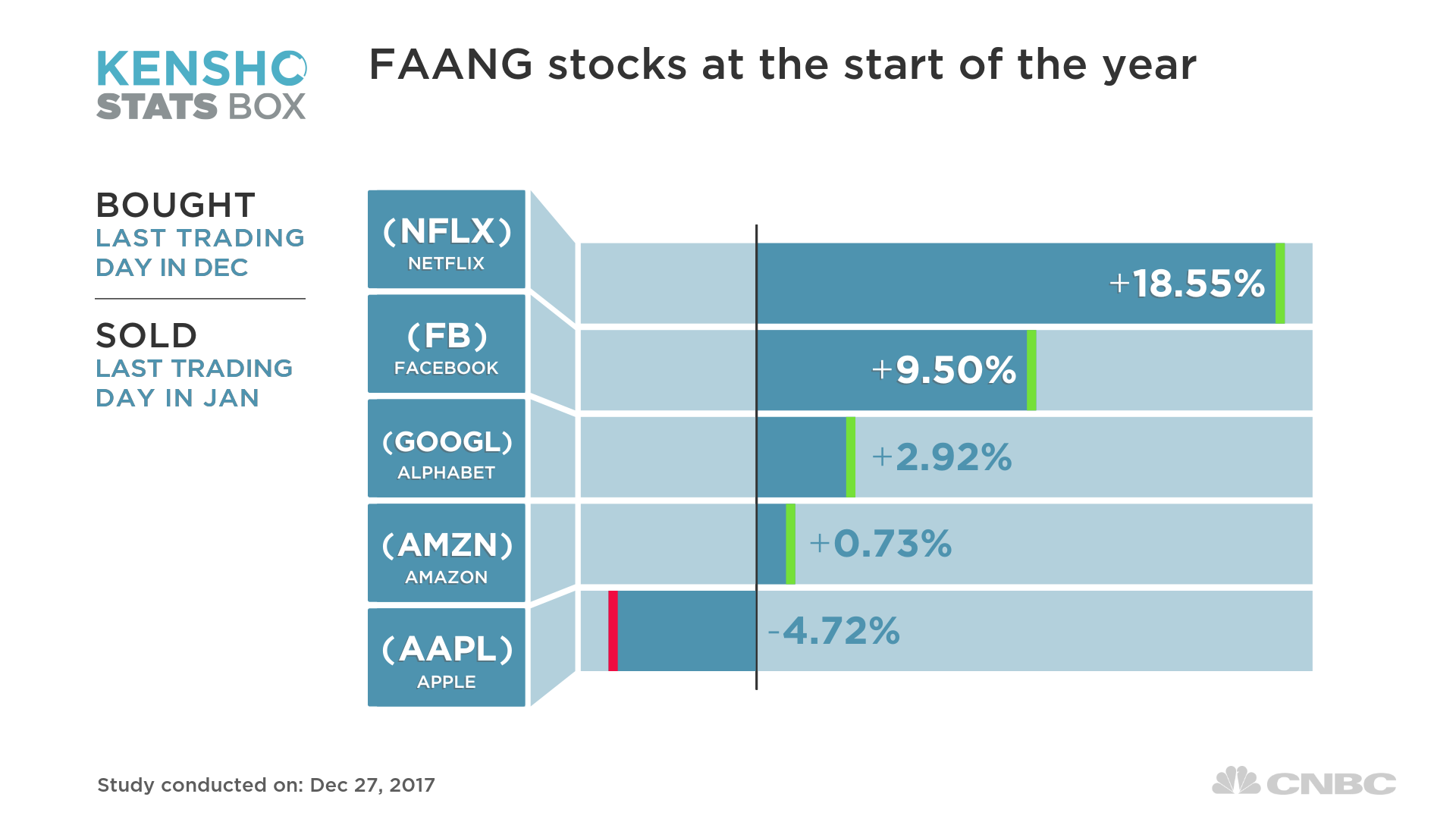

CNBC looked at the performance of the FAANGs if you bought them on the last trading day of December and sold the stock on the last trading day in January based on a five-year average

Apple is the only stock that is typically in negative territory after the period

Netflix and Facebook could be the best so-called FAANG stocks for investors at the start of the year.

FAANG refers to Facebook, Apple, Amazon, Netflix and Google-parent Alphabet. These stocks have seen big rallies this year.

Using data analytics platform Kensho, CNBC looked at the performance of the FAANGs if you bought them on the last trading day of December and sold the stock on the last trading day in January.

The average return if you did this since December 2012 is shown below and was calculated to see which of these names historically has a strong start to the year.

Netflix and Facebook could be the best so-called FAANG stocks for investors at the start of the year.

FAANG refers to Facebook, Apple, Amazon, Netflix and Google-parent Alphabet. These stocks have seen big rallies this year.

Using data analytics platform Kensho, CNBC looked at the performance of the FAANGs if you bought them on the last trading day of December and sold the stock on the last trading day in January.

The average return if you did this since December 2012 is shown below and was calculated to see which of these names historically has a strong start to the year.

Netflix and Facebook could be the best so-called FAANG stocks for investors at the start of the year.

FAANG refers to Facebook, Apple, Amazon, Netflix and Google-parent Alphabet. These stocks have seen big rallies this year.

Using data analytics platform Kensho, CNBC looked at the performance of the FAANGs if you bought them on the last trading day of December and sold the stock on the last trading day in January.

The average return if you did this since December 2012 is shown below and was calculated to see which of these names historically has a strong start to the year.

Netflix

Netflix has beaten analyst estimates in the December quarter each time since the fourth quarter of 2012, according to data from Kensho. This could be one reason why the stock does well at the start of the year.

Analysts are estimating earnings per share of $0.42 in the December quarter, and if Netflix beats this then the stock, which is up over 52 percent this year, could continue to rally.

But "there is a little more headwind to Netflix competitively going into 2018 more than going into any other year," according to Daniel Ives, head of technology research at GBH Insights.

Amazon is of course ramping up its spend on original content, while Disney's recent deal to buy Twenty-First Century Fox's assets has bolstered the company's streaming ambitions. Apple, Facebook and HBO have all talked up the potential of original content too.

Meanwhile Netflix is continuing to increase its spending on original productions, creating a content war. But Netflix, which is seen as having first-mover advantage, has continued to expand internationally, and this will be the key for it holding its leadership position.

"If they are successful expanding internationally they have strong tailwinds going into 2018.They have built an iron fence around the consumer landscape domestically, and all signs are pointing towards the international strategy hitting the ground running," Ives told CNBC in a phone interview.

Still, not all analysts think Netflix is safe. Needham analyst Laura Martin told CNBC in November that "Netflix should be scared to death" with the competition.

Facebook

Facebook has had a testing year. It was slammed for its role in letting Russian-backed ads on its platform which reached 126 million Americans in a bid to sway the outcome of 2016's election.

As a result of this, and the increasing amount of "fake news" on the social network, Facebook has been hiring hundreds of people to try to monitor what is posted. Chief Financial Officer David Wehner forecast this year that with investments in original content and higher security costs, Facebook could see operating expenses rise between 45 percent and 60 percent in 2018.

Despite the rocky year, Facebook has continued to grow its user base to over 2 billion, and its stock is up over 54 percent year-to-date. Analysts are still positive on Facebook's ability to engage and monetize users thanks to two products: video and Instagram.

Facebook recently revamped the "Watch" tab on its site which hosts original video content. The Wall Street Journal reported in September that Facebook is "willing to spend as much as $1 billion" on original video content. This will help drive engagement, analysts at Jefferies said in a note last week, reaffirming its "buy" rating on the stock.

Facebook is also beginning to monetize the fast-growing user base of Instagram, the photo-sharing app it bought for $1 billion in 2012. Evercore ISI analyst Anthony DiClemente said Facebook could lead the surge in the FAANGs next year.

Alphabet

Like Facebook, Alphabet has had a tricky year on the regulatory front. Google was hit with a 2.4 billion euro ($2.7 billion) antitrust fine by European Union (EU) regulators in relation to its shopping service. The EU is also looking into its Android mobile operating system to see if that breaks any rules.

Regulation remains a risk going into 2018, analysts said. But the stock is up over 34 percent year-to-date and there is still big growth potential for a number of areas.

In 2017, for the first time, mobile will represent more than half of Google's total U.S. ad revenue, according to eMarketer. This means that Google is continuing to grow in mobile. Meanwhile its YouTube video service continues to excite investors.

"YouTube continues to be the crown jewel from the ad point of view. People are spending 43 minutes a day and that is increasing into 2018," Ives told CNBC.

In a note at the end of November, MKM Partners said Alphabet "has the most hidden value of all mega-caps," citing YouTube and its Maps products as big areas that can be further monetized.

Amazon

It may be surprising that Amazon on average has a fairly quiet performance in the first month of the year given the Black Friday and Cyber Monday sales in November as well as the Christmas shopping period.

But usually, the impact hasn't been priced in by the end of January.

So far, there have been a number of positive noises made about Amazon's holiday performance. Ives said his research indicates that Amazon captured between 45 percent to 50 percent of all holiday online retail sales versus 38 percent during the holidays season in 2016. Prime members were spending 22 percent more than a year ago too.

"Prime growth remains the key jewel for Amazon going forward as cross- selling around Whole Foods customers and putting up more walls/barriers around its growing Prime customer base is a major ingredient in Amazon's ability to fend off competition in 2018 and beyond," Ives said in a note on Wednesday.

Amazon also continues to show strong growth in its Amazon Web Services cloud businesses. And a number of analysts have forecast that the company could push further into healthcare. CNBC reported earlier this week that Amazon is also experimenting with various advertising products across its portfolio and off its website, to challenge Facebook and Google.

Bullishness around the stock could see its value hit $1 trillion in the next year, Morgan Stanley said in a research note from November.

Apple

It's been an exciting year for Apple. The U.S. technology giant released the iPhone X, the first radical redesign of its device in a long time.

But it's also hit a few roadblocks with that same smartphone. There were long waiting times when it was first released, and on Tuesday, Taiwan's Economic Daily, citing unnamed sources, reported that Apple will slash its sales forecast for the iPhone X in the first quarter from 50 million units to 30 million.

Still, many are convinced that the iPhone X will kick off an iPhone "supercycle" with demand pushed out into next year. At the same time, Apple's software and services division, which includes Apple Music and other services, continues to be strong and allows the company to monetize the large iPhone user base.

At the same time, Apple's performance in China, which is seen as a key market for future growth, has improved.

The question for many investors now is what the next big thing for Apple will be. Ives said it's unlikely to be autos, but video streaming and original content could be a big deal if Apple decide to invest.

"What is the next magic silver bullet they will build their growth story around? The ones that make the most sense is streaming content on the video side," Ives said.

Still, many are convinced that the iPhone X will kick off an iPhone "supercycle" with demand pushed out into next year. At the same time, Apple's software and services division, which includes Apple Music and other services, continues to be strong and allows the company to monetize the large iPhone user base.

At the same time, Apple's performance in China, which is seen as a key market for future growth, has improved.

The question for many investors now is what the next big thing for Apple will be. Ives said it's unlikely to be autos, but video streaming and original content could be a big deal if Apple decide to invest.

"What is the next magic silver bullet they will build their growth story around? The ones that make the most sense is streaming content on the video side," Ives said.

@originalworks

@steem-untalented

The @OriginalWorks bot has determined this post by @mahmud99 to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

Great read and great advice. I have been wondering what stocks to start out with in the new year. Think i have my answer. Thanks!

thanks for read this post