Labors new Tax on Success

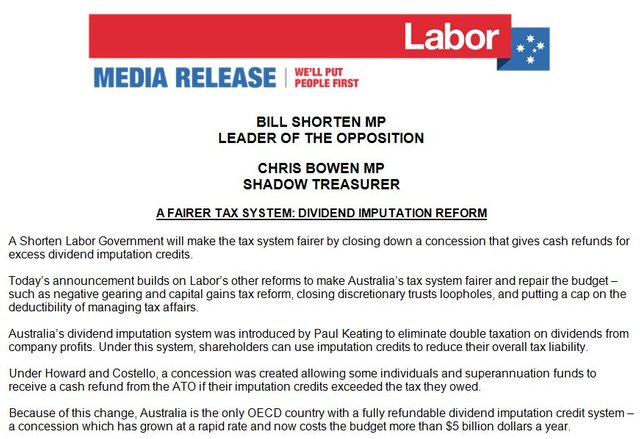

This week the Australian Labor party announced another new tax, this time aimed at moderately wealthy retirees who recieve an income tax refund on franking credits for investment divedends.

Once again this is an attempt at class warfare. The people that are to be affected by these measures are not the millionaires or even the billionaires as they aren't going to be claiming these refunds. The people to be affected are the teachers and builders and nurses that worked hard, invested hard and built a solid foundation for themselves to get them through their later years in modest comfort.

What are these refunds?

So in 2001 while Little Johhnie Howard was PM, we had bucket loads of cash. The government of the day wanted to reward those who had actually put in the effort and made a difference to their own wellbeing. So they set up a scheme to pay a refund on a divedends franking credits when it comes to tax time.

For those that don't know, a franking credit is an amount that equates to the tax that the company has already paid on their profits. This way the income from a dividend isn't taxed twice.

So when it comes to your tax return, you show $X income LESS $Y credits.

But when we get low income investors that don't really have a normal income such as Self Funded Retirees, these credits actually amount to giving you a refund from the Tax Office. In some cases it can be THOUSANDS of dollars a year.

.jpg)

So what the Labor party want to do is stop those refunds and basically take money out of the pockets of the retirees and force them to rely on the Labor party's best friend.....WELFARE.

Anti-Taxation?

So I guess this all sounds like I'm very Anti-Taxation. But this isn't true. I 100% beleive that we should all pay a fair share to fund the greater good of the country.

Anti-Welfare?

Then am I anti-welfare? Far from it, i beleive we need SOCIAL SECURITY. When someone is down on their luck, or hurt or sick they need to be supported. This is a security net to catch and help those in need.

What we don't need is a society that is addicted to welfare at the expense of others.

Currently taxation is a means of penalising those who put in the extra effort. The rich are the sugar daddies of the poor according to left wing policy.

But this is bad politics. It creates a divide and class warfare.

There is a major difference between those that are poor and those that are BONE LAZY.

The welfare system of today has created a multi-generational culture of entitlement. People thinking it is their RIGHT to recieve tax payers money and that they can do anything they want with it.

New Proposal

So my new proposal to the boffins in Canberra is a system of equality. If they want to tax the richer part of Australia say $5Billion dollars, it must also be met with an EXPENDITURE reduction of an equal amount.

So want to increase Fringe Benefits Tax? We must also cut medicare spending.

Remove capital gains tax? Reduce foreign aid budget.

The system will quickly balance out. We would see plummeting national debt, emplyment figures would climb, personal taxation rates could be lowered and Australia's place amount the top 20 developed nations would be well and truely cemented in.

Will this ever happen? No of course not, but it'd be nice to dream.

So nice post my dear

Great the post

It's not just class warfare, it's generational warfare.

Have you noticed the millenial vs boomer rhetoric over the last couple of years. You know, where the millenials blame the boomers for climate change, expensive housing and the boomers blame the millenials for not working hard enough or being soft snowflakes?

Identity politics is going next level.

100% agree

There are 2 ways to plug a budget deficit: reduce spending or increase tax. The easy option is to increase tax, or take away tax credits.

There is no win here, and taking away the refund from excess imputational tax credits, forces those who may rely on that refund to live comfortably, to possibly have a much lower quality of life by being "taxed to death" at a higher rate. And you're right, it will affect the low-income investors, and elderly a lot more than others, which will undoubtedly put a greater burden on other areas of the economy, forcing up expenditure. It's a vicious circle.