US Capital Market Review 2/9/18

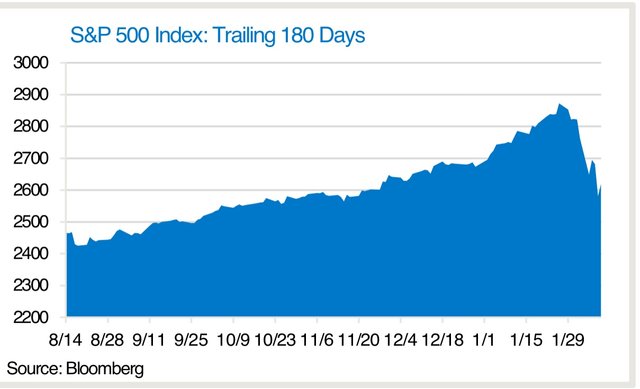

What a wild ride this week! It was a rough one, with the markets down for the second consecutive week. The S&P500 was down 7%, and 2018 has turned red for the year, despite the strong start. In an oddity, small caps outperformed large caps this week, which is rare when the markets go down as much as they did this week.

Given the weekly loss and volatility, the VIX soared and closed above 30 after being sub 10 nearly all year long. While I am not sure what affect it is truly having, I am hearing chatter that leveraged volatility products are causing a lot of the market sell off. Regardless, the big scare on Monday was the Fed giving itself wiggle room to have 4 interest rate increases in 2018, instead of the guided upon 3 interest rate increases. This news shouldn’t have had as much affect as it did, but the uncertainty spiked the volatility, which, when leveraged at 3-4x, caused some quick selling, which scared people and caused further selling.

In other economic news, a strong jobs report came out this week and the unemployment rate remains at historic lows near 4.1%. Treasury yields were strong all week, despite the volatility, with the 10 year closing above 2.8%.

In political news, a budget deal to prevent a government shutdown failed to get completed before Thursday night deadline (not a shocker), but was quickly remedied when President Trump signed a massive spending bill, which raised the debt ceiling, on Friday morning.

Fundamentally, little changed during the week despite the volatility, and the shakeout will likely prove to be a buying opportunity in 2018 for those with a long-term investment horizon.

Good luck!

Brian

Hi Brian, I totally agree that fundamentals are strong and would not commonly be a point of distress, but I just wrote about why VIX could be a catalyst, would you mind checking it out, would value your opinion :)

Really interesting read, thanks as always for doing these roundups! This is actually the first time I've seen any really good explanations for this weeks cliff dive so it's really good to read some well reasoned theories rather than 'the end [recession] is nigh' type talk!

thanks for the weekly report! God help us and this week is good news! thanks for sharing

It isn't all that shocking that there has been a bit of a pull back in the market. 2017 was a huge year for growth with many of the major players in the market seeing significant gains. Some companies have been setting all time record highs as far as stock price and market cap. As a teacher I have taught my students about the market using a tool called How the market works. http://www.howthemarketworks.com/ It has been a great tool and I would highly recommend it to anyone who want to get their feet wet in the market but isn't yet ready to risk the their hard earned money. The platform has even started to adopt cryptocurrency for their investor want to be's. It sometimes feels like the stock market is controlled by a very small number of major players but at the end of the day that is no different than what we are dealing with every day in the Crypto world. Fingers crossed for a return to the green soon.

excellent as always, the socio-economic-political summary of the week! If I think it was a week of difficulties in all sectors, let's hope for good news for this week, thanks for the report

thank you friend very good information and if you have had all the reason to say that 2018 started in red and more when you talk about the steem power that has fallen so much that when making a vote is very low and nothing is generated, very good content, greetings brother.

@calitoo

well done - i like your blog and followed and upvoted cause this is the first time i met you

Sir As usual u are posting good post

This market chart will provide many informations

Thnak u sir for this post ..

Plz doo always like this..

Nice review about capital market.

good info here , I think stocks and shares will always hit highs and lows