Dharma protocol: Open protocol for Tokenized debt (Review a Featured Dapp)

Dharma Protocol is a decentralized finance application that operate on the Ethereum blockchain,

Dharma protocol paved way for the trading and creation of digital lending products by tokenizing debt. It is part of a new wave of decentralized finance products that seek to democratize access to financial services.

At the moment, Dharma protocol stands at a ranking of 252 of all dApps across several hundreds of blockchains, as ranked by @stateofthedapps at State of the Dapps

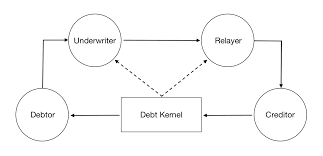

Dharma ecosystem can't work without these key players which include

1. The borrowers (debtors)

2. The lenders (creditors)

3. The underwrites and relayers...

Debtors, they are the individuals who would like to receive a loan, and they can do this by approaching the creditors and receive one exchange for paying back the initial borrowed amount plus interest.

Underwriters on the Dharma platform helps debtors structure their loans by providing key pieces of information such as: The negotiating terms, the risk level, and the interest to be paid.

The relayers, helps in finding or in searching for creditors to fund loan applications by hosting it on their global order book.

https://www.stateofthedapps.com/dapps/dharma-protocol

At the basic level, Dharma operates on top of various smart contracts known as the Dharma Settlement Contracts. Each play a different role in the operation of the platform and is very crucial to its functionality. One out this key contracts is the Terms contracts (which is used to define the terms in a debt agreement between two individuals) that provides the benefit of allowing any potential future disputes to be easily resolved.

When a debtor and a creditor enters in a debt agreement,,a signed cryptographic message called a Debt Order is then submitted, if the debt order is valid then the transaction begins, and a unique token known as Debt Token is minted to the creditor.

This debt token is tradable and thus can be exchanged between individuals in an open market place.

There's another term called the DEFAULTS; This occurs when a borrower is unable to make there loan repayments as agreed by their Term Contract, so the loan is considered to have entered into default when the expected amount repaid exceeds the actual amount repaid at any point in time.

COLLATERALIZED LOANS: The situation by which creditors cam recoup somewhat the value of their loan if the borrower was ever to default. Collateralizing a loan reduces the risk to the creditor as it guarantees that they will recoup some of the value of their loan upon s debtor's default

While in Uncollaterized loans, no asset has been put up by the borrower upon entering a loan agreement, which is more higher risk than their counterpart, collateralized loans.

However, the Dharma protocol utilizes a key player in its ecosystem known as an Underwriter that make it less risky for creditors to enter into uncollateralized loan agreements, they do this by making a prediction as how likely it is that a borrower will be able to successfully make their loan repayments. The underwriters are Trusted Third party.

The DEBT ORDERS is included in what makes Dharmal protocol work well, debt order is a representative of an individual's intent to borrow a certain amount. A debt Order is considered filled when it has been signed by Both the borrower and lender, signature of am underwriter is also required if made available while facilitating the loan.

RELAYERS are another key player in the Dharma protocol ecosystem,because they help borrowers find creditors to fill their loans by hosting their Debt Order in an open book.

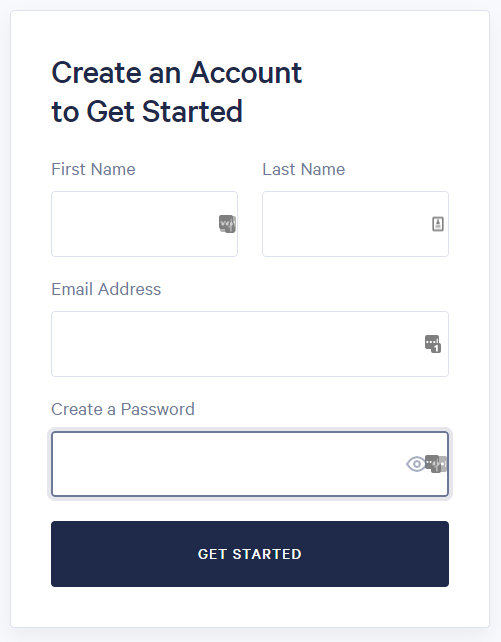

Getting started with Dharma is not a tough process, you just set up an account with your email and provide your password and other necessary details like your names etc and you're good to go....

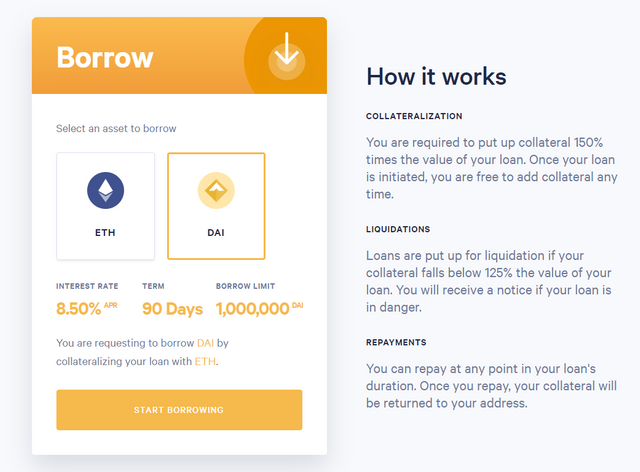

You don't really need to be long time member before you cam start borrowing or lending... Yeah, you can start immediately. At present, the platform appears to be limited to borrowing or lending Ethereum against Dai, or vice versa. This means that if you want to borrow Ethereum, you will need to collateralise the loan with Dai, or conversely, if you want to borrow Dai then you are required to put up Ethereum as your collateral.

Asset lending is currently also restricted to the two currencies, Ethereum and Dai. However, the process for adding assets to the lending pool is quite easy, you are first prompted for the amount that you want to add to the pool and the address to which any interest (or collateral) will be paid into.

After this, you are asked to deposit the assets into an escrow address which will then be added to the pool as soon as the transactions are confirmed on the Ethereum blockchain. The time to set up a loan offer was limited only by the Ethereum transaction confirmation time (on the order of a minute or less), no smart contracts required for this platform.

The simplicity and ease of the user interface is something that currently amazing out in the often highly technical and information dense front ends of most financial dApps. So, if Dharma is able to stand out some more features for power users and perhaps start to include different tokens for lending and security then this platform might be the lending platform that captures a critical mass of users due to it's easy to use interface.

Aside the aspect of forgetting to have third party while negotiating with your borrower or lender, there is nothing else I do not like about Dharma protocol.

In conclusion, Dharma protocol is an open financial protocol that aims to democratize access to lending products through its decentralized lending platform. According to DeFi Pulse, an analytics platform for decentralized finance applications, a total of $13 million dollars have been locked up in the protocol. This serves as an indication as to the value that has been transacted over the platform.

Through its ecosystem of lenders, borrowers, underwriters and relayers, it aims to provide a viable alternative to today’s modern financial system. Virtually any type of loan can be created on the Dharma Protocol; from regular consumer loans to corporate bonds.

However, Dharma Protocol is not the only decentralized finance project operating in the lending space. There includes other such as: Compound Finance and Ethlend.

This post will not be upvoted or entered into the competition. We frown on plagiarism. A number of sections have been directly taken from this post by @bengy https://steemit.com/powerhousecreatives/@bengy/dharma-digital-asset-lending-market-ethereum-dai

So sorry for that... @oracle-d

I'd work on that...

Thanks