The most important social media stock last year is not what you expect

All of the major social media companies have now reported their fourth-quarter earnings. As usual for Facebook and Alphabet (owner of YouTube, and somehow, still, Google+), it was a tour de force, with the companies generating $12.9 billion and $32.3 billion respectively, both with double-digit growth over the same period the year before. Even Snap, Snapchat’s parent company, had a decent quarter, posting a smaller-than-expected loss, closing above its IPO price for the first time in months.

Yet amazingly, the best social-media performer on Wall Street over the past year was Twitter. The microblogging site, which posted its first quarterly profit ever today (Feb. 8), has actually blown the other stocks out of the water with its performance.

Even before today’s spike on the profit news, Twitter had been having a surprisingly positive year, given the scrutiny around Russian bots meddling in elections, and the latent abuse issues on the platform. Its stock price had been up about 44%, and that jumped to 74% on today’s news, making it the best investment by far in the social media space over the last year. (Whether that continues to hold true when Twitter posts its next earnings, is another matter.)

Much of Twitter’s revenue growth in the quarter came from data licensing—insight on the collective stream-of-consciousness that is its platform, which it sells to companies—and video advertising.

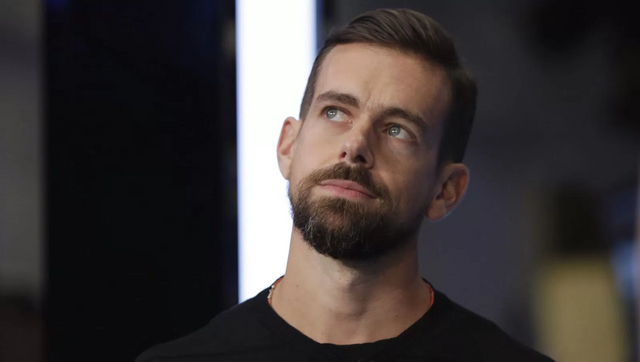

It’s worth pointing out, however, that Twitter is coming from a far smaller base than its competitors. Twitter’s stock price a year ago was $18.72—Facebook’s was $134.19, and Alphabet’s was $829.88. Any meager dollar-amount increase in Twitter’s price is going to mean a far larger percentage increase than for Facebook and Alphabet. But still, anything you’d invested in CEO Jack Dorsey’s social media company over the last year would’ve given you a far larger percentage return than an investment in the behemoths.

Oh and by the way, the other public company Dorsey founded and runs, Square, is also having a great year: The payments company’s stock price is sitting at $41.67, which is a massive 188% more than the $14.47 it was worth this time last year. Perhaps all the naysayers who’ve said there’s no way Dorsey could successfully run two public companies (even Elon Musk told him not to) need to reevaluate their position.