Case Study 4-1: Taxation of Cryptocurrency - Referral Fees (Tax Liability)

Index - https://steemit.com/tax/@alhofmeister/tax-blog-index

To complete my earlier examples, I've decided to calculate the tax due on each one.

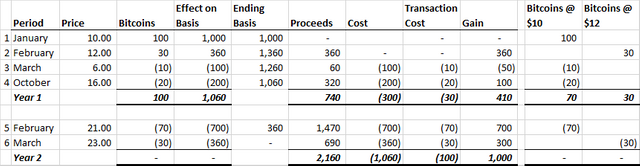

Notice that this example was developed using the First In First Out (FIFO) methodology. This also assumes that the taxpayer receives referral fees on a regular basis and that the fees would be subject to self employment tax.

Problem

(1) Taxpayer A decides to invest in Bitcoin. In January, Taxpayer A buys 100 coins at the price of $9 a coin with a transaction fee of $1 a coin spending a total of $1,000 to acquire the coins. (2) In February, Taxpayer A receives a referral bonus of 30 Bitcoins when the market price of Bitcoins is $12 a coin. (3) In March, Taxpayer A panics at a drop in the price of Bitcoin and sells off 10 coins for $6 a coin with a transaction cost of $1 a coin making a total of $50 off the sale. (4) In October, Taxpayer A decides to sell off 20 coins when the price of Bitcoin spikes to $16 at a transaction cost of $1 a coin making a total of $300. (5) In February of the next year, Taxpayer A decides to sell off some of their Bitcoin at $21 a coin with a transaction fee of $1 a coin receiving $1,400. (6) In March of the next year, Taxpayer A sells off their remaining Bitcoin (30) at $23 a coin with a transaction cost of $1 a coin receiving a total of $660.

Solution

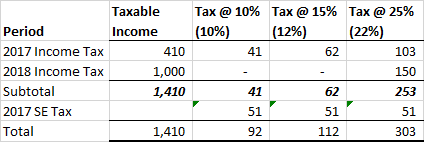

Note that I am not considering any outside income in an effort to focus on the tax effect of the transaction. Additionally, I am breaking out the tax consequences if a taxpayer is in the 2017 (2018) 10% (10%), 15% (12%) and 25% (22%) tax brackets.

Note that if total self employment tax owed by a taxpayer is less than $400, the taxpayer will not owe any self-employment tax. Additionally, the above example does not consider the deduction for self employment tax which can be applied to ordinary income.

Disclaimer

Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.

Which country is this tax example based in?

This is based on U.S. income tax laws.

@OriginalWorks

The @OriginalWorks bot has determined this post by @alhofmeister to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!