US Capital Markets Review 3/2/18

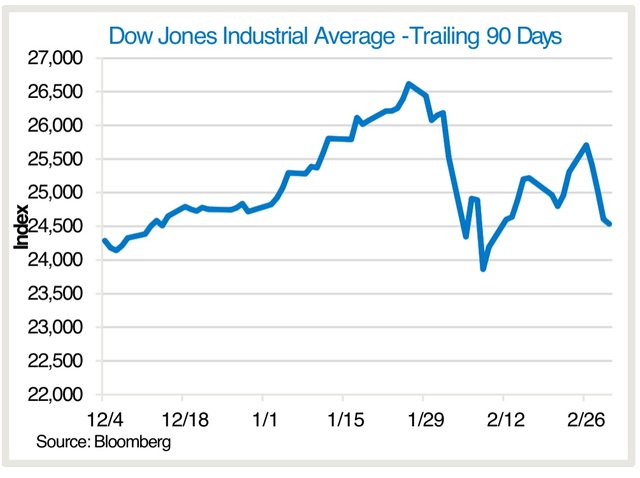

The US capital markets had a rough week this week. The major indices were all down, with the Dow Jones Industrial Average leading the way at an over 3% loss for the week. The weekly loss puts in the Dow index in the red for 2018 at (0.7%) year to date.

In economic news, inflation numbers came out this week mostly as expected, which shows modest inflation. The consumer price index showed 1.5% inflation over the last 12 months. Inflation was also the discussion as it pertained to the Fed. Minutes from recent meetings were released, and the Fed is very focused on inflation and how it is doing compared to their 2% target. The big uncertainty hampering the markets is a possible 4 rate hikes in 2018, instead of the consensus view of 3 to start the year.

The political front seemed to little effect the markets this week, although there is always drama (Kushner and some foreign loans, as well as his security clearance down graded; Putin boasting of impossible to stop nuclear weapons).

Given a possible 4 rate hikes from the Fed this year, as well as the fact that they have a ways to go to finish their interest rate raising, I like the financial sector right now. I think bank stocks will outperform the general markets, as most of them are lenders who will now be able to charge higher interest rates and they are slower to increase depositor interest rates, allowing for a bigger spread - these things will boost their top line and profitability. Being underweight on bonds funds (not an issue if you buy specific issues and hold to maturity) is also a good idea, as rising interest rates mean a higher effective yield on bonds, causing those holding to have downward pressure on the present value of their bonds. If you still want bond exposure, sticking to short duration bond funds is a safer option.

Good luck,

BrianI

All in all I'd say Jared Kushner had a rougher week than the markets did!

How many of the 4 possible rate hikes do you see taking place?

Also, do you think that the announcement from Russia will cause a boost in the weapons sector as they get new contracts in a race to catch up with the Russians?

If you asked me at the beginning of the year, I would have said no way there is more than 3 hikes, but I am not so confident now. I still think there will only be 3. Regarding weapons spending, I am doubtful there will be an increase to take advantage of, aside from the the budgets increases already upcoming. The experts thing Putin is bluffing on his capabilities so I am not even sure there is anything there to be concerned about above the already strained relationship... good luck!

But he said that he wasn't bluffing. :D

I think you're right that there will probably be 3. I wonder if they get scared and just do 2 though. It's hard to predict. I guess that's why we listen to you, right? ;)

Hello friend @brian.rrr, greetings to you and your beautiful family. Good to know all this information, since I had no knowledge about it and it is always good to know new things and more if they are as important as this topic on the Review of the US capital markets, as this is a great country power that has grown in all this time. Regrettably here in my country inflation is also very high and therefore that forces the prices of food, personal products, cleaning products; everything of the basic food basket goes up in prices, and it is the gravitational problem that is affecting us here in Venezuela, the inflation. Excellent publication, my friend, thank you for sharing it.

Hello friend, greetings to your beautiful family, very important information that maybe we have not much idea, thanks for sharing it, I hope this week next everything will improve!

good job! happy to support! sentiment incicators for stock very bullish here...(lts of negativity and fear) So we can revisit the old highs...then it a long, long decline..

Excellent! Great report, is not surprised by the inflation part, the economy is so unstable! The important thing is that the index is not high, but it is necessary to take measures to prevent the index! thanks for the report, like every week

Thank you for sharing this info with us! I'll continue following you, have a nice day! :)

this is a very good information.this time i read your post and i am knowing us capital markets matter.i have no idea this matter.its fully new thing for me.i am very happy because today i am receive new idea about us capital matter.thank u very much for your good post sharing.imformative post sir. @brian.rrr

hey there

click on my link to earn 2000 per month free

https://steemit.com/money/@wolf92/easy-job-from-home-earn-at-least-2000-dollers-per-month

vote and tell me if you like it

Friend Brian, I see that apart from fishing very well, you are also very good at discussing economic issues! By sharing news like this you inform a lot of people appropriately. Congratulations. Best regards.

well u.s faces inflation during the last year of barrack obama and now donald trump is keeping the system too tight.

i hope soon U. S will came out of inflation and the exchange will rise.