Nexo: Expand Your Financial Sovereignty with Passive Income

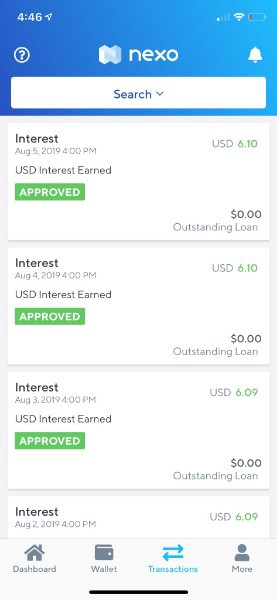

At the time of writing, the yield for fiat deposits on NEXO is 8% per year APR with no minimum required. The best rate you’ll find at FDIC insured banks is around 2.39%. Below you can see my actual account accumulating compounded interest on Nexo.

I haven’t added more money into my account, the increase from $6.09 to $6.10 is purely due to the compounding effect.

What is Nexo?

Nexo enables digital asset holders to use their assets as collateral to secure fiat loans. Most of their clientele are hedge funds, cryptocurrency exchanges, crypto miners and cryptocurrency investors. Nexo essentially pools money from fiat depositors and lends it out to these players. These borrowers pay back the loan with daily payments which enables Nexo to make daily interest distributions to their depositors.

Unlike banks, Nexo is able to guarantee loans by requiring collateral. The collateralized asset will be liquidated immediately by the Nexo oracle once it crosses the liquidation price threshold. Borrowers can prevent this in two ways:

Add more collateral

Pay back some or all of the loan

The Nexo oracle is designed to ensure the collateral is always worth more than the face value of the loan. This is a sharp contrast from the fractional reserve lending model used in the legacy banking system. Nexo isn’t FDIC insured but the funds are custodied with Goldman Sachs backed custodian Bitgo. Currently, $100 million is insured through Lloyd’s of London.

How to Begin?

Getting started is very simple and easy. No need for KYC (entering personal information) unless you want access to higher daily withdrawals, get a Nexo card, or receive dividend distributions. Currently you can only deposit USD stable coins, however bank transfers for US citizens is in the road map. To use Nexo you must first convert your fiat into a USD pegged stable coin. Coinbase makes this very easy to do.

Simply send your USD stable coin to Nexo and begin earning daily interest. It simple as that!

Want to learn more? Watch my youtube video below.

Are There Any Risks?

Despite being a licensed and regulated financial institution there are always going to be risks. This applies to any investment you make in your life. As an investor you need to do your own research and decide how much risk you’re willing to accept.

You should consider the following points before putting your hard earned money on the platform:

This model is new and still experimental

Is Nexo prepared for a potential bank run?

Third party has custody of funds

Nexo oracle could reveal bugs or vulnerabilities in the future

Regulations from governments may adversely effect business

Also, click here to view a reddit forum discussion on potential red flags: https://www.reddit.com/r/Nexo/comments/cjp6sx/due_diligence_on_nexo_red_flags/

Conclusion

Personally I think these lending platforms are a gateway to decentralized finance. In the future, I firmly believe protocols will mediate most financial transactions. Ask I write, these defi protocols are being rigorously tested and their respective governance models are being constructed. They aren’t prime time ready, but I would imagine in the next 5–10 years they will become more ubiquitous.

Want more info on crypto related finance? Follow me on

Twitter: https://twitter.com/CryptoOneStop1

Youtube: https://www.youtube.com/channel/UCNgGAqSgBp8-qxY51u1-_MA

Medium: https://medium.com/me/stories/public