Understanding the Flash Crash of 2010: Causes, Impacts, and Lessons Learned

Introduction:

In the realm of financial markets, the term "Flash Crash" resonates as a stark reminder of the inherent complexities and vulnerabilities within the global financial system. Among the most notable occurrences in recent memory is the Flash Crash of 2010, a rapid and unprecedented event that sent shockwaves throughout the financial world. This article delves into the intricacies of the Flash Crash, exploring its causes, impacts, and the enduring lessons it imparts to investors, regulators, and market participants.

Origins and Timeline:

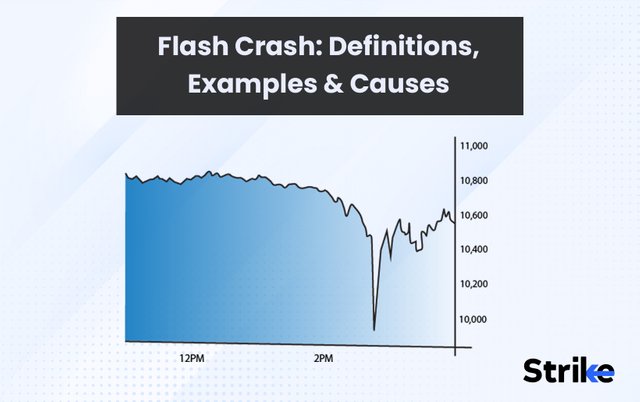

On May 6, 2010, the global financial markets witnessed a tumultuous event that would later be dubbed the "Flash Crash." In a matter of minutes, major stock indices, including the Dow Jones Industrial Average (DJIA), experienced a rapid and inexplicable decline, followed by a swift recovery. The sequence of events unfolded with remarkable speed, leaving analysts and investors scrambling for answers.

Causes of the Flash Crash:

Numerous factors converged to trigger the Flash Crash, with high-frequency trading (HFT) emerging as a central catalyst. HFT algorithms, characterized by their lightning-fast execution speeds and reliance on complex mathematical models, played a significant role in exacerbating market volatility. As these algorithms reacted to price movements, executing trades at an unprecedented pace, liquidity evaporated, exacerbating the downward spiral.

Furthermore, the prevalence of electronic trading platforms and the interconnectedness of global financial markets heightened the propagation of market shocks. With trades executed in milliseconds and automated systems amplifying the impact of sell orders, the Flash Crash unfolded with unprecedented velocity, catching both traders and regulators off guard.

Impacts on Market Participants:

The ramifications of the Flash Crash reverberated far beyond the confines of Wall Street, affecting investors, traders, and market infrastructure alike. For individual investors, the sudden and drastic decline in stock prices led to significant losses, eroding confidence in the stability of financial markets. Moreover, the erosion of liquidity and heightened volatility prompted institutional investors to reassess their risk management strategies, placing a greater emphasis on safeguards against sudden market dislocations.

From a regulatory standpoint, the Flash Crash underscored the need for enhanced oversight of high-frequency trading activities and the adoption of circuit breakers to prevent excessive market volatility. Regulators scrambled to investigate the root causes of the event, scrutinizing the role of algorithmic trading strategies and the adequacy of risk controls implemented by market participants.

Lessons Learned and Regulatory Responses:

In the aftermath of the Flash Crash, regulators implemented a series of measures aimed at fortifying the resilience of financial markets and mitigating the risk of future disruptions. Key among these measures was the adoption of circuit breakers, designed to halt trading temporarily in the event of extreme price movements. By providing a brief respite for market participants to reassess their positions, circuit breakers serve as a crucial safeguard against unchecked volatility.

Additionally, regulators sought to enhance transparency and oversight of high-frequency trading activities, requiring firms to register as market makers and adhere to stringent risk management standards. By subjecting HFT firms to greater regulatory scrutiny, authorities aimed to mitigate the potential for algorithmic trading strategies to destabilize markets.

Moreover, the Flash Crash underscored the importance of collaboration among market participants, regulators, and technology providers in safeguarding the integrity of financial markets. By fostering open dialogue and information sharing, stakeholders can collectively address emerging risks and enhance the resilience of market infrastructure.

Conclusion:

The Flash Crash of 2010 stands as a sobering reminder of the inherent complexities and vulnerabilities within the global financial system. Driven by the proliferation of high-frequency trading and the interconnectedness of electronic trading platforms, the Flash Crash exposed the fragility of modern markets to sudden and unforeseen disruptions. Yet, amidst the chaos and uncertainty, the event also catalyzed a concerted effort among regulators, market participants, and technology providers to fortify the resilience of financial markets and mitigate the risk of future flash crashes. As the landscape of financial markets continues to evolve, the lessons learned from the Flash Crash serve as a guiding beacon, reminding stakeholders of the importance of vigilance, collaboration, and adaptability in safeguarding the integrity of global financial markets.