Case Study 51: Wash Sales - Advanced - April

Index - https://steemit.com/tax/@alhofmeister/rqgmk-tax-blog-index

Introduction

The purpose of this posting is to further demonstrate the effect of the wash rules on securities purchased 30 days before/after the sale of the same (or substantially similar) security for a loss. As there is a requirement that there be a high frequency of trading for someone to be considered a trader under the IRS standards, I'll be breaking this series into 12 parts (1 for each month).

Problem

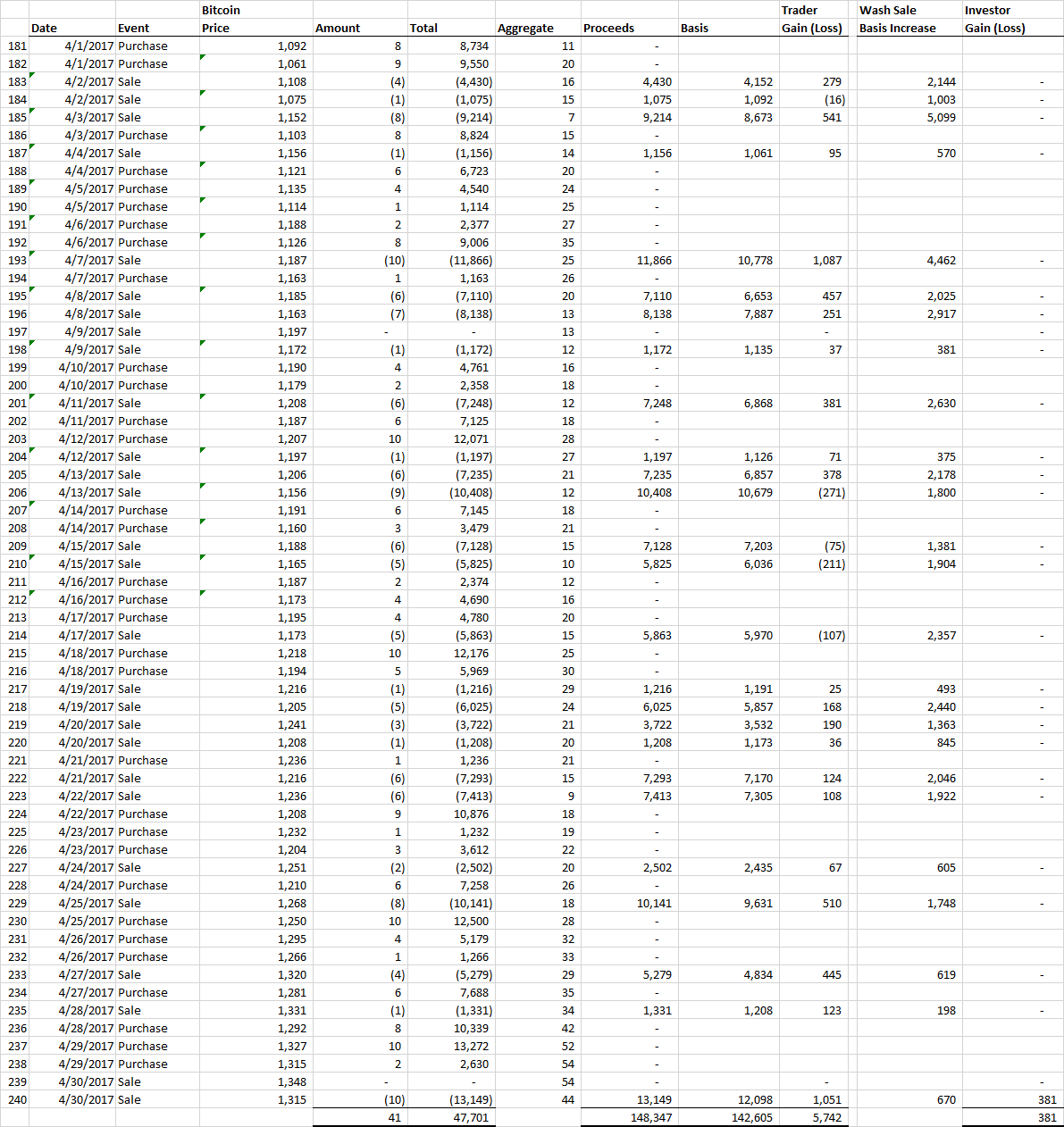

Taxpayer A actively trades Bitcoin in order to take advantage in short term swings in the market. The diagram below shows April trading activity along with the tax consequences of being treated as a trader vs. an investor.

Solution

Note that Taxpayer A will carryover $5,361 of loss disallowed by the wash-sale rules into May (if Taxpayer A is classified as a investor).

References

https://steemit.com/tax/@alhofmeister/wash-sale-rules-cryptocurrency-application

Disclaimer

Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.

@OriginalWorks

and how do you take advantage?

The optimal tax strategy is going to be largely dependent upon the facts and circumstances surrounding the taxpayer. There are pros and cons to each tax treatment.