The Fed Pauses For Inflation Michael A. Gayed

Summary

- Last week, the Federal Reserve elected to keep interest rates steady – likely through 2020.

- They said they will stay sidelined until inflation increases.

- Some stocks and ETFs to look for to take advantage of this new stance.

- I do much more than just articles at The Lead-Lag Report: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Every once in a while, the market does something so stupid it takes your breath away. - Jim Cramer

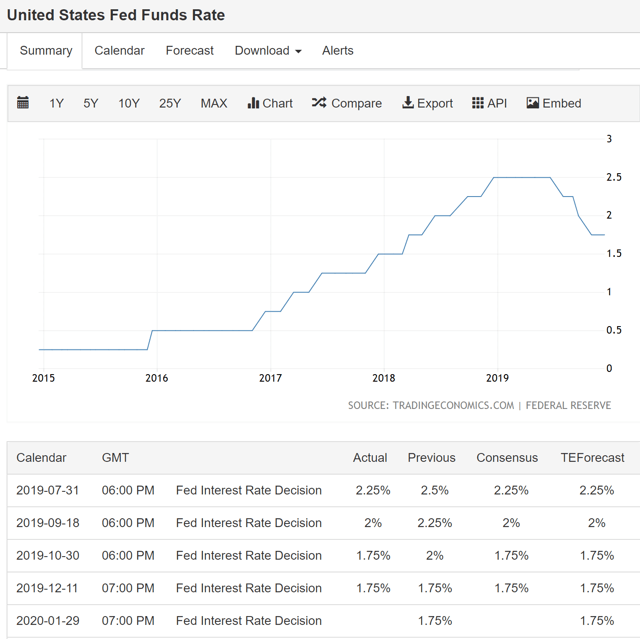

After using the last three meetings to lower the interest rate target, in order to stimulate what they saw as a weakening U.S. economy, the Federal Reserve elected to hold rates steady on December 11. The reason for lowering this year was the weakening of the manufacturing economy, trade tensions affecting the U.S. and global economies, and the potential for a recession to start. Remember, as we discussed on the Lead-Lag report, a recession is kind of like an avalanche - much easier to prevent before it starts, much harder to stop once it starts rolling downhill. Currently, the central bank's benchmark rate is in a range of 1.5% to 1.75%, and the rate-setting committee voted 10-0 to leave the rate unchanged at this meeting. Clearly, most officials think this lower rate is enough to stimulate through the economy and stave off any recession, something that may be clearer if we get some de-escalation of trade tensions as well. We've talked about the trade war between the U.S. and China, but this week, the USMCA was also given some more legs and looks likely to replace NAFTA in the new year. Things are looking up, as Mr. Powell noted when he said "our economic outlook remains a favorable one".

Source: Trading Economics

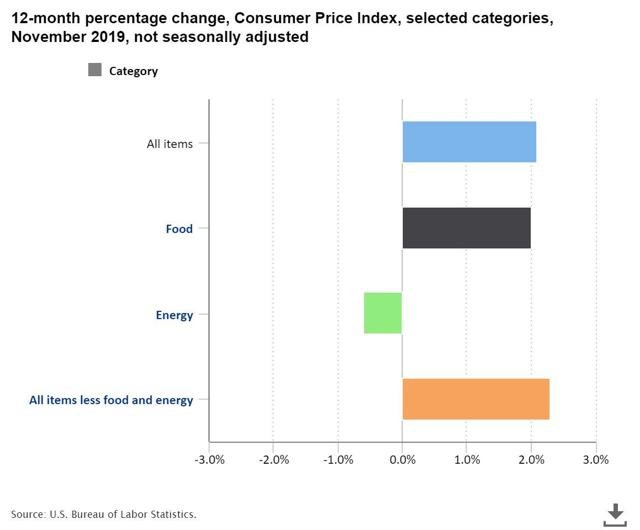

One of the major things to take away from the Fed meeting is that 2020 hikes remain off the table, even if the economy starts to heat up, as long as inflation remains low. And inflation looks stuck in the mud, especially if tariffs decrease in 2020 as opposed to increase in 2019. The recent reading on inflation in consumer prices was supposed to be more, given the trade tensions, and unemployment rate at such lows. Consumer prices only increased at a 2.1% annual pace in November, from 1.8% in October, according to the U.S. Bureau of Labor Statistics. This is as U.S. unit labor costs were also revised down for Q2 and Q3 in a report earlier in the week. So, what does that all mean? Companies cannot seem to raise prices in the face of globalization and consumers' tendency to Amazon (NASDAQ:AMZN) their purchases (i.e. they are able to shop around at the click of a phone button, so if your price is too high, they can just Google (NASDAQ:GOOG) (NASDAQ:GOOGL) for a better one). How long can low inflation continue? Probably longer than we all think. The internet has been a massive phenomenon in the last 5, 10, 15 years, and one of the things it is doing is keeping inflation lower via stable prices. The Fed won't move unless that metric stays, consistently I think, above the 2.5% range - something it hasn't done in a long time. Jerome Powell has stated his preference to let inflation run hot for a period as well, before raising interest rates.

...Read the Full Article On Michael A. Gayed's Blog on Seeking Alpha

Author Bio:

This article was written by Michael A. Gayed. An author on Seeking Alpha and founder of the Lead Lag Report.

Steem Account: @leadlagreport

Twitter Account: leadlagreport

Learn more about Michael A. Gayed on Seeking Alpha

Steem Account Status: Unclaimed

Are you Michael A. Gayed (a.k.a. leadlagreport)? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

Congratulations @leo.syndication! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!