What is Svandis? Overview of the Svandis project

1/ Introduction to market context

In an era of information explosion, volume news does not mean value. Svandis wants to revolutionize the way you get information.

Over the past few years, the ICO has become one of the most potential areas, attracting attention from the general public, and investors in particular. At the present time, there are quite a few ICO review pages that provide general information and give objective reviews of the project. However, for newcomers to this market or to retail investors, they may take a long time to get to know the first place because there are no reliable addresses to find out. Potential projects or accurate information on projects. In addition, there are many "rumors" around projects that make it difficult for investors to find good projects to invest. In order to solve this problem, Hermann Finnbjörnsson and his team members came up with the idea of creating Svandis - a platform that provides tools and information to help investors put more effort into their business. Make more accurate business decisions.

2/ What is Svandis and its solution

Svandis is a platform for the pre-coded market to provide financial research and analysis tools for professional short-term and long-term traders, analysts, venture capitalists and participants in the ecosystem of this market.

Svandis will provide users with 12 major analytical tools for each project, including: ICO and project tokens, evaluation of coding and project tokens, Svandis index, construction only numbers, notices, tables, other analytical elements, heat maps and groups, projects should be monitored and projects warned, custom user interfaces, markets and portfolios.

3/ Features

- ICO and Token Sale Screener to select and analyze the upcoming ICOs that investors want to participate in.

- Electronic money and Token Screener to select the likely token for the transaction

- Diverse visual tools provide traders with a simple visual representation of all valuable information. These features include Svandis indexes, thermal maps, charts, group analysis and impact factors.

- News feeds in real time to keep users updated 24 × 7

- Customizable user interface allows traders to freely enter their setups for technical indicators, price warnings, and create tracking lists among other criteria options.

- The market to ensure the liquidity of the token Svandis

4/ How does the project work?

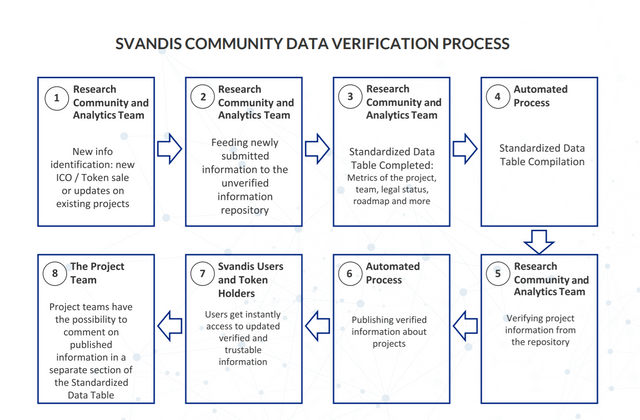

Svandis's operational mechanism will be divided into two main phases. The first phase is set up with the goal of forming a team of professional ICO analysts. Every user is encouraged to write reviews of existing ICO projects on the market, then Svandis' team of analysts will review all of the information that the user is evaluating. Each time a comment is completed, the user will be rewarded with a certain amount of SVN token. In addition, with each article being rated, the credibility score of that person's popularity will also increase. Finally, Svandis will have a potential set of ICO evaluators and analysts.

For the second stage, Svandis encourages users to double check the information available on the system. If each information provided is authenticated by 10 users, the credibility of the provider will be increased. Once the user is confirmed the information over 10 times by 10 different users in the system, they will be tagged as reliable analysts. Top best analysts will be invited to the Svandis team for project analysis and evaluation.

The operating mechanism of Svandis is quite competitive, which will encourage users to provide more information as well as useful articles to increase their credibility. In addition, for each turn of information authentication, other members of the community also have to think and learn because it is directly related to the project's investment and capital attraction. In particular, the information and articles will again be re-evaluated for accuracy and reliability by members of the Svandis team. The result is a team of analysts with highly targeted articles that help investors make the right choices.

B / DataMining Apps:

The highlight of Svandis' technology is the DataMining App. Users can install this app on their phones or PCs, and then automatically download the market data on the web and copy a copy of the Svandis system data. As Svandis says, with faster and faster network speeds, more data will be collected and higher token rewards. Through the DataMining application, Svandis ensures that users will have access to the latest information in the shortest possible time.

5/ Business model:

Svandis will focus on a mixed B2C and B2B business model, as our target audience includes retail electronic money traders, institutional investors, transaction funds, Analysts and traditional retailers plan to enter the electronic money market.

Svandis's goal is to turn complex market information into simple, useful and reliable information. And traders will have to pay to get that information, giving them a competitive advantage in this fierce market. Participants who receive information will be reviewed through the number of SVN token users hold. Of course there are free bundles for basic level, but for getting more detailed information and using the main functions it is only accessible by the SVN token.

And the level of access and level of tokens required for each level will be announced after the product is released.

In addition, participants who contribute information will be rewarded with Token SVN.

6/ Token and Token Information Sales:

Token name: SVN (built on ERC-20 standards)

Total supply: 400,000,000 SVN

Hardcap: $ 12,000,000

Token sale: 60%

Token price: 0.05 USD

Payment accepted: ETH

KYC: Yes

Ban: US, China, Singapore

Use of funds:

40% - Development and security

30% - Analytics Room

20% - Marketing and business development

5% - Activities

5% - Legal

Comment:

The project has a lower hardcap than many other ICO projects on the market, which is a good signal for investors. In addition, Svandis's token allocation mechanism is reasonably well-suited, with the majority of token (60%) being sold out, with the remainder divided equally between the company and its development team, Marketing is also quite reasonable. In particular, under this mechanism, there will be no bonus programs such as bounty or airdrop, ie the opportunity to control the token prices on the floor will also be much smaller. According to Svandis adviser Nodari, the token for the team will be blocked for two years, for bonus investors will also be blocked token within a year. With the current token locking mechanism, it is possible to guarantee that some of Svandis' tokens on the floor will be difficult to manipulate by any party.

7/ Roadmap:

The current road map of the project runs until the first quarter of 2019. This can be seen as a detailed roadmap and the progress of the Svandis project is quite fast. Up until now, Svandis has developed the DataMining App platform, and in the third quarter of 2018 will launch trial versions of Screeners, Newfeed and Heatmap. Until the end of the year, Svandis intends to test all of the tooling functions Svandis provides to its users, which are noteworthy milestones for this project. However, it can also be seen that the capital mobilization of the project is slower than the proposed roadmap. The private and pre-sale rounds that are scheduled to begin in the first quarter of this year will not be finished yet, and the token that is due to begin in the third quarter of this year may be delayed more slowly than the current one. out.

8/ Communication and Community:

Official Telegram Chat (7000+ members): https://t.me/svandis_chatroom

Official Telegram Announcement (300+ followers): https://t.me/svandisio

Twitter (2400+ followers): https://twitter.com/svandisio

Medium: https://medium.com/svandis

The hype (Fomo) of the project is not high, the number of new members of the official telegram channel has increased slowly, but in recent times, the interaction between the community and the project has increased relatively, although Most questions remain about public sale and tokens. In general, the project does not have a proper marketing plan to draw attention from the community, although Svandis is in the private presale phase.

9/ Human Resources and Partners:

9.1/ Dev team:

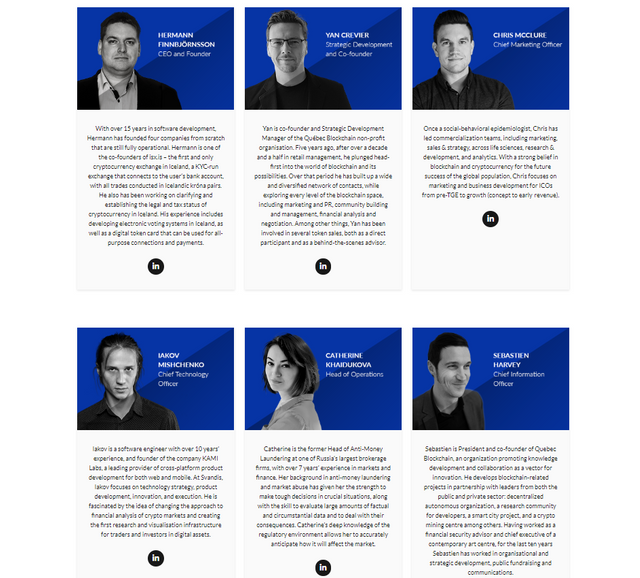

Hermann Finnbjörnsson (CEO): More than 15 years in the industry, has formed four companies including the isx.is (the first and only electronic money exchange company in Iceland) and a trading platform. KYC (connected to a user's bank account), graduated from Flinders and Háskóli universities by computer engineering

Yan Crevier (Co-Founder): Co-founder of Quebec Blockchain, a not-for-profit organization that promotes and develops blockchain projects, has attracted $ 15 million for the ICO Latium project.

Iakov Mishchenko (CTO): Over 10 years of experience in the field of software development, founder of LAMI Labs (a provider of cross-platform product development ideas), graduated from Kharkiv University Radioelectronics Computer Science....

Svandis's development team has quite a few members, of whom only two have direct experience in the technology and blockchain field, including CEO Hermann Finnbjörnsson and CTO Iakov Mishchenko. This may cause the progress of the project to be slower than other ICO projects at the same time. However, Svandis is still recruiting more members for its development team to be able to deliver better performance.

9.2 / Advisory Team:

Bokky PooBah (blockchain consultant): A blockchain security expert with more than 20 years of experience in the field of quantitative software development, has been working on blockchain Ethereum since 2015, as a contract security auditor. Smart for more than 20 companies

Kate Kurbanova co-founder of the ICO Akropolis project, Cindicator project manager (technology that combines the pros and cons of human and artificial intelligence)

Nodari Kolmakhidze: Chief Investment Officer Cindicator, PhD in Financial Market Analysis.

There are also many other members of the advisory team. Compared with the development team, Svandis' team has many years of experience in the field of computer technology, especially blockchain technology. Many consultants also come from ICO projects such as Kate Kurbanova from the Akropolis project or from David Kolmakhidze from the Credits project. This is a great advantage for Svandis because it is sure that the project will receive a lot of advice as well as project development orientations from the consultants with many years of experience in the field.