Impact of the New Tax Bill on Middle Income Taxpayers (Standard Deduction, Exemptions, Child Tax Credit)

Index - https://steemit.com/tax/@alhofmeister/tax-blog-index

Introduction

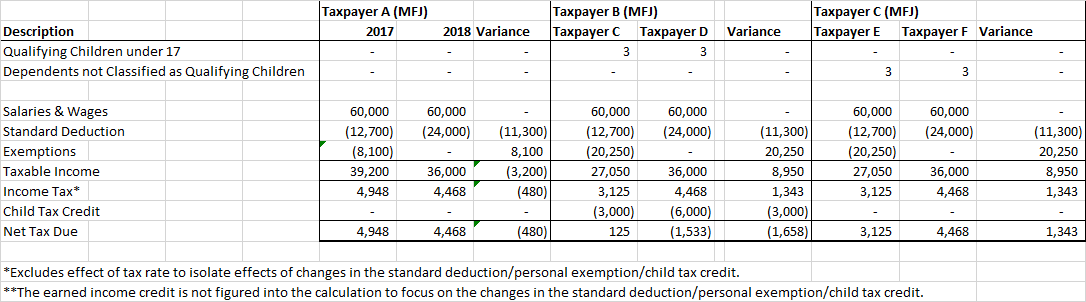

Over the next couple of articles, I hope to explore the impact of the of the new tax bill with a focus on the changes to the standard deduction, exemptions & the child tax credit. The purpose is to demonstrate the tax implications of the new bill on families of varying size and income. To increase the visibility of the impact, I will be ignoring the effects of the earned income tax credit, the change in tax rates (using 2017 rates), and measuring the impact on taxpayers filing married filing jointly.

Calculation

Conclusion

As shown above, taxpayers with no dependents as well as taxpayers with qualifying children will benefit from the changes to the tax code. Taxpayers with dependents that aren't qualifying children, however, will pay more in taxes under the new tax plan.

Taxpayers with no dependents benefit from the increase in the standard deduction. The detriment associated with the removal of personal exemptions is not offset by the benefit of the increased standard deduction for taxpayers with dependents. Taxpayers with qualifying children, however, will benefit from the increase in the child tax credit which will outweigh the detriment described previously. The taxpayers with dependents that aren't qualifying children (such as children over 17) won't receive an offsetting benefit.

Disclaimer

Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.

Easy to understand. Short quick read. Gunna pass the word to a friend with older teenagers.

Thanks!

@OriginalWorks

Great find dude, great find.

Thanks!

great.

Thanks!