How Steemit Payouts Work - A Beginners Guide

A lot of new platform members seem to have a hard time understanding how, exactly, the Steem blockchain pays them for content. Really, that's understandable - the system is quite complex! Having written summaries more times than I care to count, let's address the issue fully right here, right now!

A lot of new platform members seem to have a hard time understanding how, exactly, the Steem blockchain pays them for content. Really, that's understandable - the system is quite complex! Having written summaries more times than I care to count, let's address the issue fully right here, right now!

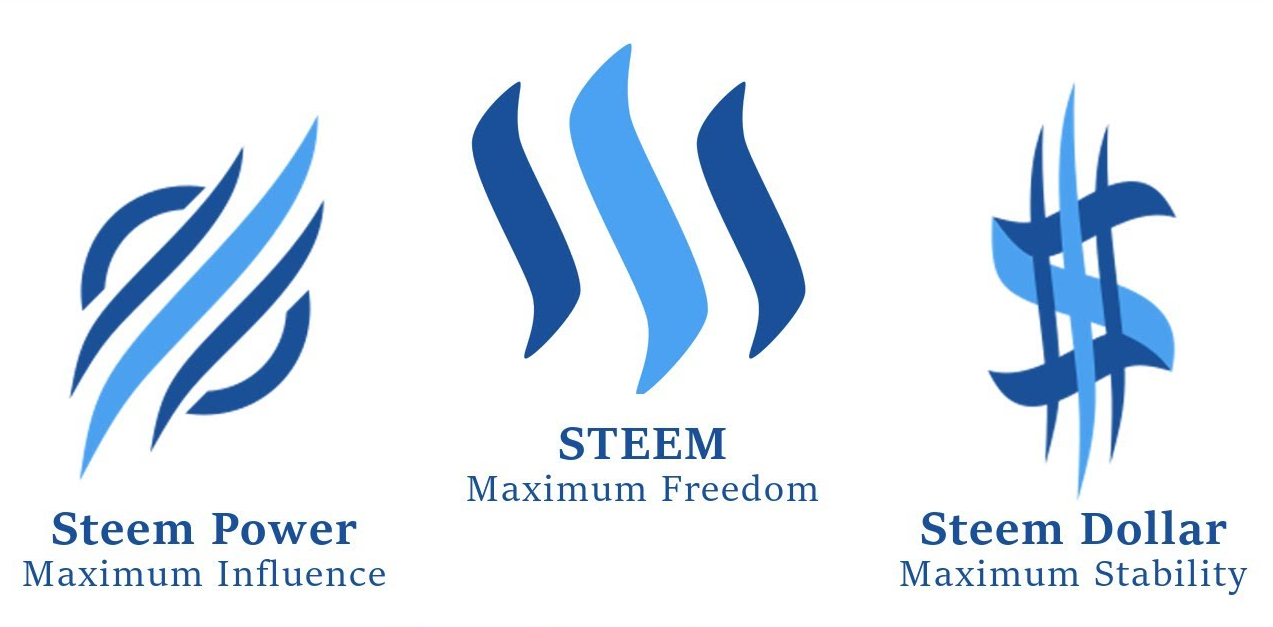

The Steemit website is a front end for the Steem blockchain, which has three primary stores of value:

Steem Dollars [SBD] - Steem dollars are the debt instrument of the platform. Anyone is able to exchange one SBD for one US dollar worth of STEEM (see below). For example, if the value of STEEM is USD$10, one SBD can be swapped for 0.1 STEEM. This means the SBD asset is dollar pegged from below - it should always be worth at least a dollar! If you manage to find SBD for sale for below USD$1, you can buy them, convert them to STEEM, and sell the STEEM for a tidy profit.

Steem [STEEM] The bread and butter coin of the Steem blockchain. STEEM is not pegged, and can go up and down freely. It can be sold at an exchange like SBD.

Steem Power [SP] - SP is locked up STEEM, which is earned as rewards or by turning STEEM into SP 1:1 in a process called 'powering up'. The more SP your account has, the most weight (or value) your vote has. SP can be converted back into STEEM in a process called 'powering down', but a full power down of an account takes 3 months.

Now, on to the good stuff!

The Reward Split

Let's imagine you have written a post, and the payout reads $20. When your post is 7 days old, one of several things can happen depending on the rewards option selected when you published it:

If you published with the 'decline payout' option selected, you get nothing. A strike-through will be visible through your pending payout. This is often used by the creators of the platform.

If you selected the 'Power up 100%' option, your payout is split as follows:

Of the total payout, 25% is divided among the curators (the people who voted for you). This leaves you with 75% * $20 = $15

You get the remaining amount paid out as SP. SP has the same value as STEEM. At the time of posting, the value of STEEM is USD$6.54, so you would be paid $15/$6.54 = 2.29 SP. This is immediately used to power up your account when you claim your rewards.

If you selected the 'Default (50%/50%)' option, your payout is split as follows:

Of the total payout, 25% is divided among the curators (the people who voted for you). This leaves you with 75% * $20 = $15

The 50/50 split means you get half of this paid out as SP, and half as SDB.

For the SBD: 50%*$15 as SBD = 7.5 SBD

For the SP: 50%*$15 worth of SP = $7.50 worth of SP = 1.15 SP at current market rates.

So which option was better?

The 'Power up 100%' option yielded 2.29 SP = USD$15

The 'Default (50%/50%)' option yielded 1.15 SP + 7.5 SBD = USD$72

Until the value of SBD drops back below a dollar, the second choice is far more advantageous. Even if your aim is to maximise your account's power, you can sell the SBD for STEEM to yield a total SP far greater than the 'Power up 100%' option would have yielded.

Be careful holding SBD right now! They are massively overvalued, being worth $1 (of STEEM) but trading for USD$8.62. To compound matters, the insane rise in the value of STEEM has vastly increased the rate at which SBD is minted. These two factors can be reasonably predicted to result in a drop in the trading price of SBD in the near future.