Case Study 7: Taxation of Cryptocurrency - Mining (Disregarded Entity - Inventory)

Index - https://steemit.com/tax/@alhofmeister/tax-blog-index

Introduction

To help facilitate a better understanding of the taxation of cryptocurrency, I've decided to put together a series of examples which increase in complexity to demonstrate the potential tax implications of investing in cryptocurrency. I'll break each example out to include the tax impact of the various transactions occurring in 2017 and the tax impact if the scenario occurred in 2018 to demonstrate the effects of the new tax law.

After reviewing my first example on mining, I found it to be too simplistic. In my next series of articles, I will significantly expand the example to include multiple types of business entities, the element of mining pools, the idea of multiple use property as well as the tax implications in 2017 vs. 2018.

In this example, the taxpayer sells the coins immediately after mining. As a result, I will treat the mined Bitcoins as inventory to demonstrate the effects.

Note that I am treating cryptocurrency mining as an activity which would qualify for the 20% deduction for pass through entities for 2018. The activity might not qualify under IRC 199A as it might fall into the definition of dealing in commodities which will hopefully be clarified by IRS regulations this year.

Scenario

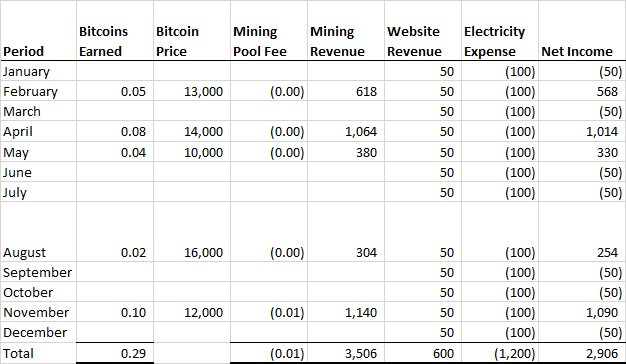

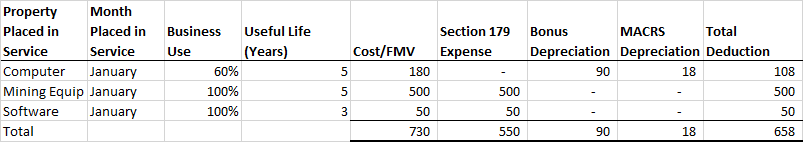

Taxpayer A decides to mine Bitcoin in January. To accomplish this task, Taxpayer A acquires mining hardware for $500, purchases software for $50 and joins a mining pool that distributes earnings net of a 5% surcharge. Each month, the mining operation increases the electricity bill by $100. In addition, Taxpayer A manages the website the mining pool uses to advertise and is paid $50 a month. Taxpayer A uses a personal computer that is also used for personal reasons (40% personal/60% business). The personal computer was acquired in a prior year and converted to it's current use. The computer cost $600 when it was originally purchased but it's current fair market value is $300. Over the course of the year, Taxpayer A receives the following payouts from the mining operation:

- In February, Taxpayer A is awarded 0.05 Bitcoins when it is valued at $13,000.

- In April, Taxpayer A is awarded 0.08 Bitcoins when it is valued at $14,000.

- In May, Taxpayer A is awarded 0.04 Bitcoins when it is valued at $10,000.

- In August, Taxpayer A is awarded 0.02 Bitcoins when it is valued at $16,000.

- In November, Taxpayer A is awarded 0.10 Bitcoins when it is valued at $12,000.

Additionally, Taxpayer A engages in the following transactions throughout the year:

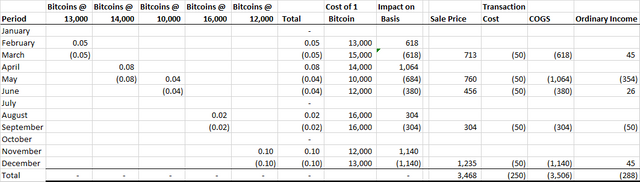

- In March, Taxpayer A sells 0.05 Bitcoins when it is valued at $15,000. Transaction fees totaled $50.

- In May, Taxpayer A sells 0.08 Bitcoins when it is valued at $10,000. Transaction fees totaled $50.

- In June, Taxpayer A sells 0.04 Bitcoins when it is valued at $12,000. Transaction fees totaled $50.

- In September, Taxpayer A sells 0.02 Bitcoins when it is valued at $16,000. Transaction fees totaled $50.

- In December, Taxpayer A sells 0.10 Bitcoins when it is valued at $13,000. Transaction fees totaled $50.

Calculations Common in Both Years

Monthly Mining Operating Income

Sale of Inventory Schedule

2017 Tax Treatment

Fixed Asset Schedule

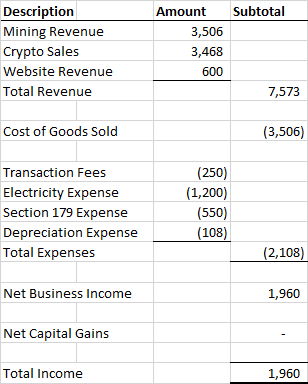

Taxable Income Calculation

2018 Tax Treatment

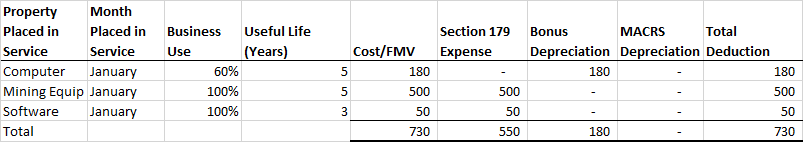

Fixed Asset Schedule

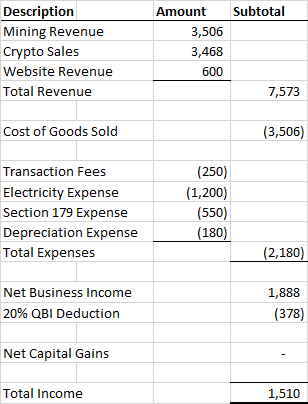

Taxable Income Calculation

Disclaimer

Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.

@OriginalWorks

The @OriginalWorks bot has determined this post by @alhofmeister to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!