Steem: Long-Term Potential Worth the Risk?

Steem is one of the three currencies created by the Steemit platform and it presents an interesting investment opportunity.

While leisurely perusing the Steemit whitepaper, I started seeing something valuable in Steem, despite some extensive downward pressure.

Now, this article isn’t to be taken as investment advice for any short-term or long-term gain, but it will help present a few of the thoughts I had when reviewing this token.

The Problem:

In order to understand Steem, it’s useful we dive into the Steemit platform and the overall problem Steemit is looking to solve.

The battle for attention

More than two million blog posts are written and published EVERY DAY, and each has to find a way to break through the noise. Many content creators utilize some sort of combination of owning their own platform (ie. www.alexmoskov.me), guest posting or being a contributor on various other sites.

The onus of content distribution falls on the content creator, and many content creators end up finding that content distribution can take more time and effort than the creation of content itself. Then, you’ve got content creators who operate at a much larger scale and are capable of creating much bigger impressions through the use of different marketing strategies.

This means that the content you see on a daily basis isn’t necessarily the best, but it might be the best marketed.

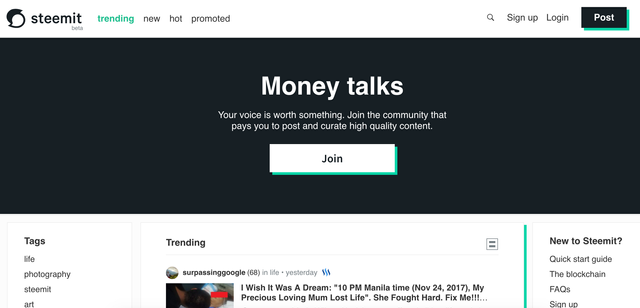

The Steemit platform helps alleviate this problem by rewarding content curators. People who upvote and comment on posts get rewarded. The more Steem Power Units curators have, the more their vote will count, the more influence they will have, and the more they will get paid as well.

The battle for monetization:

Unsurprisingly, The current content dilemma circles around money. The Internet has provided virtually anyone a platform to voice their opinions and ideas.

The digital environment has given multi-million dollar media companies a new outlet, and content creation has developed into a full-time job for many individuals.

The problem with content is how content is monetized. The most viable ways to get paid for content for many media companies and individuals are either through advertising, affiliate marketing, or some sort of payroll.

Creating unbiased content often comes at the expensive of the content creator. The audience expects high-quality stuff but isn’t so keen to pay for it.

The Steemit platform offers a solution by directly rewarding content creators for their content. If a piece of content is genuinely popular and valuable, the writer ends up being compensated. This money comes not from the audience, but from the Steemit network itself.

Steemit: the Solution the Content World Needs

Steemit is an extremely interesting solution. Here are a few quick hits of what you need to know.

Steemit has three different currencies:

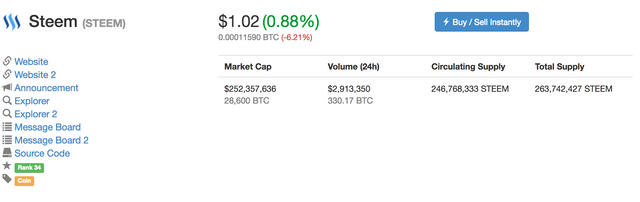

Steem: The currency that can be bought and sold on most open markets. This is how most people using the Steemit platform “cash out”. Steem currently “erodes” at an annual rate of 9.5% every year due to the production of new Steem.

Steem Power Units: Steem Power Units (SP) are a more long-term offering. When you buy SP, you’re locked into it for 2 years. This limit is meant to keep people invested in the platform long-term and stop people from suddenly dumping their units on the market. Holding SP entitles the owner to a proportionate ownership share in the network. 90% of all the new Steem made every day goes to people holding SP. Additionally, half of what content creators receive when paid out per post is in SP.

Holders of SP receive a higher weight to their upvotes, helping users to build up more of an authority and influence on the site.

Steem Dollars: Steem Dollars are pegged to the U.S. Dollar and are a bit more stable. 50% of the compensation comes in Steem Dollars. Holders of Steem Dollars are able to do one of three options:

- Convert them into Steem and sell them on the open market.

- Hold them and essentially earn 10% interest when compared to Steem.

- Exchange Steem Dollars for SP and hold for the long term.

There’s a lot to Steem and the Steemit platform, but many of the intricacies fall beyond the scope of this article. I recommend learning more about Steemit and the role Steem plays in detail (the whitepaper is a great source).