Introduction of $LEND

Introduction of $LEND

LEND is the future of DeFi. LEND, is our DeFi multi-chain lending platform, designed from the ground up with the intention of creating a fully inclusive decentralized financial ecosystem with zero barriers to entry. With LEND, our users will be able to know they are safely maximizing the earning potential of their crypto assets and savings. Users can interact with the protocol in a few ways; Deposit crypto assets to earn competitively high interest, similar to a traditional savings account. Or use their crypto assets as collateral to borrow tokens.

Key Features of LEND:

- Lending — Supply assets to the protocol to earn interest

- Borrowing — Supply assets as collateral to borrow crypto

- Governance — Vote on important future protocol decisions

- Earning — Earn 25% of all platform revenue with $LEND tokens

- MultiChain — Launching on BNB Chain, Eth & Polygon with framework complete for many other chains. Each chain means an additional stream of revenue to be earned by $LEND token stakers.

Is LEND safe?

The sustainability, safety and overall longevity of the LEND protocol is something we’ve kept in mind since day one. We aren’t aiming for overnight success, we’ve been building this ecosystem for over a year and aim to stick around for many more.

With LEND we really wanted to ensure protocol safety from any adverse events. To protect our users and ourselves we have adopted a risk mitigated approach to all aspects of the platform.

LEND Safety Features:

- Security Audit — Industry leading experts at Peckshield have reviewed and approved LEND smart contracts multiple times.

- Collateral Requirement — All borrowers required to be overcollateralized for optimal liquidity within protocol. This means users have to provide more collateral than they are able to borrow.

- Only Liquid Assets — LEND will only ever support the most liquid assets on the market. This has been done to avoid protocol manipulation that might result in total systemic failure. (Like Mango)

- Automated Liquidations— Unhealthy borrower accounts that go into negative equity will be liquidated by the protocol to remove bad debt.

Why do you need LEND

$LEND tokens will be the native token for the LEND protocol. Within the token structure, the token will give holders governance and voting rights in important decisions for shaping the future of the platform. It doesn’t end there though…

$LEND tokens are also the key to earning passive income from the protocol. Once the token has launched, holders can supply $LEND to the protocol in exchange for $tLEND which actually makes them eligible to claim 25% of the total revenue generated by the protocol! 25% more than any current existing protocol! Can Venus do that?

$tLEND tokens can also be staked or locked by users to earn additional Platform Reward Fees based on a 90-day vesting schedule. Locking tokens for the full 90-day term means an increased share of protocol revenue will be received.

How LEND Operates

In the LEND ecosystem, every asset the Protocol supports has a tTokenized version of the particular asset. So when an investor supplies an asset, they would receive a tTokenized version of it. Using USDT as a case study, if an investor provides USDT for Lending, he would receive $tUSDT. The investor is able to automatically earn interest as the tToken he possesses is used to create borrow balances by other participants on the protocol. It is also imperative to note that when supplying tTokens, the basic amount of tTokens supplied would increase in value over time in the likes of a savings account. The proprietary tTokens are required when apportioning collateral to establish a borrow balance.

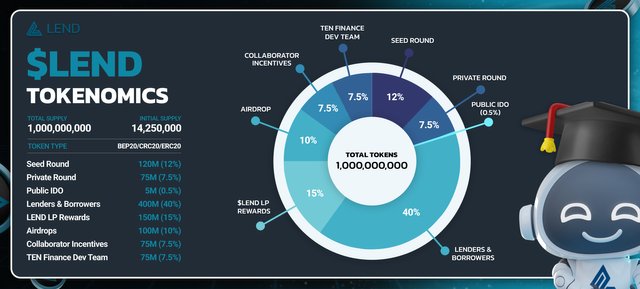

Tokenomics

- TOKEN SYMBOL: LEND

- TOKEN TYPE: BEP20/ERC20

- TOTAL SUPPLY: 1,000,000,000

- INITIAL SUPPLY: 14,250,000

- INITIAL MARKETCAP: TBA

ROADMAP

For More Information:

Website: https://www.lend.finance/

Whitepaper: http://lend.gitbook.io/

Telegram: http://t.me/lendfinance

Twitter: http://twitter.com/lend_finance

Github: https://github.com/tenfinance

Medium: https://medium.com/lendfinance

Author:

Bitcointalk username : hoacomay1992

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2593708

Smart Chain Wallet (BSC) Address: 0x5E2b16194357cd8d300A658bfa70049826806029