Cryptocurrency Tax 101 — Intro to capital gains and crypto tax treatment

At BlockFi, we want to increase the knowledge and awareness of the impact made by blockchain and crypto products. One topic most people don’t seem to be aware of, even as cryptoasset owners, is the benefits and implications of crypto taxes. We break it down for you to understand exactly what that means and how it could affect you this tax season.

Disclaimer: This post is for informational purposes only and should not be relied on or construed as tax advice or investment advice. It is best to consult with applicable professionals before making investment or tax-related decisions.

TLDR

1. Cryptocurrency is treated as property by the IRS. Trades, sales, and purchases using crypto are taxable events, subject to short and long-term capital gains/losses tax treatment.

2. Borrowing USD against your cryptoassets with a BlockFi loan is not a taxable event. This means you can access liquidity while keeping the same level of ownership and upside in your crypto holdings.

3. The after-tax cost of borrowing can be reduced if you use the proceeds of the loan to make certain types of investments.

Background — Crypto Tax Treatment in the US

In 2014, the IRS let cryptoasset investors know that “the sale or exchange of convertible virtual currency, or the use of convertible virtual currency to pay for goods or services in a real-world economy transaction, has tax consequences that may result in a tax liability.”

The IRS treats “virtual currency” as property, which means every trade you complete with cryptoassets is a taxable event. If you sell your cryptoassets to purchase goods (iPhone X or a 1965 Ford Mustang) or services (an event planner for your Grandmother’s 90th birthday bash or a developer to build an app for your business), it’s a taxable event. If you exchange your Ether for Bitcoin or vice versa, it’s a taxable event. If you liquidate your cryptoassets for USD, it’s a taxable event.

However, if you put up cryptoassets as collateral for a loan — which does not qualify as a trade — it’s not a taxable event.

A BlockFi loan allows you to achieve liquidity on your Bitcoin and Ether without triggering a taxable event. And depending on how you’re spending the money you borrow from BlockFi, you may be eligible for additional tax benefits.

Due to the increasing popularity and value of certain cryptoassets, you have the potential to make a substantial return by purchasing Bitcoin or Ether for investment purposes. It’s important to understand how capital gains taxes work if your crypto investments increase in value.

A capital gain occurs when you sell a cryptoasset for more than you spent to buy a cryptoasset.

In some cases, capital gains taxes can add a substantial amount to your tax bill. When considering your capital gains tax costs you should consider the following variables: federal tax rates (which offer preferential treatment for long-term capital gains) and state income tax rates.

Federal tax rates and short vs long-term capital gains?

At the federal level, the amount of time you hold onto a cryptoasset has an impact on your capital gains tax rate.

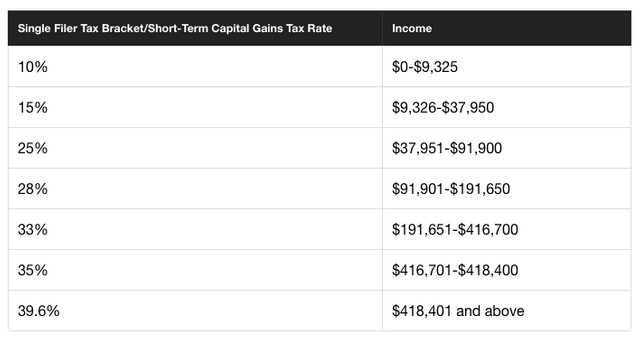

If you have held assets for less than a year then they are subject to short-term capital gains rates which are the same as your ordinary income tax rate.

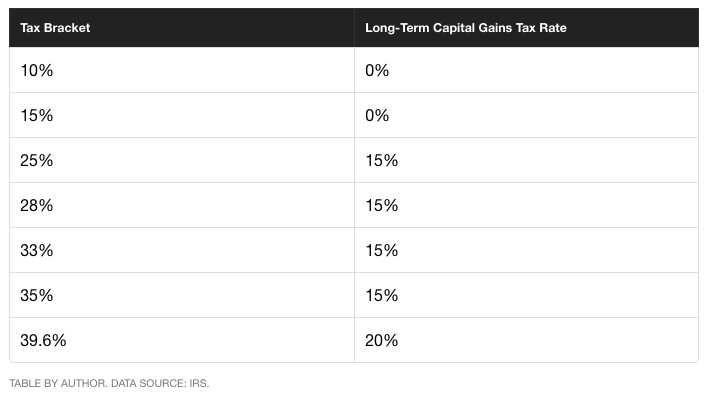

If you have held assets for more than a year then gains are subject to preferential, long-term capital gains tax treatment. The table below show the ordinary income and long-term capital gains tax brackets for the 2017 tax year (please note that tax rates in 2018 are different than what is listed below).

Source — https://www.fool.com/retirement/2016/12/16/capital-gains-tax-rate-for-2017.aspx

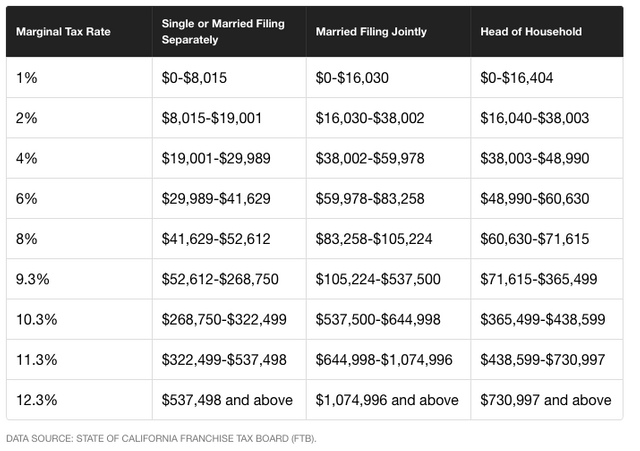

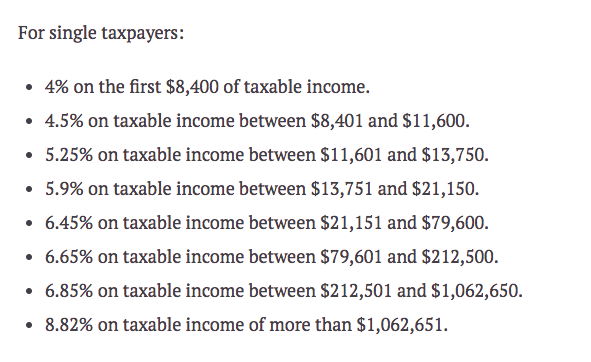

Some states also have income taxes which generally apply on all income and don’t have preferential long-term capital gains treatment. Let’s look at state income taxes for the three largest states — California, Texas, and New York. Texas has no state income tax, but we have included tax tables for California and New York below.

Source of CA data — https://www.fool.com/taxes/2017/04/27/2017-california-income-tax-what-you-need-to-know.aspx

Source of NY data — https://www.bankrate.com/finance/taxes/state-taxes-new-york.aspx

New York City also has a city income tax which tops out at 3.876% for single filers earning more than $50,000.

If you want to see a breakdown of your capital gains tax rates based on your location and income, Smart Asset has a Capital Gains Tax Calculator that is a very helpful tool.

Example Calculation

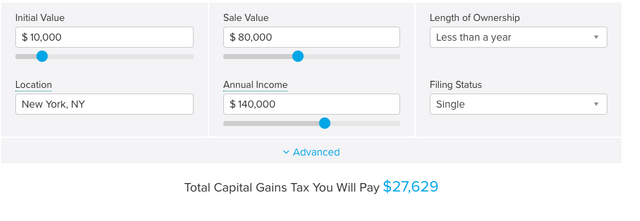

Let’s look at a theoretical example for a New York city resident. Let’s assume that this taxpayer bought 10 Bitcoin on April 15th, 2017 for $1,000 each, for a total investment of $10,000.

Fast forward to March 2018 and Bitcoin has increased in value to $8,000 and her $10,000 investment is now worth $80,000. Since she held the Bitcoin for less than a year, it would be considered a short-term gain if she sold now. She would owe tax at her ordinary income rates.

Assuming she makes the average blockchain developer salary in NYC of $140K, she would owe an estimated $27,629 in tax, representing a 39.47% effective rate on your $70,000 gain.

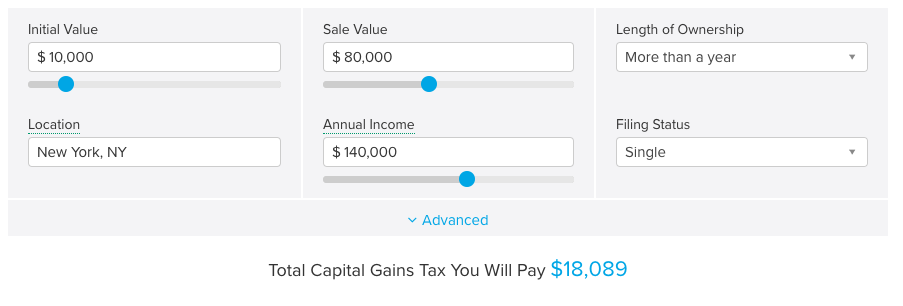

Now let’s look at the same scenario with long-term capital gains at the same price. Your tax bill is significantly reduced to $18,089 due to the preferential long-term capital gains tax rates.

Value of a BlockFi Loan

If you want or need liquidity now but have not held onto your cryptoassets long enough to take advantage of long-term capital gains tax rates, a BlockFi loan may be a valuable solution. BlockFi offers terms of up to twelve months, and your Bitcoin or Ether is securely stored for you. So, after paying off your BlockFi loan, if and when you do decide to sell your cryptoassets, you will likely qualify for long-term capital gains tax rate. Moreover, as a borrower you make interest-only payments throughout duration of the term with a balloon of principal at the end. You have the convenient option to make those payments using the collateral that you already posted if your LTV ratio qualifies. Another added feature is the option to refinance at the end of the term.

Depending on how you use the proceeds of the loan, there may be additional tax benefits. Certain investment-related expenses — like the interest on a loan from BlockFi — may be tax-deductible against your net investment income.

Wait…what does that mean? And what expenses are considered tax-deductible?

Net Investment Income = Investment Income — Investment Expenses

So, if you borrow money to buy assets — like equities, bonds, additional cryptoassets or other securities — for investment purposes, the interest paid on that loan becomes an investment interest expense.

Why? And what does this look like in practice?

The IRS wants to incentivize investments, and offering deductions for investment interest expenses is one way they do that. When determining the impact that this would have on your after tax outcome, you need to consider the size of your gain and short vs long-term tax rates plus the expected return from the assets purchased with the loan proceeds.

Consulting with a financial planner or tax advisor is a great way to make sure you understand the impact and consider all of the applicable variables.

Conclusion

Cryptoasset activity is definitely taxable! There are a few variables that impact your tax rates that you should understand when making decisions. BlockFi loans can be a helpful tool in your overall investment strategy. Learn more about BlockFi loans at our website or other blog posts, how it works and loan structure example.

ADDITIONAL RESOURCES:

- Crypto Tax Girl: http://cryptotaxgirl.com/

- BitCoin Taxes, Vijay Boyapati: https://medium.com/@vijayboyapati/bitcoin-taxes-78044aa903ac

- Investment Interest Expense: https://turbotax.intuit.com/tax-tips/investments-and-taxes/what-are-deductible-investment-interest-expenses/L9TeFQAf9

- Capital Gains: https://www.forbes.com/sites/kellyphillipserb/2018/01/09/what-you-need-to-know-about-taxes-cryptocurrency/#67edd871605f

Originally posted here.

Great info. Especially, with taxes approaching. I would have never thought taxes would have to be paid on crypto, that was supposedly to be free from government oversight, but the tax credit is a bonus. Once again, thanks for the info.

Of course! Happy you liked it.