Seasonal Tokens is the best for crypto market

Presentation

Irregularity might be an issue for cryptographic money financial backers considering their decisively drop in costs including Bitcoin. Occasional Tokens are hence acquainted with structure irregularity work for the benefit of financial backers. Spring, Summer, Autumn and Winter tokens have been intended to ascend in value comparative with each other during an anticipated succession. Spring tokens will more often than not ascent in cost, then Summer, Autumn, Winter, and Spring once more. The four tokens presented via Seasonal Project have booked creation splitting that happen, for each token, nine months after the past token's dividing. This will empower financial backers to convey a coin while it's ascending in esteem, then exchange it for a coin which will ascend in esteem during the following months. A financial backer who follows this technique will continuously hold a symbolic that has as of late become scant when contrasted with what the market has gotten comfortable with , and whose cost are frequently expected to rise in light of the fact that the market acclimates to the new shortage. Every symbolic will have a total stock of about 33,112,800 tokens. These coins are many times expected in future to have around equivalent worth. In any case, at some random time before then, at that point, one token will be created at a quicker rate than the others, and after some time will quite often become less expensive to search for. Another token, which was recently created at the quickest rate, will have as of late divided its pace of creation, and can then be produced at the slowest pace of the four, and can become more difficult to find, and therefore costlier, over the long haul. Exchanging the costlier tokens for the less expensive ones will permit a financial backer to expand how much tokens that the person claims over the long haul. A financial backer who holds 1 Spring Token, for example , can hold on until the speed of creation of Spring Tokens is split, then the Summer Token will be the one that is delivered at the absolute best rate. This may ultimately make the Summer Token become less expensive than the Spring Token, whose newly discovered shortage will make it costlier. The financial backer could likewise be prepared to exchange the 1 Spring Token for 1.5 Summer Tokens. Those 1.5 Summer Tokens could later be exchanged for two Autumn Tokens, and individuals progressively could later be exchanged for two .5 Winter Tokens. The cycle finishes when the Winter Tokens are exchanged for Spring Tokens once more, and consequently the financial backer may by then be prepared to purchase 3 Spring Tokens, and may rehash the repetitive interaction to amass more.

The Seasonal tokens are ERC20 based tokens which have been given on the Ethereum blockchain. As ERC20 tokens, the occasional tokens are many times exchanged permissionlessly on decentralized trades, put away on standard equipment wallets, got and sent with the Metamask module, and saw on etherscan.io. Excavators utilize their own equipment to play out the work important to mine the occasional tokens, however to present the subsequent verification of-work to the ethereum network, the digger should purchase the gas utilized by the savvy contract, which really takes a look at the confirmation and issues the tokens. The amount of gas expected for this is in many cases unsurprising, yet the value of that gas relies upon how occupied the organization is at that point. Because of this, the whole inventory of 33,118,200 tokens is a gauge upheld the theory that precisely one award will be paid out at regular intervals. By and by, the speed will be near the precarious edge of this worth yet not actually sufficient to it.

UTILITY OF SEASONAL TOKENS

By holding Spring tokens while they are becoming more expensive, then, at that point, exchanging them for Summer tokens, and holding them while their cost rises, etc, a financial backer can constantly hold a symbolic whose cost is rising, and may expand how much tokens they own over the long haul.

A financial backer with Spring tokens, can utilize them to supply liquidity then stake that liquidity position inside the homestead. That financial backer will then, at that point, get Spring, Summer, Autumn and Winter tokens for as lengthy on the grounds that the liquidity is left experiencing the same thing. 9% of recently mined tokens are circulated from the Seasonal Token mining pool to the homestead.

Whenever tokens are given to the homestead consistently, it makes the tokens more significant, on the grounds that tokens utilized for cultivating produce better returns. The homestead additionally adds to the pivoting interest for the tokens that makes it productive to exchange them during a cycle. Subsequently the tokens are frequently used to help their cost and drive turning interest. Diggers have a monetary motivating force to expand the value of the tokens they mine, and that they can do that by giving a negligible portion of their approaching tokens to the ranch.

Holders of the tokens can utilize them to amass more, by cultivating and recurrent exchanging. Since the tokens become costlier to mine and purchase, the ability to encourage more tokens over the long run without purchasing or mining them turns out to be increasingly helpful.

At the point when everyone realizes that Spring tokens ought to be exchanged for Summer tokens, brokers prepared to be to offer Spring tokens to somebody and purchase Summer tokens from somebody. Other repeating brokers could likewise be reluctant to search for Spring and sell Summer once they realize that Summer goes to ascend in cost straightaway. The ranchers who give the liquidity to the token/ETH exchanging matches on Uniswap and so on as counterparties for the repeating brokers. Since the ranchers get ranch pay, they will make an overall gain though they pass up some or every one of the likely benefits of repeating exchanging.

SIMPLY BUY SEASONAL TOKENS

Buy ETH for your wallet

Choose your token

Pick your pair

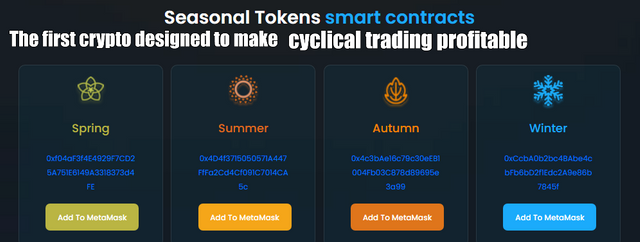

SMART CONTRACTS

Spring

0xf04aF3f4E4929F7CD25A751E6149A3318373d4FE

Summer

0x4D4f3715050571A447FfFa2Cd4Cf091C7014CA5c

Autumn

0x4c3bAe16c79c30eEB1004Fb03C878d89695e3a99

Winter

0xCcbA0b2bc4BAbe4cbFb6bD2f1Edc2A9e86b7845f

End

Mining produces occasional tokens all year. The rates at which the tokens are created are intended to allow anybody to get a portion of the new tokens by trading them consistently. Everybody realizes what arrangements to make. Recurrent exchanging allows merchants to bring in cash by exchanging new tokens available without harming different brokers.

FOLLOW OFFICIAL LINKS FOR MORE UPDATES:

https://www.seasonaltokens.org/

https://mobile.twitter.com/Seasonal_Tokens

https://discord.com/invite/Q8XZgJEDD3

https://seasonal-tokens.medium.com/

https://www.reddit.com/r/SeasonalTokens/

AUTHOR

Forum Username: tarekmoin

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=943193

Telegram Username: @Cryptofutures087

Smart Chain (BSC) Wallet Address: bc1qy79pkefcp7uyv7q69dmu87mxgn0jpy9l7lfrrh

Your post was upvoted and resteemed on @crypto.defrag

Your post was upvoted and resteemed on @crypto.defrag

@tarekabdullah use the proper tag for your post to get votes from curators and also try to complete your achievements.

If you have any doubt in proper tag check this post.