Analysis of Volume YTD for Pump & Dump Strategies

Index - https://steemit.com/tax/@alhofmeister/accounting-and-finance-blog-index

Introduction

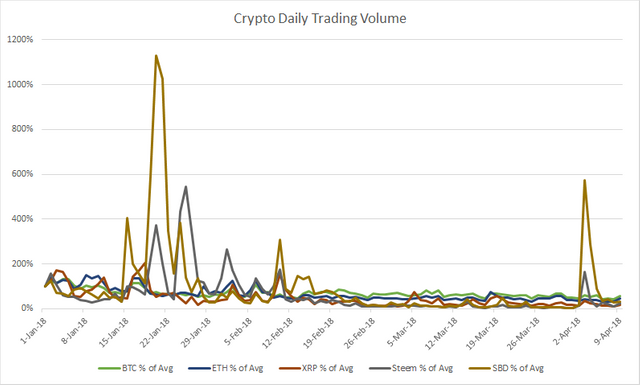

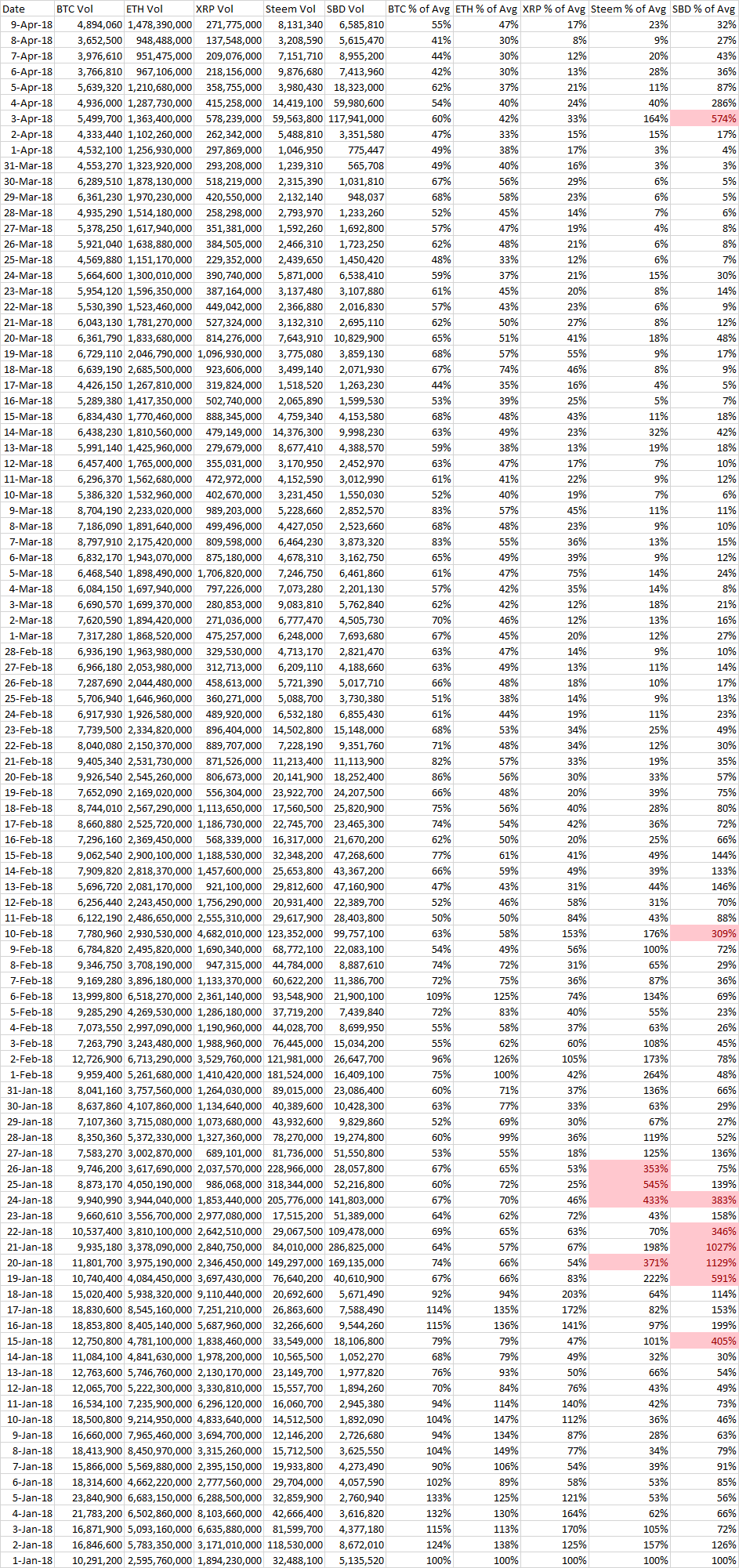

With the latest spike in Steem/SBD, I thought it would be interesting to examine the trading volume of Steem, SBD and the largest cryptocurrencies. Although high trading volumes do not necessarily indicate market manipulation, the likelihood of organic trading at +3x the YTD average trading volumes in a single day are unlikely. In my analysis, days suspected of pump and dump schemes are identified by trading values over 3x the average daily value. As the market capitalization of SBD is significantly lower than Steem, it is more susceptible to manipulation.

Chart

Raw Data

References

https://coinmarketcap.com/currencies/bitcoin/historical-data/

https://coinmarketcap.com/currencies/ethereum/historical-data/

https://coinmarketcap.com/currencies/ripple/historical-data/

https://coinmarketcap.com/currencies/steem/historical-data/

https://coinmarketcap.com/currencies/steem-dollars/historical-data/

@contentvoter

Hi @alhofmeister

Excellent article. I subscribed to your blog.

I will be grateful if you subscribe to my blog @dreladred

Good luck to you!

Transfer 1 STEEM or 1 Steem Dollar to a-0-0 if you want me to resteem your last blog post and get upvotes from over 32,900 followers. https://steemit.com/@a-0-0