Why is the price of STEEM pumping, and what is the effect?

Whenever the price of STEEM rises we see an increase in interest.

This has a feedback effect because some of those onlookers may like what they see about the project and become investors.

This last week the price of STEEM rose significantly on Saturday and Monday. So far the price seems to be maintaining its gains and establishing a new floor at a higher level after each rapid rise.

The fact that the price pumps but not excessively and then doesn't fully dump thereafter is a good sign.

Traders are getting in and staying in, for whatever reason.

It is hard to tell where the buying pressure on the markets is coming from since those statistics are not available. We can however see where in the world interest is increasing and that is also very positive.

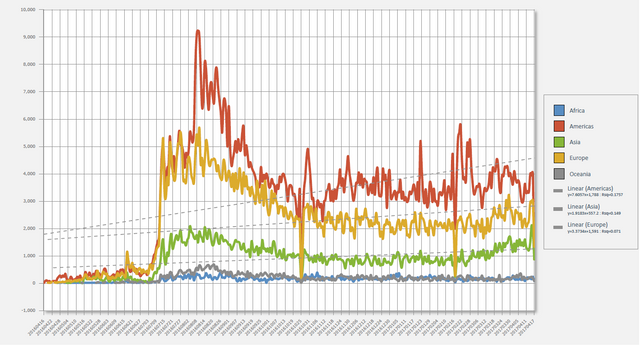

Note the green line, it is growing at a faster rate than all other lines.

This indicates that there is a definite increase in activity from Asian countries.

The green line has entered yellow (Europe's territory) If this more rapid growth continues we may even see Asia strongly competing with Europe in coming months.

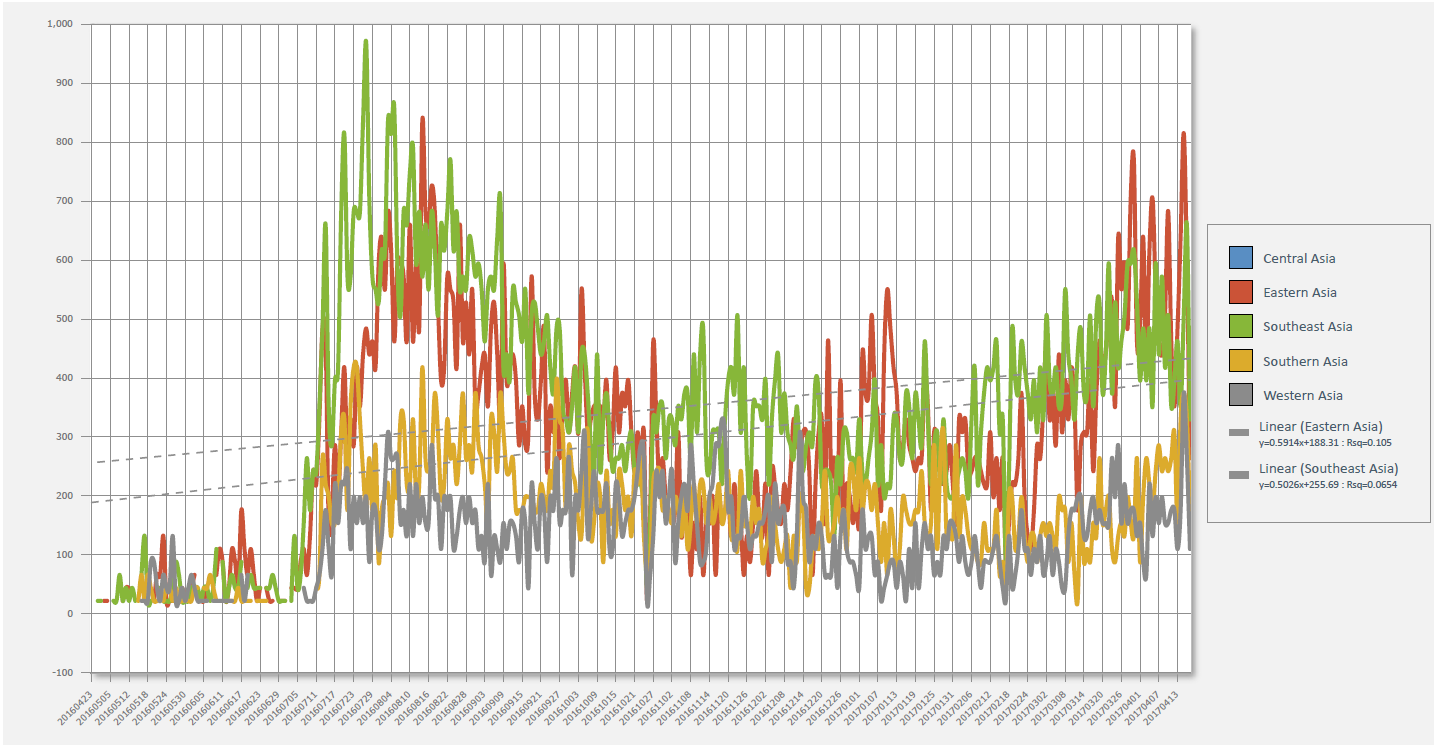

The growth is most pronounced in Eastern Asia although all Asian regions are showing a significant uptrend.

Analysis of trends by region show that South Korea, China and Indonesia are the sub-regions and countries where most of this interest is coming from.

Growth leading to popularity in the East bodes well for STEEM, we have all seen what it has done for Bitcoin.

Personal opinion here, but the price of STEEM is most likely being bouyed by the rise in altcoins in general. If you take some of the simpler bots that look at just fundamentals like MACD cross, then STEEM looks like a real strong buy because everything above it is over bought.

It's the end of the fiscal year in the USA. Many people are getting their tax returns and looking for a place to invest. Some of these people are new to crypto and they might be buying bots to manage small crypto portfolios.

It would explain the rise of the alts in general, and I think when a coin begins to look overbought, then they just sell and go to the next coin down the list :D

Could it not be something a lot simpler? For example; Up until the recent hardfork, there has been a higher inflation rate due to higher rewards. Now, while the pool is refilling, the rewards are considerably lower, meaning there is less pressure on the price of STEEM increasing because there is less STEEM being created and added to the marker.

You are right as the amount of Steem I have received is not too good since the hard fork

Patience... it will recover... I the first 4 months at the start nobody got anything, but it payed off

Perhaps, an interesting possibility, but author rewards are minuscule compared to whats already in the market.

I'm sure that it's many reasons, and these ones you mention as well. At least its not the full pump and dump of other alts so far. STEEM is behaving a little differently. Where does the strong accumulation that generally preceding each rise feature in your calculations because to me it looks like a good percentage of it is being held onto.

Interesting content, I am happy if the value steem back riding and I want to invest in steem, but today I just learned about crypto and hopefully be able to invest in the steem in the near future @gavvet

Enjoy the journey, crypto is a wild ride.

thank you @gavvet

thanks för bra inläg

thanks

This is a good news for all of us, I am also very pleased we are from Indonesia could be contributing to the rising value of steem, I think this post is very nice and thank you my friend @gavvet for this information

Indonesia seems to be concentrated in Medan or is that just the way the IP's are routed?

I would guess that the Acehnese traffic is being routed through Medan. You can see from both the tag activity and Google Trends that 90%+ of the Indonesian activity on Steemit is from Aceh.

Not all Aceh traffic appears to go through there, some comes up directly as Aceh.

Makes sense, probably just different internet providers doing things differently. There are some users from Medan and North Sumatra as well.

I may also be relying on Google Trends too much. It seems to take about a month for it to actually reflect a new trend (charts change daily and recent data is very unreliable), so it's quite possible that interest is simply spreading across the country.

Thanks for the information, Good to have someone paying attention( unlike me)

Source: https://www.tradingview.com/x/o2ObkdpX/

This is a super significant price level for Steem. It's not only trading within a price zone that's had a lot of selling pressure in the recent past (shown by all the candle wicks within the yellow rectangle on the above daily candle chart), but it's also testing the 200 day simple moving average (pink line) for the first time (unless you consider the super long wick of the candle at the far left of the yellow rectangle to be a test, in which case this would be the second test of that moving average).

I don't expect price to be able to stay above the 200 average for long, for two reasons:

1.) as I mentioned, this is only the first test of it after trading below it since...well, forever. Markets tend not to allow price to escape the "momentum" of the long term averages, which brings me to my next point.

2.) the 200 average has a very steep down-slope, which makes this a very low probability point of continued price appreciation (short-term). This type of set-up with the 200 average leads to the average having a "pulling effect" on price, which tends to sling shot it back downwards, as that has been the strong long term momentum of the market (clearly indicated by the long-term average).

Having said that, I see the current price action of Steem as a definite positive and I believe price is indicating a possible pivot into a long-term uptrend (just not "confirmed" yet). I say this for a couple of reasons.

The 200 average test is one obvious indicator of change (of pattern), but, in itself, doesn't say much about chances of changing trend. More positive for me is the fact that both the 50 (red line) and 100 (blue line) moving averages are below price and moving up (in the case of the 50) or flat (100), on top of the recent "ranging market" (price moving mostly sideways) condition of Steem, which has been a real rarity.

Prices tend to range for a while before a change of trend, as strong buyers slowly accumulate from the strong, but slowly dissipating pressure of the sellers, until that selling pressure runs out...then, look out for the rocket shot!

Seems like your analysis was correct, a little drop soon after it but it's bounced of the previous floor.. many range here for a week or two

Yeah, I believe the highest probability scenario is for it to range until the momentum of the 50 SMA "catches up" to price. Things could get interesting if price gets squeezed between it (or the 100 SMA) and the 200 SMA. We could get a bollinger band squeeze type of breakout... either direction, really.

But, like I said in my previous comment, things are looking positive for Steem price for the first time in a Loooooooooong time (relative to technical analysis), so my bet is on UP.

It looks like it's holding its gains at around 20000 satoshis.

thanks for updating us on it!

Sure thing.

Anyoung haseyo! Nihao! Selamat Pagi! :)

我很好!

LOL... are you sure? ok, two negation equals positivity ... :)

That's google translate for ya!

btw, my news scanning result is here, which might help pushing the price as well

https://steemit.com/news/@deanliu/one-week-in-media-steem-is-doing-great

Looking good. Thanks for the update :)

Only a pleasure.