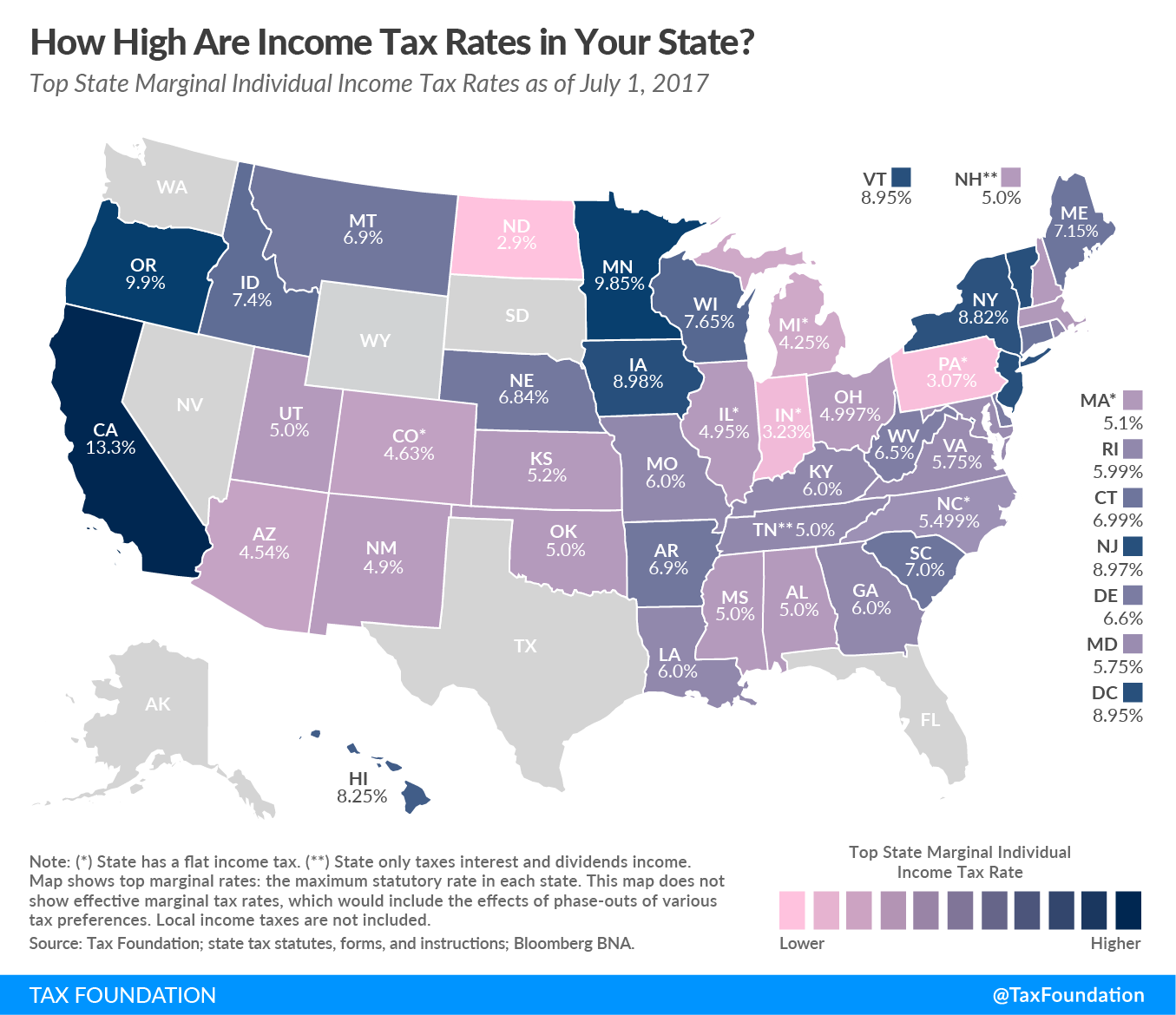

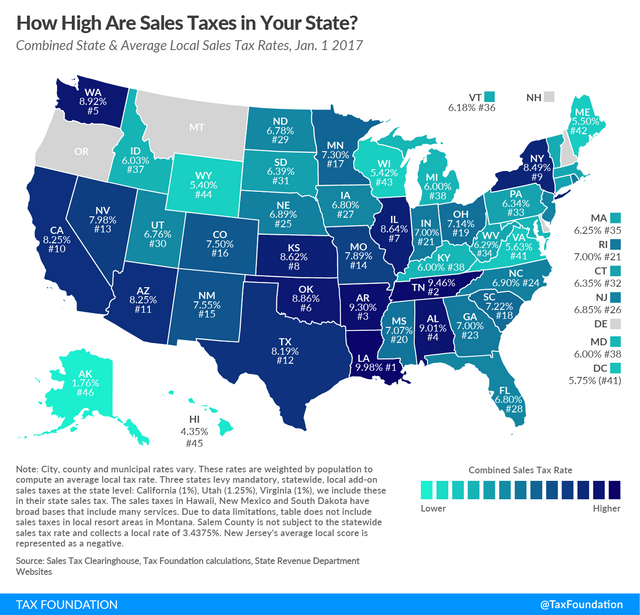

State Income and Sales Tax Rates by State

Index - https://steemit.com/tax/@alhofmeister/2666al-tax-blog-index

Discussion

Although this tax blog tends to focus on federal income taxes, a variety of other types of tax exist at the state and local level. Two of the biggest taxes assessed at the state level are sales tax and income tax. Below, I have listed maps available on the Tax Foundation website which demonstrate the income and sales tax rates by state. Note that Washington, Nevada, Wyoming, South Dakota, Texas, Alaska, and Florida do not have a individual income tax (depending on the state, however, they might have a corporate income tax). Also, Oregon, New Hampshire, Montana, and Delaware do not have a sales tax.

Maps

Income Tax

Taken from the Tax Foundation website.

Sales Tax

Taken from the Tax Foundation website.

References

https://taxfoundation.org/state-individual-income-tax-rates-brackets-2017/

https://taxfoundation.org/state-and-local-sales-tax-rates-in-2017/

Disclosure

Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.

great work

Thanks!

Thanks a lot for this, @alhofmeister! I have a question - does this mean that states like Texas and Nevada has no income tax?

Nevada doesn't have an income tax, but Texas has a gross receipts tax for business. Texas does not, however, have an individual income tax. The map specifically address individual income taxes.

Ahhh, I see. Therefore, if you're thinking of doing remote business, Nevada is your best option to maximize cost-benifits, correct?

There's more to consider than just taxes when making that type of decision. It's important to remember that spending a dollar to save 30 cents still results in a loss.

Good point. I was just referring to freelancers or like jobs that could be performed remotely (i.e. writing/programming jobs) - since there's no income tax in Nevada, you get to keep everything that you earn. Plus, the living costs is Nevada is probably much cheaper than places like California. Correct me if I'm wrong, though - I'm not that familiar with the legislation/tax regulations in the US haha

Fair enough.

@OriginalWorks

Yes @alhofmeister

So glad i "live" in arizona! california would tax you for air if they could can it!

Probably.