Holiday Season 2018: Insights about Shopping that You Must Know

According to Adobe’s forecast, online sales in the US will grow to $124.1bn during the holiday season this year, reaching a new record. In latest Singles’ Day, Alibaba’s sales also create a record, $30.8bn in the 24-hour shopping event. Even though not all the online transactions are closed via mobile devices, almost all customer behaviors are involved with mobile channels. Customers are increasingly comfortable to search and research products, and complete the deal via smartphones.

The holiday season is not only the time to celebrate, but also a time to do shopping. This is the common sense nearly all over the world. And mobile channel is the most important touch point in 2018 holiday season. If a retailer wants to put the customer experiences on the map, the holiday season is absolutely an important and competitive time.

However, you may discover that some retailers discover new opportunities from mobile channels while others cannot. Therefore, we use the data from AppBi to identify the top 10 shopping apps in China-based App Store and U.S.-based App Store aiming to find some new trends.

Mobile commerce trends overview

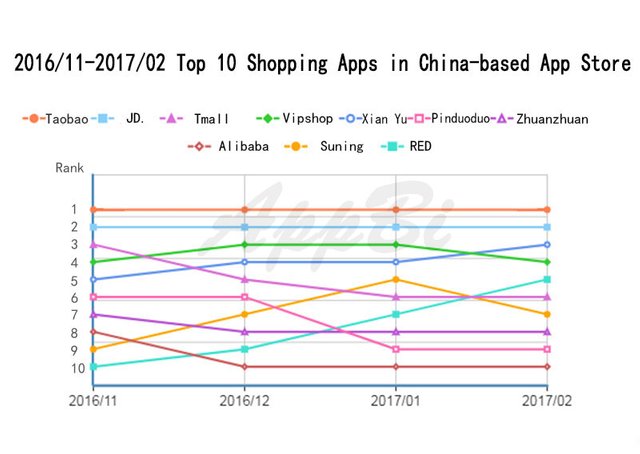

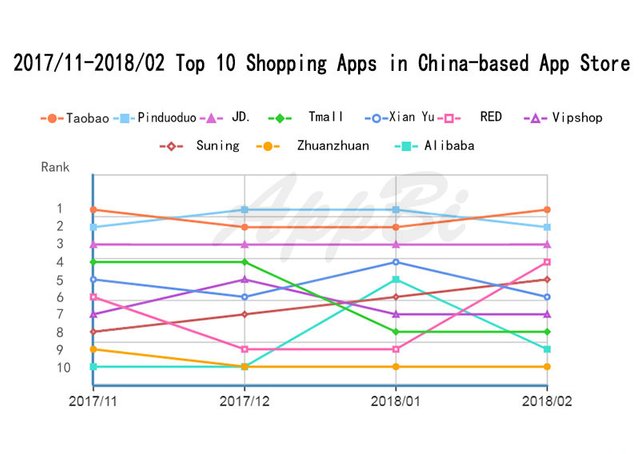

M-commerce brings new opportunity and challenges. China has become a mature e-commerce market. Taobao and JD.com have always been the primary marketplace for Chinese to do online shopping. However, it doesn’t mean they can lay aside all anxiety and reset content, especially on mobile platform. In 2016-17 Chinese holiday season (from Singles’ Day to the end of Spring Festival), Vipshop and other online discount marketplaces rapidly rose.

In 2017-18 holiday season, the top ranks of shopping apps have changed a lot. The social-commerce platform, Pinduoduo has surpassed JD.com and once exceeded Taobao. It is noted that another social-commerce platform RED, also known as Xiaohongshu climbed from 10th to 6th. On the other hand, Vipshop fell from the 3rd place to 7th.

It indicates that the new entrants in Chinese m-commerce market are facing the competitions from both traditional brands and disruptors, though the mobile channels help them to attract more customers.

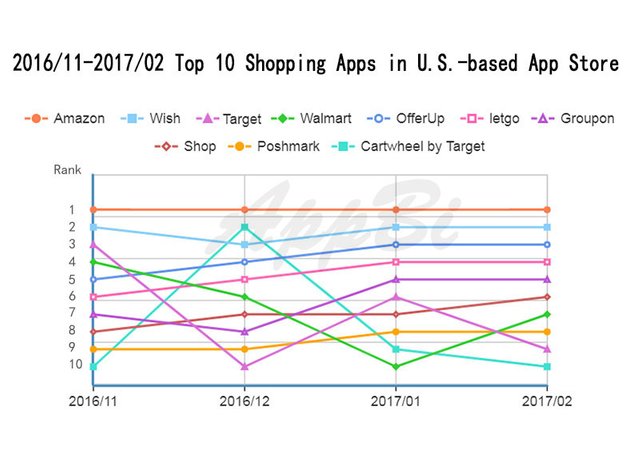

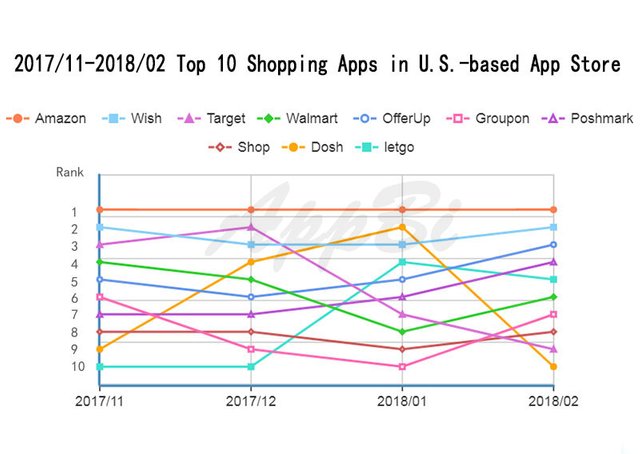

In fact, the U.S. m-commerce sector is facing the similar situation. Though Amazon is the primary shopping app that Americans search and purchase products. The disruptors, like OfferUp, are attempted to attract the attentions of customers. Since the competition between new entrants is more intense, the rankings #4-#7 changed rapidly.

Today, customers do not buy things, they purchase experiences. Although traditional retailers and ecommerce giants occupies the leading positions, more and more disrupters enter the top list. More importantly, new players have attracted a large amount of customers by differing with giants. For instance, Pinduoduo is a social-commerce marketplace. Instead of focusing on single customers, it encourages users to team up with other members to split bulk purchases. Groupon is not a new player, but it is socializing group purchases via Deal Feed, which allows users to check friends’ deals, status and reviews on Facebook.

Price still impacts on purchase decisions. If you take a close look at the top shopping apps in App Store, you will find that price is still one of the most important facts when making decisions. But, it displays in the different way in China and U.S. Chinese customers are more likely to visit middle and low end marketplaces to discover the better deals, such as Taobao and Pinduoduo. However, online buyers in U.S. are more likely to search coupons, discounts and promotions in dedicated apps, like Target Cartwheel and Dosh. The former is a platform to find and share coupons and the latter is a cash back app.

Secondary market is rising. In holiday season, customers usually buy a lot of goods and receive various gifts. What they do if they do not like a product or gift? Return is a process that makes both retailers and customers a headache. Now, customers have another choice, sell it on secondary marketplace. That is why shopping apps, like Xian Yu, Zhuanzhuan, OfferUp, and Letgo become increasingly popular.

How to reach customers and stand out from competition?

As you can see, the m-ecommerce market is full of competition and disruption. Large ecommerce brands, new players and disrupters are all searching for opportunities to attract smartphone owners and stand out. That is what AppBi is doing right now, optimizing your marketing budget of App Store Search Ads through executable insights based on intelligence and data. And here are some general strategies that retailers should try to boost the sales in holiday season:

- Understand your customers’ behavior. It is well known that customers’ expectations are increasingly complicated as well as customers themselves. Retailers cannot use the universe concepts to define their shoppers anymore. Pinduoduo, for example, attracts more elder and low-educated shoppers than Taobao and JD. These shoppers are more likely to be attracted by price-related keywords, like discount. How to decide the right keywords requires professional tools and expertise, so it is a smart choice to co-work with an agency, such as AppBi.

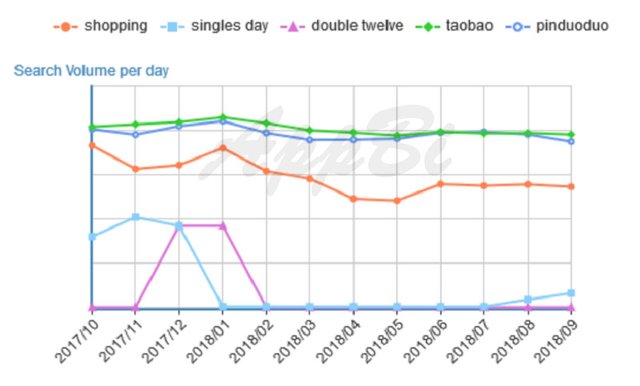

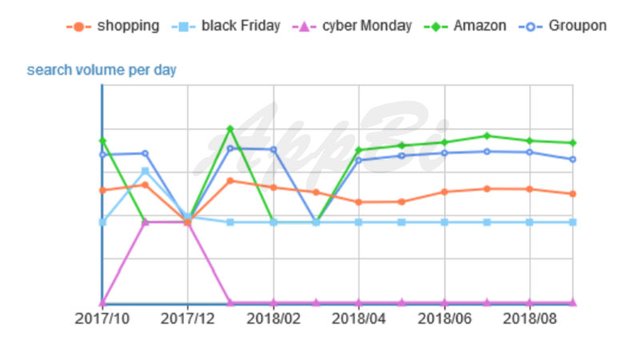

- Use the right keywords to target your customers. Just understanding your customers is not enough. Retailers have to convert the insights and data into action. Chinese customers prefer to directly search shopping app names in App Store. The search volume of Pinduoduo is higher than shopping events, though it is lower the universal keywords, like “shopping”. However, American shoppers prefer searching “Amazon” to “shopping” and big shopping events. In fact, according to AppBi, the customers’ preferences are complicated depending on region, age, education and income level.

- Dynamically optimize your keywords. It is important to invest your budget on the right keywords if you want to appear on top of the result. As mentioned previously, that is partly depending on your customers. Another important fact is time. The keyword “shopping” is always hot all year round; however, “Singles Day” or “Black Friday” is more efficient before and during the holiday season. AppBi suggests retailers to optimize the keywords dynamically.

About AppBi

As the leader ASM agency around the world, AppBi provides the advertising intelligent AI bidding platform that helps retailers and brands to optimize App Store Search Ads in real time.