Gold, Stocks & Cryptos ALL Down : What’s Up?

Federal Reserve Chair Janet Yellen is up, that’s what. She finished her 4 year term on Friday and went out with a bit of a bang. She reminded us all of the power of the Fed with another great example of her now infamous “Jawboning” that, this time, would rock the markets rather than sooth them.

Source

I won’t give you the direct quotes because it does sound mundane and if you’re not familiar with “Fed Speak” it will probably just confuse my point. She basically said to expect higher interest rates in the US and this kicked off proceedings for the selling in Stocks and Gold to begin. She was then backed up by Dallas Fed President Robert Kaplan who said more than 3 rate hikes might be needed this year. The selling accelerated.

Source

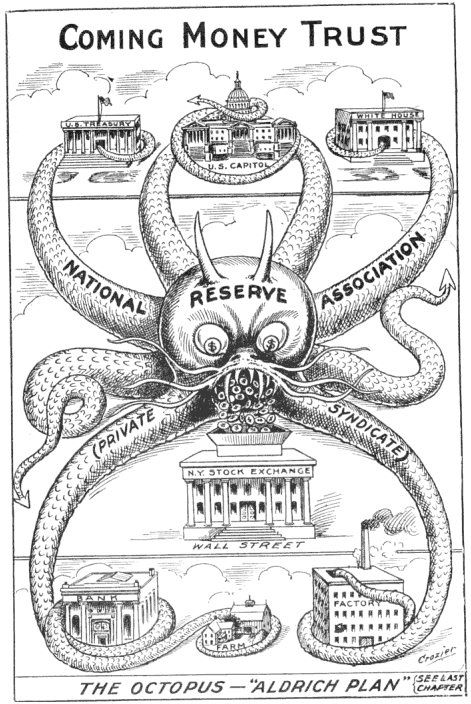

This is how the Fed operates. They can move markets with words and they often come out in procession like this to add weight to each other’s statements and give the impression that what they are saying is as good as certain. The market nearly ALWAYS responds and it shows just how much power this centrally planned (and private) financial institution has on the global markets. They aren’t nicknamed the “Vampire Squid” for no reason.

Source

Stocks sold off in their worst day since Trump was elected in 2016. Gold took a hit too, and Cryptos….well if you’re here on STEEM you probably already know about Cryptos. We were probably going to have a bad weekend anyway, but still it is rare that all 3 of these asset classes were down TOGETHER. So you have to ask yourself the question – What’s UP?

Source

Well, other than Yellen, the US Dollar is up. CASH IS KING again, for at least the weekend anyway. That horrible inflated fiat currency that has been used to fuel corrupt governments and wars across the globe is back in charge of momentum again for now. Trumps choice to be the new Federal Reserve Chair is Governor Jerome Powell and so he is the new guy in the hot seat. The question I am asking myself, did Yellen just shit the bed on the way out? Could this be just the tip of the iceberg and a broad sell-off (particularly in Stocks) may have just been triggered. Did she just give us the signal?

Source

Again it seems wise to suppress that inner Conspiracy Theorist nutter and listen to the rational mind. Stocks had a bad day but they were down less than 3%. Gold was hit but it fell by less. Cryptos have had a torrid weekend but even they look oversold with so much panic and FUD going on. The US Dollar still stinks and that’s not likely to change much either. So this was probably just Yellen flipping us all the bird on the way out.

Source

http://looneytunes.wikia.com

http://dimartinobooth.com

http://gorillawire.com

https://giphy.com

http://tvtropes.org

What's up? Fear!

And hunger.

Cant sell at this rate, but i need cash

I think this is gong to be a trend this year

Every major central bank is signalling an end to their quantitative easing(money printing/stock pumping) This suggests that 2018 is going to be a tough year for stocks and bonds.

When the margin calls come in the traders have to sell what they can which is usually what is liquid, in this case paper gold.

Maybe

Keep stacking, its on sale!

wait for the right time.

Ding, dong... the witch is dead!

bubble is popping! I saw this coming. I decided to stay long with my STEEM.. I believe in this platform, so I think it will work out!

nice post

Some puppet will just take her place, it's a perpetual pyramid scheme fueled by wars, debt and slavery.. Crypto will be back up, I bought more, love half price sales.

The Fed's TIPS can be measured in the SOMA report. There has been no easing of quantitive purchases, Monday the BTFD program goes back in full form. It was Super Bowl weekend and the algos got some time off is all. Now back to work bitch!

I wrote you a post about anarchy.

"Vampire Squid" is Goldman Sachs, not the Fed @buggedout. I worked there so I know. Aside from that, I've been thinking a lot about how macroeconomic variables affect cryptocurrencies, if at all. I don't think there's any real connection between inflation, interest rates or currencies and crypto. Maybe when there's fear and lack of trust in the real economy then crypto should get a boost?

No connection between inflation and interest rates? Wait, what? Macros not affecting cryptos?? Lets see what btc does on a +10% DOW plunge. BTFD, maybe.

there's no connection between inflation and crypto as well as between interest rates and crypto :) there's obviously a connection between inflation and interest rates. don't think global GDP growth is a factor in bitcoin price - don't you agree?

The Tuesday plunge proved macros and cryptos are intimately connected. The Thursday plunge may have been the first sign of uncoupling.

Global GDP dropping would likely bring crypto down, but we haven't seen that one since pre-09 so its impossible to know. I would bet that a drop in the one would produce a dive in the other, but after this week, it may be different this time.

Clearly though, up until Thursday, when the dow dipped, crypto fell.

It's kind of the same beast but people also refer to the Fed as the Vampire Squid or even The Vampire Squid of Vampire Squids. That cartoon is actually from 1912 and may have gone some way to inspiring the nickname.

The whole Federal Reserve system is rigged to help banks make money. It was concieved by bankers to help bankers. Look into it; it interesting how blatantly corrupt the system is and that fact that it is still around is nuts!

Cant be in a bull market forever, has to cycle

Yep, massive hike in December = big drop in January. No big surprise though. The trend lines follow the long term investors. Volatility follows trading sentiment. There has to be a balance.