Robotics in Banking

Robots in bank? What is this fuss all about?

Well with the proliferation of computer processing power, technology has reached a point where its ability to perform human-like task has become possible. Most think, rightfully so, of robots as physical humanoids acting as human and interacting with humans, or big machines with long arms making car parts (think Toyota factories). There are also the “bots” which is the same concept but refers to the non-physical robot, such as software. These include the “chatbots” that everyone is talking about today.

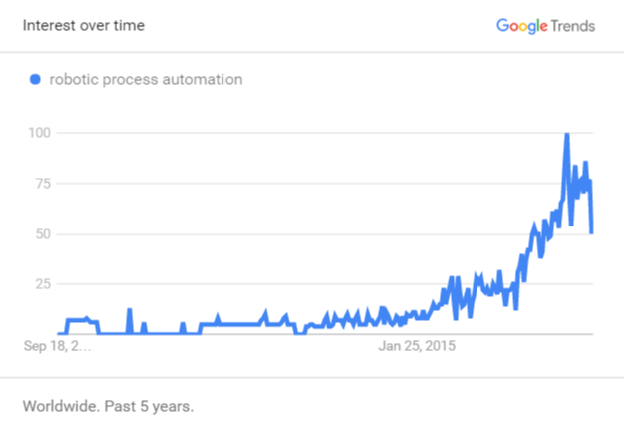

When we talk about robots in the service industries, we essentially are talking about bots. There are various names for referring to robotics in service industries such as Rapid Automation (RA), Autonomics, Robotic Process Automation (preferred term for this article), software bots Intelligent Process Automation or even plain Artificial Intelligence, but all these terms essentially refer to the same concept: letting organizations automate current tasks as if a real person was doing them across applications and systems. Functional trained robots are virtual workers and execute rule-based information processes, improving accuracy and efficiency.

What is worth noting when talking about Robotic “automation” is the different meaning of what automation pertains to in this context. “Automation” today can be defined as including any functional activity that was previously performed manually and is now handled via technology platforms or process automation tools like robotic process automation (RPA) platforms. Thus, what a lot of leaders currently regard as “automation” is likely driven by core IT investments (i.e., the implementation of specialized enterprise apps such as ERP, CRM or BPM). All of these can drive automation — but not to the level that Robotic Process Automation can by mimicking human actions at the software presentation layer or user interface (GUI), and interacting with multiple applications, just as a human would.

The primary opportunity for Robotic Process Automation in the banking industry at this time is that it can extend the creative problem-solving capabilities and productivity of human beings and deliver superior business results. Thanks to this technology humans have the potential of attaining new levels of process efficiency, such as improved operational cost, speed, accuracy and throughput volume, leaving behind the repetitive and time consuming low added-value tasks.

The obvious and major benefit resulting from implementing Robotic Automation can be foreseen as a significant amount of cost savings from automation in not only front office and customer-facing activities but in support functions as well. Top drivers for implementing Robotic Automation beyond cost savings include:

High quality by a reduction of error rates

Time savings via better management of repeatable tasks

Scalability by improving standardization of process workflow

Integration by reducing the reliance on multiple systems/screens to complete a process

Reducing friction (straight-through processing)

Back-end operations still require a lot of human support, despite not being revenue-generation areas. There is obviously room for improvement, especially considering that, in essence, back-office tasks do not require direct interaction with customers and can be performed more efficiently and effectively off-site or by robots.

So is Robotic Process Automation in banking mature? Are any banks using such technology? This new domain is still at its infancy but we can start seeing some use cases today. In India, ICICI, the country’s largest private lender became the first in the country and among the few, globally, to deploy robotics that emulates human actions to automate and perform repetitive, high volume and time consuming business tasks cutting across multiple applications. The bank has re-engineered 200 business processes with software robots that are configured to capture and interpret information from systems, recognize patterns and run business processes across multiple applications to execute activities including data entry and validation, automated formatting, multi-format message creation, text mining, workflow acceleration, reconciliations and currency exchange rate processing among others.

At BNY Mellon, they have a dedicated robotic process automation team that uses Blue Prism® to programmed bots with rules that let them perform research on orders, resolve discrepancies and clear trades. It takes a human five to 10 minutes to reconcile a failed trade. A bot can do it in a quarter of a second. The bank is also is also using bots in its data-reconciliation group. For certain clients, such as pension funds, the bank has to regularly go to the client's website, pull certain records, and compare them against the bank's own records, to make sure all the records match. Where people used to do that task, now bots do the basic work and humans only handle the exceptions. In addition to being faster, bots can work at night, saving employees from having to work night shifts. They can handle overflow when a stream of work outpaces the available staffing.

Another example can be taken from RBS, who installed ‘Luvo’, a robot able to understand questions and then filter through huge amounts of information in a split second before responding with the answer. If Luvo is unable to find the answer, it passes the query on to a member of staff who can solve more complex problems.

Technology might be ready for robots, but is our society ready?