The facts about "BITCOIN"

Traditional money is on the defensive and fiat currencies as they exist now, are outdated. Bitcoin itself is now valued at $160 Bn. and exploding. At $160 billion, Bitcoin’s market cap just passed GE’s. A company that was once the largest company in the world, founded in 1892 with 295,000 employees and 123 billion in revenue.

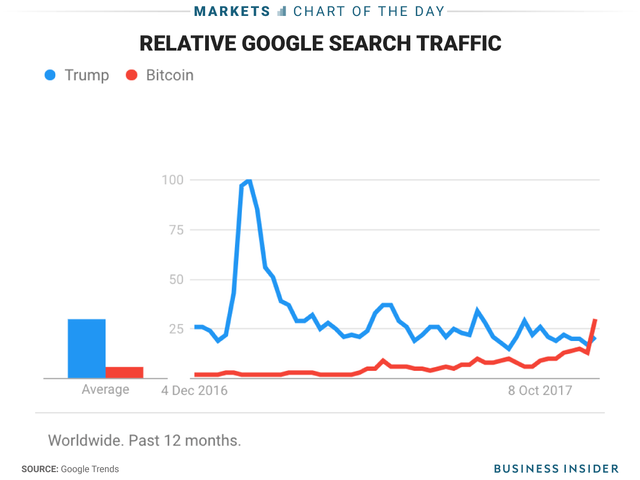

As history reads this, the fanfare and brand recognition of Bitcoin today is unprecedented. How to convey this trend of search and mainstream interest? Bitcoin exceeds searches for controversial publicity seeking President Donald Trump.

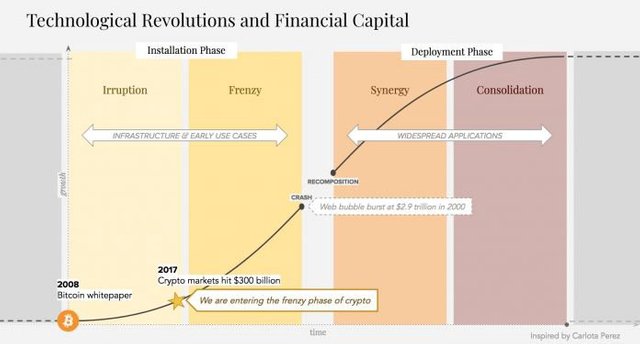

Cryptocurrencies and ICOs are signaling a boom of blockchain innovation, unlike the tech and finance world have seen before. They can alter entire industries in months to years, in addition to creating thousands if not millions of new jobs. Further blurring the lines between virtual and real, the Crypto Singularity is disruptive.

The Great Bitcoin Rally is just a Symbol

If Bitcoin has hacked the attention economy, it’s because the Crypto Singularity is aligned to the values of Millennials. There’s no other way to explain it, young people around the world are tired of elitist centralized institutions and governments controlling their destiny, from big banks, to greedy politicians to very ideas of inherited wealth and stifling wealth inequality.

As blockchain momentum grows, capitalism must adapt or face the consequences. The Crypto Singularity in this sense is nothing short as a war of values for a better world.

If Bitcoin has gained nearly 1,000% against the dollar, it’s not only that we’re putting our money where our mouth is, it’s that our heart wants to invest in a new kind of world, not only where the 1% gain the majority of all future earnings and profits. At the root of the Crypto Singularity is the preference of young people for a decentralized implementation of social justice, and however many decades it takes, in the scope of history, that’s the end-game of how disruptive the blockchain could be on the global banking system, economy and outdated identity politics of nation states.

The CFTC giving the green light on bitcoin futures products, is a sign that in 2018, crypto derivatives are coming and this means tremendous gains by the crypto assets that follow Bitcoin. If Cryptocurrency assets have a market cap of around $300 Bn. now, how much will they have even at the end of 2018, in one year’s time?

However, Bitcoin price action actually according to some analysts does resemble the Dutch Tulip mania of the 17th century, but in an age of coming exponential technologies, we now have to consider cryptocurrencies among them, and there are many which even the futurists today do not understand.

Correct me if I am wrong?