My first post on Steemit: car buying 101

Hello everyone, this is my first time writing a blog ever. Wasn't too sure what I should write about, so I guess I'll stick to what I know best; selling cars/buying cars.

A little background on me... when I turned 18, I drove into a car dealership that had a huge sign outside that said "now hiring, will train". then for the next 12 years I have been a car guy. I have held pretty much every position in the sales side of the car business. I went from; sales, internet manager, inventory manager, fleet manager, sales manager then to finance manager (the guy that asks you for more money once you've already decided on the car, and your monthly payment) I first started selling cars so that I can pay for culinary arts school, but I made so much money, that I forgot about chasing my passion of cooking.

Im going to write this to help the customer, so sales guys.. sorry :)

So, most of you have been there.. before you even get out of your car, there seems to be overly enthusiastic salesman that want to shake your hand. (trust me, nowadays he's not the bad guy) You shake his hand, he asks you what you're looking for, and from there on, you start the process of buying a new or used vehicle.

Tip for the sales person reading this; I know some dealerships set the rules where whoever gets to the up is the one to take them, but let the customers breathe! NO ONE likes to be sold anything in the first place!!

Now, the salesperson has already shown you a few cars, then asks that you step inside to talk to about "the numbers". Don't be afraid, no one can force you anything. Just go inside and see what they have to offer. If you were serious about buying the car you test drove, then it wouldn't hurt to leave with some information leading to the purchase anyways. (you'd be surprised, how many people come in to test drive a car, when they are sooo far from purchasing one.. super annoying)

Once inside, most salespeople (if they are doing their damn job) will ask you to fill out a credit application as soon as you sit at a desk. You can tell them, "Im not ready to buy", "Im going to provide my own financing", "fuck you".. they will still ask for a credit app. This way they have your information, not necessarily to run your credit, but to be able to contact you in the future, if you do not buy today. Most dealership sales managers, are "not allowed" to give numbers, unless their guy gets an app. Still, no harm done.

Lets pretend that you were serious about buying this car, so filled out an app. Now your sales person will ask you a few questions, "how are you buying this car? cash/finance? etc", "how much money can you put down?" now, a good sales person will not follow that last question with a "what kind of monthly payment are you looking for?" because if you tell them, I only want a $200/month payment, the salesperson just fucked him or herself by confirming that limit with you. Believe it or not, there is a lot of psychological back-and-forth when it comes to buying cars. That is why, the old sharks sell more than the greenpea (new guy).

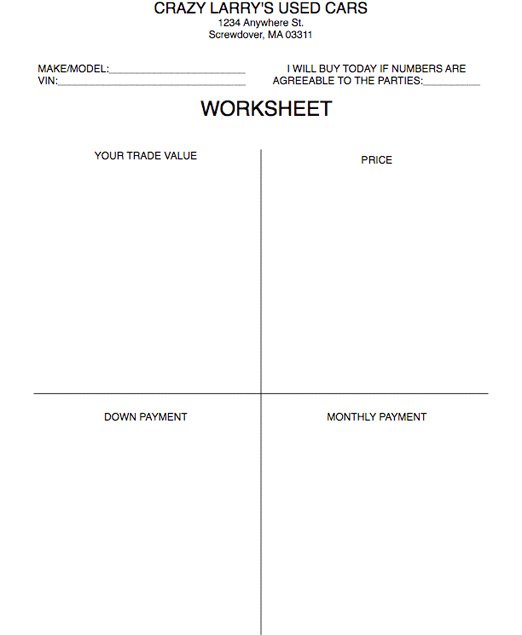

Let's say you are looking at a $30,000.00 car with $5000.00 to put down, a good desk manager, (sales manager) will send your guy back with a pencil (proposal, aka 4square) with something that looks like this;

It'll say

-$30,000 + TTL (tax, title, license)

-$5000 down,

-no trade (if there isn't one)

now, here is where the paper doesnt make a whole lotta sense.. the payment will come back about $700/month.

The reason behind that... us car guys usually multiply $25.00 for every $1000 financed. So for a $30,000 car, +$3000 tax and license, -$5000 down, brings you to about $28,000. They take $28 X $25 and get $700 a month. If a salesperson can get a customer "sign next to that monthly payment" then they got you.. got you good..

Whenever my guys got a commitment on the first pencil, I gave them high fives, hugs.. all that shit, (of course, when the customer isn't looking). You car payment should have been $500 a month if you had decent credit.. at 60 months. If they didn't specify the length of the term, they'll probably try and get you for 72 months at the same payment.. and leave it to the finance guy to explain it to you.

Now you're in the "box" (f&i manager's office).

The f&i manager, (finance and insurance) has about 3 minutes to build rapport and soft close you to find out what you are able to pay as a monthly payment. If you agreed to the $700 payment as mentioned above, the finance guy doesnt really have to sell you anything on his own to make his money. At $700, he has a very nice cushion of about $200/month that he can now fuck with. To a not so savvy customer, if the f&i guy "included" a longer warranty (extended service contract), gap insurance, paint and fabric protection, tire and wheel coverage, etc etc.. they get happy and immediately say "thank you!".

If you are certain that you are going to keep your new car long term, (more than 5 years) an extended service contract is NOT a bad idea... at the right price. Average cost of an extended warranty to the dealership is about $800 for domestic mid range cars, like the Chevy Malibu or something like that. (72 months of coverage, powertrain, electronic, and "bumper to bumper") For German cars, such as BMW, the cost depending on the model, will go from $1000-$2000. They will try to sell these things for about $4000.

If you add a $1000 warranty to a 60 month term, you are only looking at about a $20/month difference. If you are not putting any money down, buy gap... Cost is usually around $300, they will try to sell for $795. ($400-$500 is an ok deal)

DO NOT BUY PAINT AND FABRIC PROTECTION, OR ETCHING SYSTEM (aka, anti theft insurance) Both of these products have a cost about $50 per car, and they will sell for $1000 - $2000 if the f&i guy is talented. Just don't buy it. Your insurance will pay for theft, and you can wax your own damn car for $50 (if that) and get the same results.

Before this blog becomes too long and boring, the best way to buy a car nowadays, is to send in an email inquiry, bring in the internet pricing they sent to you, (don't believe that "this vehicle has already been sold" bullshit, they can match any of the same vehicle with the same options to that price). Pay invoice less holdback, (use this term verbatim, and they'll think you know what you're talking about. (INVOICE LESS HOLDBACK) and of course, any rebates that are available.

**a $30,000 car will probably have a $28-$29000 invoice (not a lot of room in between) and about a $1000 holdback.

Once you get the price you want, if you can get a "platinum" service contract (bumper to bumper) for 72 moths for $1000.00 you should buy it, if you are sure that you will keep the car for at least 6 years. If you decide you don't need it, you can cancel anytime before the 72 months and get your prorated refund anyways. (first 30 days there is no prorate fee in california)

I hope this helps! if you have any specific questions, please comment them and I will try to get to you quickly! Thanks for reading!

@misterdad very informative and interesting post. Need to be resteemed.

Thank you. This is very helpful, will keep this in mind when I buy a car.

Hi, my new 2022 C300 suffered some damage (dent + paint scuff) on the front right fender (passenger side) and some scratches on the right-side panel (passenger side). I use https://roboticsandautomationnews.com/2023/01/07/select-auto-protect-a-comprehensive-review/58949/ insurance, I have a platinum package and they covered all costs, this included parts, paint, body, and mechanical labor. So, you are welcome to try this insurance as I am happy with their service.