How to use the OCOs in the Cryptorobotics trading platform?

Trading on crypto trading platforms or exchanges comes down to placing orders for buying or selling cryptocurrency. The trading process is more complex than it may appear at first glance, as there are a lot of subtleties in trading itself. For instance, every trader should know how to use the various types of trade orders. Therefore, we will now consider them in more detail on the Cryptorobotics trading platform.

What are the different types of orders intended for?

Order types exist for the traders who want to submit a request to buy or sell crypto and retain control over their order after entering the market. That is to say, a trader who opens a new order to purchase or sell cryptocurrency can adjust the parameters for trading and manage risks.

In trading in cryptocurrencies or other assets, all orders are divided into several categories, depending on the conditions for their execution. It is also possible to change the order parameters such as execution time and much more. Understanding how different orders work is the foundation of crypto trading.

Let's take a closer look at what types of orders are there and how you can use them in the Cryptorobotics trading terminal.

Type of orders on the Cryptorobotics trading platform

The traders can configure the following orders on the Cryptorobotics platform:

- Limit order

- Stop limit order

- Market Order

- OCOs, or smart orders

What is a Market Order?

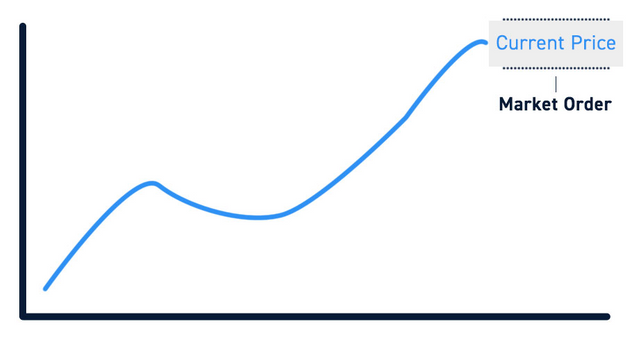

A market order is essentially the most basic form of a trade's order and is an indication to buy or sell a cryptocurrency at the best price currently available. If you enter a cryptocurrency trading platform and want to purchase a coin with the best available price right now, so placing a market order will be the reasonable choice for a trader. This type of order is widespread among newbies and is often considered the simplest. It can be useful when you just want to enter or exit a position fast with sufficient liquidity.

What is a limit order?

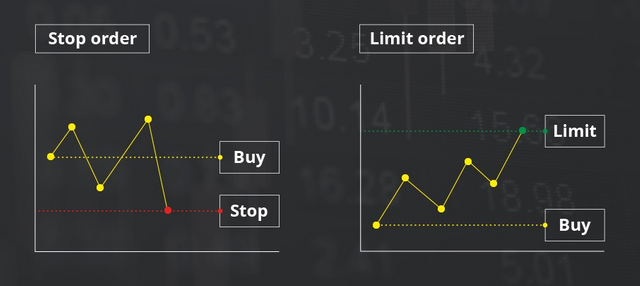

With the help of the limit order, a trader can customize a certain price at which he wants to buy or sell a coin. The order is executed only if the market price of the asset reaches the level specified by the trader. While market orders are executed immediately, limit orders are executed at a predetermined price, which is generally better than the current market price.

Example: You think the value of Bitcoin is about to go down. The implementation of a limit order will provide you with the ability to customize the cost of the trade execution. For instance, you place the order $1000 lower than the current price in the market and submit it to the order book. If BTC falls to this price, then the limit order will be implemented and the trade closed at your desired price.

Due to this order, traders have an opportunity to customize limits and manage their risks.

Therefore, traders are aware that their price caps were set up and that they do not have to constantly monitor the market in order to execute the trades.

What is a stop limit order?

A stop limit order includes two types of orders, Stop Loss and a limit order at once. Stop limit orders provide traders with the ability to customize the minimum desired amount of profit or the maximum amount of funds that they are ready to lose during executing a trade. When you set up a stop limit order, and the market hits the specified price, the limit order will be placed automatically, even if you sign out or are offline. Stop limit orders can be placed strategically based on support and resistance levels, as well as the volatility of the asset.

What are OCOs, or smart orders? How to customize it on the Cryptorobotics platform?

OCOs, or smart orders, are designed for minimizing risks and increasing the chances of getting profit.

The functionality of OCOs, or smart orders makes it possible to set up a limit order and a stop-limit (pending) order to buy or sell along with Stop Loss, Take Profit, Trailing. It can help make your trades more effective and bring you a significant profit, as well as reduce losses when the market moves down.

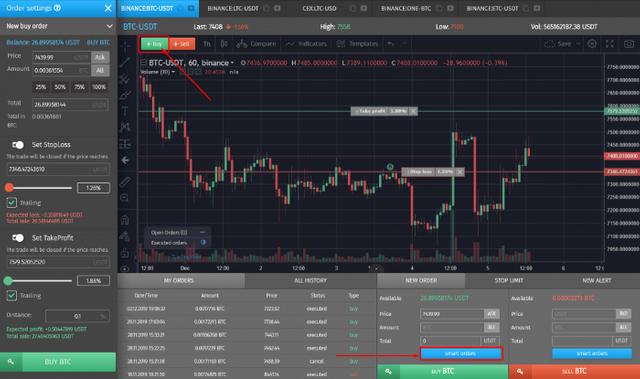

When placing a new order, you have the ability to customize its advanced settings.

You can select any type of order available in the terminal to place a smart order: market order, limit order and stop limit order.

For example, in order to start using smart orders, we set up a limit order.

First of all, you should go to the Trade section, select a crypto pair on the connected exchange, then click on the Smart order or the Buy button. After that, you will open the settings window. After that, it is necessary to specify the following parameters:

- Specify the cost of the coin at which you are going to purchase it.

- Set up the amount of the coin that you are going to buy or select the main crypto. If you add your value there, then the amount of the coins will be updated.

- You can also customize the price by moving the level on the chart.

The next step is to set up Stop Loss and Take Profit. It is allowed to use these tools both together and separately.

Let's take a look at how each tool functions.

With the help of the Take profit, you can indicate the price at which the order will be closed in profit (in percent or points). Take profit can also be set up by moving the level on the chart.

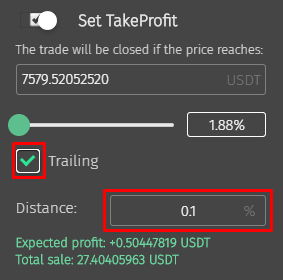

Besides, you also have the opportunity to use a Trailing Take Profit.

Let's take a look at how Trailing Take Profit works. You can configure it by adding a checkmark and indicating the distance in the percent.

When the specified Take Profit is reached, and the cost of the coin continues to increase, then the Take Profit moves up to follow the price mark you specified. Let's say you specified a distance of 0.1%.

While the price is rising, the Trailing is moving your level of the Take Profit higher. As soon as the cost of the coin starts to decline and hits a deviation of 0.1% from the maximum price, the trade will be closed.

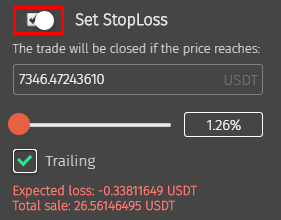

During customizing the Stop Loss, you specify the loss (in percent or points) that you are willing to lose when the price falls. The Stop Loss value can also be set by moving its level on the chart. When this value is hit, the trade will be closed automatically.

You can use both the exact price level and the percentage by moving the slider or specifying its exact value in %.

Let's analyze how Trailing Stop Loss functions. It is configured by adding a checkmark.

When the price of the coin rises, Stop Loss will automatically move up. That is, if we indicated Stop Loss from the price 3% lower with a positive rise in the price, our Stop Loss will continue to move up at a distance of 3%.

When the price drops, it stops moving, and the order will close at the value that you specified for Stop Loss or the price where Trailing moved it.

It is better to use Trailing Stop Loss only in a growing market. When the market moves flat, this tool can minimize your income.

After you have customized all the settings, you need to click on the green Buy button, and the order will be launched automatically.

If you already have a coin in your portfolio and you want to place a smart order to sell it, you need to press the Smart order button in the sell order block or on the Sell button.

When Stop Loss and Take Profit are customized, our terminal will search for exit points according to the values specified in them. You can set in the Price field the cost of the coin at which it was purchased, and from this value set Stop Loss and Take Profit.

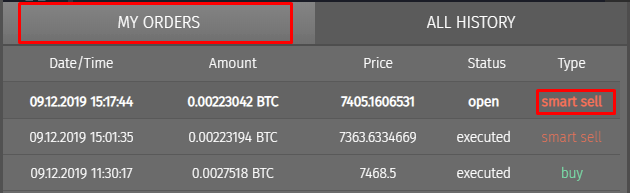

After you have placed a smart order, it goes to the “My Orders” section and is marked “smart sell”.

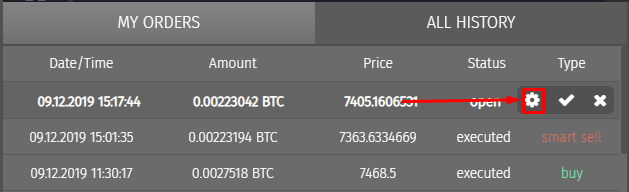

Till the order is not implemented, you can change its settings. Move your mouse cursor over your smart order, the line will display options for deleting and editing the order.

The cross is intended to delete this order. If you click on it, the order will acquire the canceled status. In this way, the asset will not be sold.

If you click on the gear, you will be able to edit the parameters of a smart order until it is implemented.

In case you click on a checkmark, you will take it to the executed status. The asset will not be sold.

After editing the settings to the order, it is necessary to click on the Save changes button.

To start placing OCOs, you can use Free or PRO packages.

It is worth noting that you have an opportunity to place only two smart orders simultaneously in the Free package. If you want to increase the number of smart orders for use, then you should buy a PRO package.