Never tire of reading a stock market trading article!

As early as a few years ago, I had a vague view through the observation of the law of the rise and fall of the stock market. This view is that when the vast majority of ordinary investors are indignant about the bear trend in the stock market, although the management will take some positive measures to cause the market to rise, the rise is unlikely to be a reversal of the market, just a relatively large rebound Only in ordinary investors, the vast majority of investors believe that the market will fall, and the previous method of holding stocks has suffered heavy losses. If you don't sell your own stocks by rebound, you will lose even more. When this view spreads like flu and is put into practice, then the market will be in the end, a long-term cyclical rise Love will go on over and over again. In this process, most of the investors will make some small money as soon as they are satisfied. In fact, they have already received the retail investors to cut the stocks at the bottom. In the operation of selling high and selling low, the institutions will constantly push up the price of the stocks and reduce their own costs, but they will never be out of the game. However, ordinary shareholders find that they do not earn much except for the handling fees for the stocks they sell When this view spreads like flu and is put into practice one after another, and is close to madness, then the market will really reach the top, and a long, repeated and resistant downward trend will be formed, and a new bear market will start. What is different from the last time is that after the expansion of the stock market, the scale has been enlarged, the form has been updated, the content has been enriched and the technique has been more hidden. The same is that ordinary shareholders once again suffered heavy losses.

In particular, in the long bear market and bull market, there will always be a small number of stocks going against the trend. It plays an implied role in the bear trend: you lose money is not a problem of the market, but you have a problem selecting stocks! In the bull market, it plays a warning role: the stock market is always at risk!

The best selling point should be determined after selecting stocks

There are many ways to make money in the financial market. The key is to learn a handy trading mode, do it repeatedly, summarize and improve it. Instead of listening to that friend say to buy this one today, listen to this friend say to do this tomorrow, our money is our own, and we should be responsible for our own money, rather than handing the fate of our money to others.

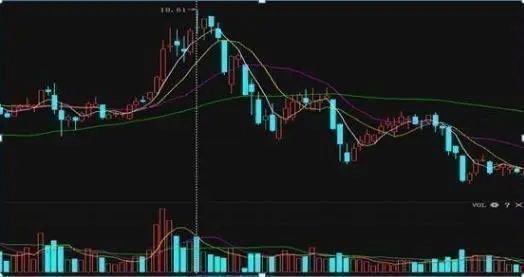

After watching, you will find a good selling point, better than a good stock, super classic

This time, I share with you some common top signals of K line. They all say that it is the master who will sell. He can improve his own ability, make his own decisions and no longer rely on others.

- Top warning of reverse T-line in upper gear

The features and conditions of the upper inverted T-line. Generally refers to the rising trend, there is an opening price, the lowest price, the closing price is the same or almost the same, and with a long shadow line, a short shadow line or no shadow line at all. It can also be called the turning line.

To sum up the above words simply and succinctly, the fact is: only when retail investors cut their meat and sell low-cost chips (stocks) to institutions, and the institutions get enough low-cost chips, the stocks will be raised; on the contrary, only when retail investors receive chips (stocks) at high prices, can the institutions deliver goods smoothly, and the stocks will fall.

In the stock market, the rise and fall of the market are to achieve this purpose. I didn't expect that this view was confirmed by Marx. In an article I saw last year, someone quoted Marx's discussion on the stock market. I didn't write down the original words, which roughly means that "the State takes money from the people's pocket by the most legal means free of charge." If anyone knows Marx's original words, please enlighten them

I think that's probably what the stock market is all about. If you understand that, it's not surprising what's going on in the stock market.

We know that the national economy is developing very fast, and the people have more and more money in their hands. Out of various considerations, people always like to save money: Yes! Now we all attach importance to children's education. Seeing a doctor is so expensive. Buying a house is also a large sum of money. How can we do without money? Although the state has introduced a lot of policies to encourage consumption, the people still feel that it is the most practical to keep money in their hands, and now the main way is to keep it in the bank.