Bitcoin - Here's What You Need To Know

Ever since Bitcoin showed up some some 8 years ago, it’s slowly but surely taken over the digital world, and will soon be a common option for you to pay for whatever you want with bitcoins.

Odds are, since you’re on Steemit, you probably know a little bit about this cryptocurrency. Despite that, likely some details have escaped you, and there are bound to be people who haven’t quite thoroughly researched this. So I decided to compile all I know into a brief, easy summary.

Throughout the week, I will put out other articles, revolving around this topic. I hope I can do what I want, which is to put you into the 10% of people who actually know what Bitcoin is, and why it’s become so important, and what they mean for the future!

Let’s get started shall we?

Bitcoin started as a solution to a big problem – loss of money/security/time in bank exchanges

It all started in 2009, when a man of whom we know very little (except that he may actually many people) published a now famous white paper (go ahead and read it, it’s worth it, and its quite small). Satoshi Nakamoto described the basis of Bitcoin technology, as well as the ledger that would accompany it, the blockchain.

In the paper, our mistery man describes the problem he/she/they aimed to fix – buying stuff on the Internet, till then, required an extra layer of trust, that’s lost when you don’t do transactions in person. A trusted third party had to be involved to process the electronic payments. It’s a general rule in law though, that the more people are involved in an exchange, the more disputes there will be in that exchange.

And it checked out. The price of fixing these disputes gets taken from the transaction. This means you lose some money just to settle these disputes, and cant make small transactions without worrying you’d lose it all, or that the trade would be reversed.

A new system, created on a trustworthy basis had to be reached, in order to avoid all these issues. A new currency would be developed along with this system.

But how could this new system work?

Introducing the blockchain

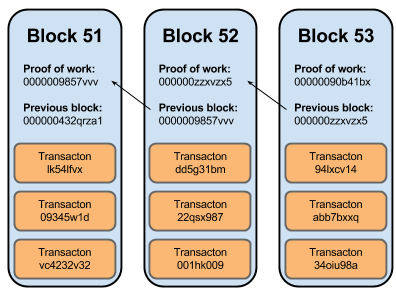

The new system was called the blockchain. It was meant to serve as a decentralized ledger that would record every transaction made openly. I will talk more about the blockchain in tomorrow’s article, but for now, just gonna leave you with the basics.

Every time you make a transaction with this system, it takes the payment information, your own personal info, and the public encryption key and puts it in a block. That block, gets hashed, which basically means it gets encrypted (I’ll speak more of this in another article), in a way that proves that the block is legitimate. As you do more transactions, you add more blocks to the chain, and the hash of every block confirms the legitimacy of the whole thing.

The hashing part is super important here as you may have realized. Without it, the system would be much less secure. But it takes a lot of time and computational power to get going. To make it go faster, it would take some people volunteering PC’s on the network working on purpose on a single block in order to make the hash.

We’ll call these people bitcoin miners. And here’s where it gets more interesting. Because from these hashing operations, a new currency is born.

Enter the bitcoin

Lemme clarify something before we continue. Whenever I say “Bitcoin”, I’m referring to the technology. Whenever I say “bitcoin”, I’m referring to the currency.

Lets have a small economy lesson (and trust me, I’m no expert). Currency basically, is something you get in exchange for a service, that represents the work that you made, and allows you to exchange the effort of that work into goods or services you want – as long as that effort is worth what you want.

Now where were we? Ah yes. The bitcoin miners give off some part of their PC’s processing power and time in order to hash the new blocks on the chain, to keep the whole process running smoothly. Our dear Satoshi thought that it’d be a good idea for these miners to get rewarded. So he decided that they would get a certain currency per block created, and that this currency would be the one used by the blockchain.

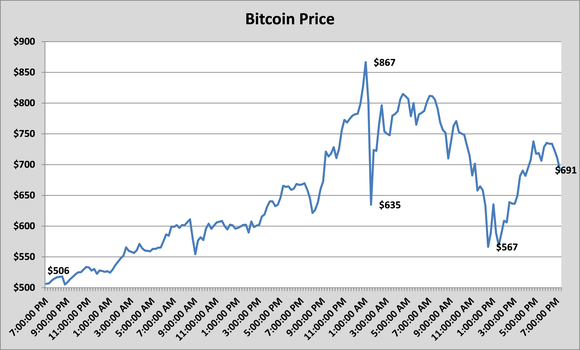

This currency has exploded in the last couple of years

The numbers speak clearly. This currency has come a long way, and it’s here to stay.

As of 2013, there were 0.3-1.3 million bitcoin users. As of 2017, there are now 2.9-5.8 bitcoin users. The value of the money has also skyrocketed. When it first launched, it was worth almost nothing. In 2011, it was worth some cents at best.

...as of the time I write this, a single bitcoin is worth $2404.60 US dollars. And it's achieved highs such as $2834.48 not too long ago.

The number of merchants who accept payment in bitcoins has also increased. By 2015, over 100 000 merchants accepted payment in bitcoins. Many companies and websites slowly but gradually started accepting bitcoins as payment. By 2017, we now have big names such as Microsoft, Apple App Store, Amazon, Paypal, Reddit, Shopify, all accepting payment for many different kinds of services in bitcoins!

And that’s not all. Japan is making a huge push so that as this summer moves on, 260 000 stores will accept payment in bitcoins. This is predicted to ease tourists’ lives by quite a lot, and to further increase the popularity of Bitcoin as a whole!

But if you follow me, by now you know – I always try to point out the bad as well as the good. Lets see the bad in this technology.

Bitcoin is very unstable – and fragile

Lets start with the simplest disadvantage – a technical one. As bitcoins are an entirely virtual currency, there is no paper associated – they are held in an electronic “wallet”. And this wallet is vulnerable to corruption, crashes, and viruses. If the wallet gets compromised, all the money within could be deleted – destroying any money you might have saved, and any hope of getting it back.

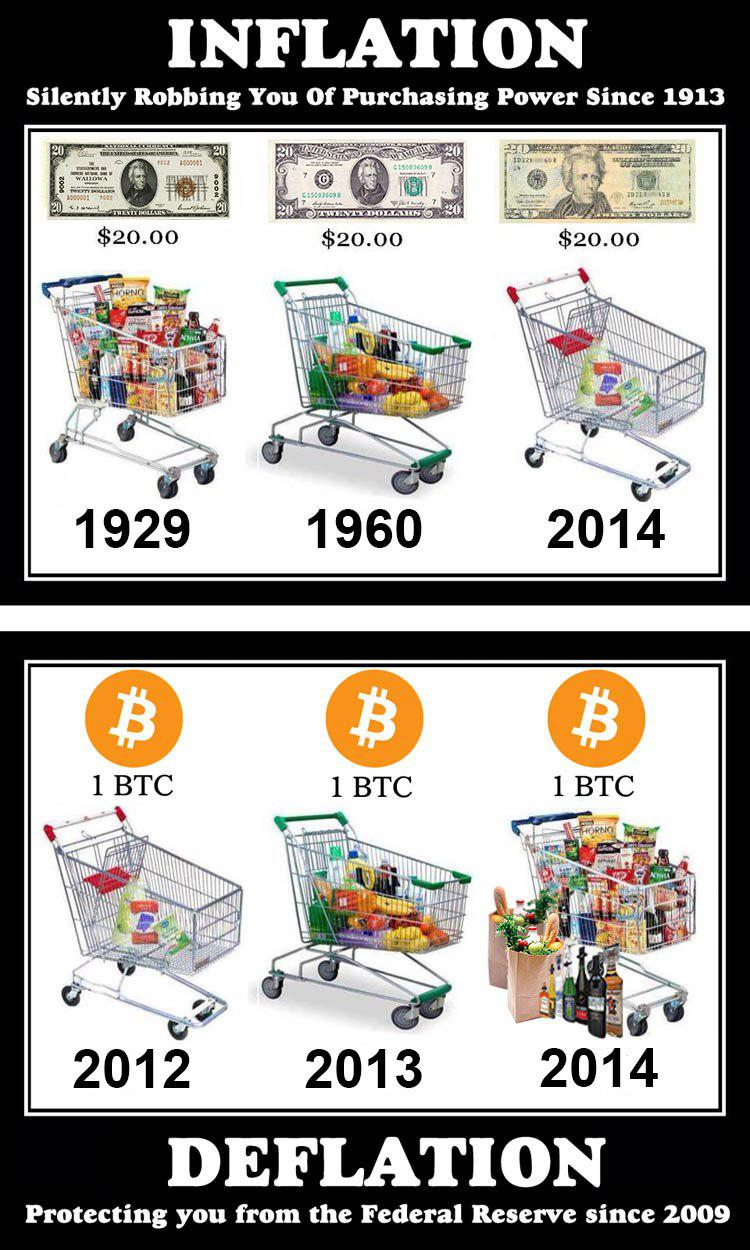

The value of bitcoins, despite the overall upward trend, is not stable. Some months it can be quite high – the next ones hit a low point. In case you are saving money to buy a certain something at a certain date, you may find yourself high and dry if the current value is in a slump. Remember me saying a bitcoin is worth $2404.60 USD right now? It was worth $2535.21 USD yesterday...

Another point concerns the deflationary nature of Bitcoin – bitcoins as a whole will cease to be produced then there are 21 million of them. That will cause price instabilities, and will only reward those who jump into this technology on time.

Finally, the malaise of the current times, which I have alluded to many times in the past, rears its’ head once again. I speak of hackers. Just some days ago, one of the greatest Bitcoin exchange services in Korea, Bithump, got hacked, and numerous millions worth of bitcoins were stolen. Other attacks like this have been known to happen, with the worst case pushing its’ victims to bankruptcy.

The need for cybersecurity in our lives is growing more and more with each passing day. In Bitcoin’s case, the need might be even greater.

That wraps this up!

This topic is very complex, and I’ve just scratched the surface on everything there is to talk about. If you follow financial news, or tech news everyday, you probably have hear a lot of Bitcoin related news on a weekly basis!

Heck, you’re on Steemit! That means you already know at least a little of Blockchain technology, and you probably already knew a lot of what I spoke about! Regardless I hope I gave you a new insight or something :)

Tomorrow, I’ll do an article about Blockchain technology itself! Stay tuned! In the meantime, feel free to tell me what you thought about this article! I’m always ready to answer questions, or hear criticism, or suggestions to improve!

Steem on guys!

I'm finding that people can relate to the idea that Bitcoin and Litecoin are the Mastercard and Visa of the future, more than they understand the gold/silver concept. They can understand that they can go anywhere in the world and spend BTC as a world currency as a convenience. I know that Bitcoin is theoretically capable of handling all the crypto currency needs once it scales, but I think , just as with gold, people will be storing it and increasing the need for litecoin in the marketplace, just as with silver.

Very likely the case! I'm gonna do an article about altcoins soon, might mention what you just said, crediting you of course!

Thanks! I'll keep an eye out for it.

Congratulations @sirlordboss! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP