Case Study 10-1: Taxation of Cryptocurrency - Mining (C Corp - Inventory - Tax Liability)

Index - https://steemit.com/tax/@alhofmeister/tax-blog-index

To complete my earlier examples, I've decided to calculate the tax due on each one. To identify the tax impact of the transaction, I have excluded income from other sources as well as the standard deduction/personal exemptions.

Note that I am assigning the salary to the owner arbitrarily ($125 a month). The determination of what represents reasonable compensation for people engaged in the practice of mining cryptocurrency is beyond the scope of this article.

Problem

Taxpayer A decides to mine Bitcoin in January. To accomplish this task, Taxpayer A acquires mining hardware for $500, purchases software for $50 and joins a mining pool that distributes earnings net of a 5% surcharge. Each month, the mining operation increases the electricity bill by $100. In addition, Taxpayer A manages the website the mining pool uses to advertise and is paid $50 a month. Taxpayer A uses a personal computer that is also used for personal reasons (40% personal/60% business). The personal computer was acquired in a prior year and converted to it's current use. The computer cost $600 when it was originally purchased but it's current fair market value is $300. Over the course of the year, Taxpayer A receives the following payouts from the mining operation:

- In February, Taxpayer A is awarded 0.05 Bitcoins when it is valued at $13,000.

- In April, Taxpayer A is awarded 0.08 Bitcoins when it is valued at $14,000.

- In May, Taxpayer A is awarded 0.04 Bitcoins when it is valued at $10,000.

- In August, Taxpayer A is awarded 0.02 Bitcoins when it is valued at $16,000.

- In November, Taxpayer A is awarded 0.10 Bitcoins when it is valued at $12,000.

Additionally, Taxpayer A engages in the following transactions throughout the year:

- In March, Taxpayer A sells 0.05 Bitcoins when it is valued at $15,000. Transaction fees totaled $50.

- In May, Taxpayer A sells 0.08 Bitcoins when it is valued at $10,000. Transaction fees totaled $50.

- In June, Taxpayer A sells 0.04 Bitcoins when it is valued at $12,000. Transaction fees totaled $50.

- In September, Taxpayer A sells 0.02 Bitcoins when it is valued at $16,000. Transaction fees totaled $50.

- In December, Taxpayer A sells 0.10 Bitcoins when it is valued at $13,000. Transaction fees totaled $50.

Solution

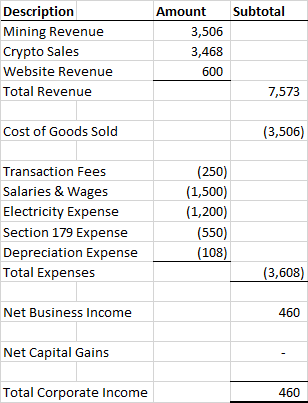

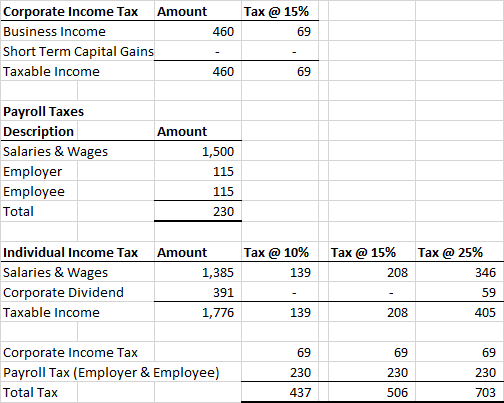

2017

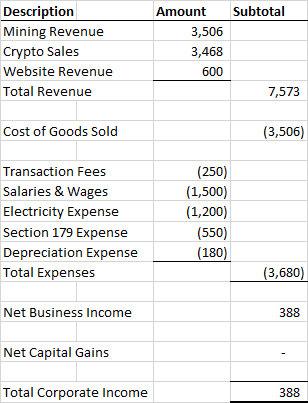

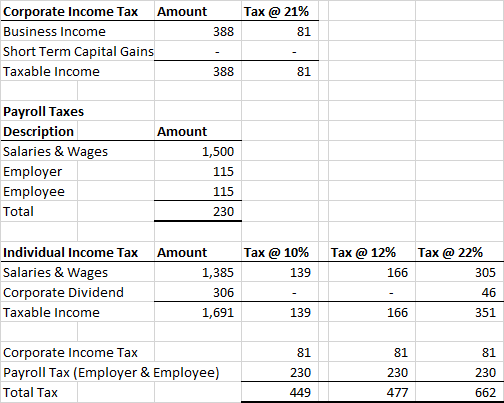

2018

Disclaimer

Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.