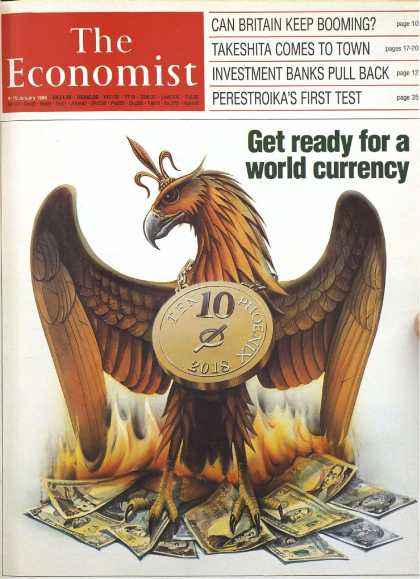

One world, one money - The Economist Jan 1988

One world, one money

A global currency is not a new idea, but it may soon get a new lease of life

Sep 24th 1998

IN DIFFICULT times, people are allowed, even encouraged, to think the unthinkable. Some of the economists who propose capital controls as a remedy for recession in Asia claim to be doing this—but they are flattering themselves. Unthinkable? Malaysia just did it. Dozens of countries still use capital-account restrictions. And it is a cliché of the orthodox “sequencing” literature that a variety of such controls should be retained until other reforms are complete. Really, to think the unthinkable, you have to be bolder than this.

So here is an idea: global currency union. Let nobody call it boringly feasible, or politically expedient. Yet, like all the best unthinkable ideas, it has more going for it than you might think—in principle, at least. The idea is not new. Richard Cooper of Harvard University proposed a single world currency in Foreign Affairs in 1984, and he was not the first to think of it. It seemed an outlandish idea, and still does. But much has happened lately to make it worth a moment's thought.

The usual way to ask whether countries would be better off sharing a single currency—that is, whether they constitute an “optimal currency area”—is to examine the following trade-off. On one side is the undoubted convenience of a single money as a lubricant for trade and cross-border investment. On the other is the loss of the exchange rate as a shock-absorber for times when one or more of the countries face pressures (an abrupt fall in demand for their exports, say, or a sudden rise in labour costs) that the others are spared—a so-called “asymmetric shock”.

In setting cost against benefit, again according to the standard view, the crucial factors are openness to trade and freedom of movement of factors of production. A small open economy has more to gain from the convenience provided by a single currency. On the other hand, if labour (especially) is reluctant to migrate, the need for the exchange-rate shock-absorber is all the greater. Weighing all this, most economists conclude that the 11 countries that are about to adopt the euro are not in fact an optimal currency area. The world as a whole is not even close.

So what has changed? The main thing is the current global emergency. This is so serious a crisis that it is likely to prove a paradigm-shifting event, though straws were in the wind already. The emerging-market disaster poses the question, How is the world to live with globally integrated finance? In addition, it casts doubt on what once seemed a good answer: that floating exchange rates are the best way to stabilise the world economy.

Shockingly unstable

According to the traditional model, a country with unduly high labour costs, and therefore a troublesome current-account deficit, could expect to see its currency depreciate; this would cut real wages, making imports dearer and exports cheaper, thus neatly restoring the economy to equilibrium. But in a world where international flows of capital overwhelm international flows of trade, this does not work. Floating exchange rates destabilise trade and investment by wrenching relative prices away from their fundamental values (that is, from the values that would put the corresponding exchange rates at purchasing-power parity). In the emerging-markets crisis that currently threatens the world economy, exchange-rate movements have not been absorbers of shocks but amplifiers and even creators of them.

Governments of small open economies have long known that it is not an option to “leave the exchange rate to the market”. Monetary policy must always keep at least one eye on the currency. But governments have also learnt, in a second big change, that intermediate exchange-rate regimes do not work either. That was the lesson of the European Monetary System debacle of 1992-93 (and, arguably, of the downfall of the pegged-but-adjustable regimes used in Asia until last year). Semi-fixed systems cannot withstand the assault of integrated capital markets: they are prone to self-fulfilling panics. In other words, they too are destabilising.

But what does that leave? Let's see. Pure floating is no use. Semi-fixed is no use. So there are two possibilities. One is to turn back the clock on financial integration: then pure-floating or semi-fixed systems might once again be used successfully. That would be enormously costly, especially to the developing countries; and it would be very difficult, because integration is partly driven by technological progress, which is hard to reverse. Still, it is a fair bet that a lot of countries will follow Malaysia's example and give it a try. Otherwise, it seems, the remaining course is to combine increasing integration with perfect fixity of exchange rates—meaning currency union.

The fashion for currency boards reflects some of this thinking. Exchange-rate flexibility is more trouble than it is worth, advocates say, so abandon it once and for all. Alas, currency boards suffer big drawbacks all of their own. Whereas a currency union has a central bank to act as lender of last resort, a country with a currency board does not. So these regimes are vulnerable to runs on banks. Currency boards are a poor test of the larger idea.

The all-or-nothing, float-or-merge analysis also provides the case in economic logic for the euro: strive for integration, it says, no holds barred. Unfortunately, EMU is a somewhat flawed test as well. It is a political project as much as an economic one, so it will not reveal everything about how well a currency union among independent nation states might work. But it will reveal a lot, and its symbolic importance will be immense. If it fails, not only will that cause enormous political harm to the European Union, but the pressure for global financial barriers will be greatly strengthened. If it succeeds, the case for a global currency union will seem much more interesting.

Fine, you say, but how would the world ever get from here to there? Hard to say, admittedly. Find the answer to that and the idea would be thinkable.

Hi, I think we are tending in the same direction - currently working at creating awareness amongst the able and responsible in this community about a SmartCoin currency with a stable relationship with cost of production of essentials. Just published a tentative layout of the concept, with the idea of following up with a perhaps more sensible proposition along the same lines. The properties of this currency should for example make it an ideal medium for payment of universal basic income. A trustworthy purchasing power relative to elementary production costs will mean that minimum wages and universal basic income quanta would theoretically have to be calculated only once and that pensions would be safeguarded against inflation. Anyhow, before I comment with more prose than your post, let me rather say that I will appreciate your opinion on what I have blogged so far..which you will find at @clicketyclick. Pardon the off topic aspects you will find there, meant as a broader introduction of myself to a wider audience. Regards

thanks for the feedback