Case Study 2: Taxation of Cryptocurrency - Altcoins

Introduction

To help facilitate a better understanding of the taxation of cryptocurrency, I've decided to put together a series of examples which increase in complexity to demonstrate the potential tax implications of investing in cryptocurrency. I'll break each example out to include the tax impact of the various transactions occurring in 2017 and the tax impact if the scenario occurred in 2018 to demonstrate the effects of the new tax law.

It's important to note that the total gain in the two scenarios when added across years, are equal ($870). Additionally, this scenario assumes that Taxpayer A taxes the position that the IRS will not apply the 2018 rules retrospectively. Notice that while the change in the tax law does not affect the total amount of the gain realized, it could potentially impact the character and the timing if the gain.

The purpose of this article is not to recommend either the more or less aggressive position, but rather, to demonstrate the impact of choosing one methodology over the other.

Scenario

(1) Taxpayer A decides to invest in Bitcoin. In January, Taxpayer A buys 100 coins at the price of $9 a coin with a transaction fee of $1 a coin spending a total of $1,000 to acquire the coins. (2) In March, Taxpayer A panics at a drop in the price of Bitcoin and sells off 10 coins for $6 a coin with a transaction cost of $1 a coin making a total of $50 off the sale. (3) In April, Taxpayer A decides to sell off 20 coins when the price of Bitcoin spikes to $16 at a transaction cost of $1 a coin making a total of $300. (4) Also during April, Taxpayer A exchanges 30 Bitcoins for 60 Ripple with the price for Bitcoin remaining at $16 a coin and incurring $1 a coin in transaction costs. (5) In May, Ripple spikes to $11 which prompts Taxpayer A to sell 30 Ripple with the transaction cost of $1 a coin. (6) In February of the next year, Taxpayer A decides to sell off his remaining Bitcoin at $21 a coin with a transaction fee of $1 a coin receiving $770. (7) In June of the next year, Taxpayer A decides to sell off his remaining Ripple (30) at the price of $16 with transaction costs of $1 a coin.

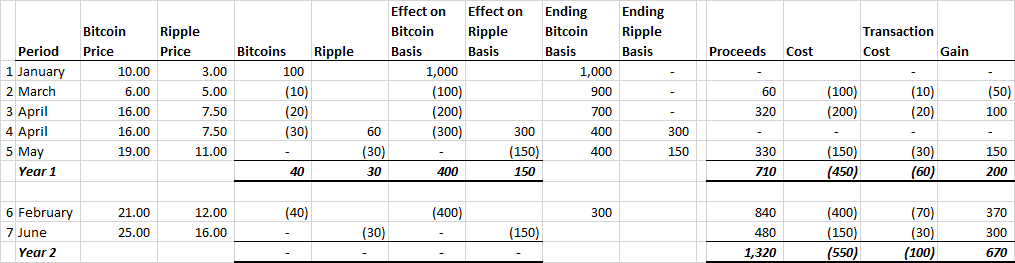

Aggressive

In year 1, Taxpayer A would recognize a total short term capital gain of $200. This gain is comprised of $100 for the sale in April of Bitcoin and $150 for the sale of Ripple in May offset by a $50 loss from selling Bitcoin in March.

In Year 2, Taxpayer A would recognize long term capital gain of $670 on their 2018 individual income tax return. This gain is comprised of $370 from the sale of Bitcoin in February and $300 from the sale of Ripple in June.

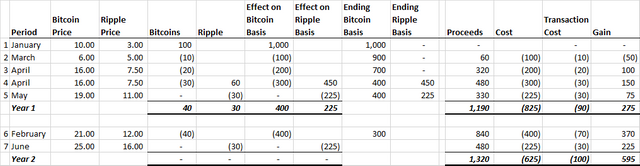

Conservative

In year 1, Taxpayer A would recognize a total short term capital gain of $275. This gain is comprised of $100 for the sale in April of Bitcoin, $150 for the exchange of Bitcoin to Ripple in April, and $75 for the sale of Ripple in May offset by a $50 loss from selling Bitcoin in March.

In Year 2, Taxpayer A would recognize long term capital gain of $595 on their 2018 individual income tax return. This gain is comprised of $370 from the sale of Bitcoin in February and $225 from the sale of Ripple in June.

Disclaimer

Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.