Metavault Trade - Decentralised spot & perpetual exchange

Metavault Trade - Decentralised spot & perpetual exchange. This is one of the best projects.

Metavault Trade is a new kind of Decentralized Exchange, designed to provide a large range of trading features and very deep liquidity on many large cap crypto assets.

Metavault.Trade aims to become the go-to solution for traders who want to stay in control of their funds at all times without sharing their personal data. Its innovative design gives it many advantages over other existing DEXes:

Very low transaction fees.

No price impact, even for large order sizes.

Protection against liquidation events: the sudden changes in price that can often occur in one exchange (“scam wicks”) are smoothed out by the pricing mechanism design relying on Chainlink price-feeds.

Traders can use it in two ways:

- Spot trading with swaps and limit orders.

- Perpetual Futures trading with up to 30x leverage on short and long positions.

Open a Position

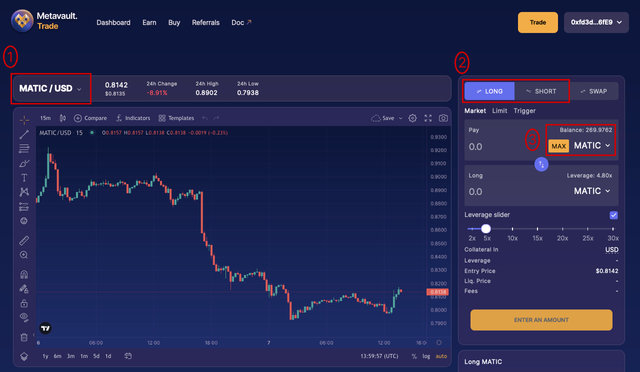

To open a position, click on the “Trade” button in the header.

You will be taken to the trading panel. Click on Zone 1 to choose the currency you want to trade.

Choose the currency in the dropdown menu.

Then, in Zone 2 click on "Long" or "Short" depending on which side you would like to open a position on.

Choosing to "Long" a position earns a profit if the token's price goes up and makes a loss if the token's price goes down.

On the other side, choosing to "Short" a position earns a profit if the token's price goes down and makes a loss if the token's price goes up.

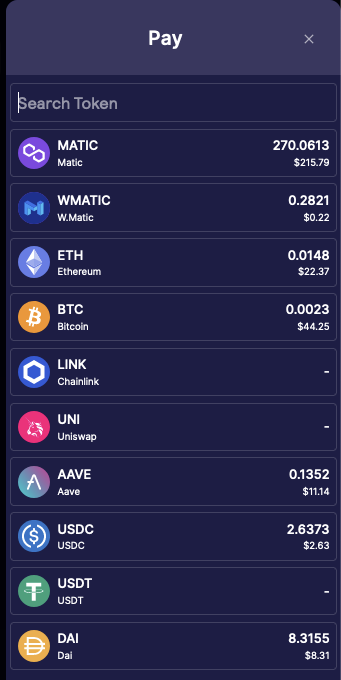

When clicking on Zone 3 a panel will appear where you can select the currency with which you will pay to open a position.

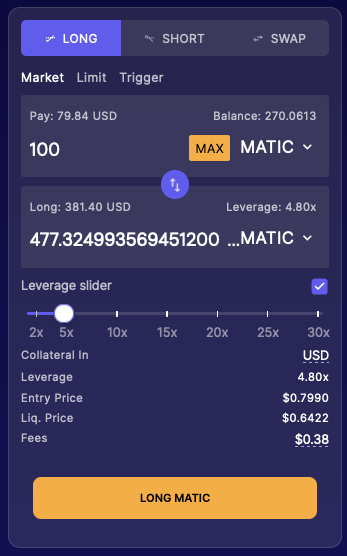

After selecting the currency you want to proceed with, enter the amount you would like to trade in the “Pay” section and use the slider to determine the applied Leverage.

In the example below, we use 100 MATIC to open a Long position on MATIC with a 4.8x leverage.

As you move the Leverage slider, you can see the values of Liquidation Price and Fees changing accordingly. The Trading Fee to open a position is 0.1% of the position size. There is a similar closing fee of 0.1%.

Additionally, a "Borrow Fee" is deducted at the start of every hour. This is the fee paid to the counter-party of your trade. The fee per hour will vary based on utilization, it is calculated as (assets borrowed) / (total assets in pool) * 0.01%.

The box below the position box summarizes the trade with: the Entry Price, the Exit Price (which is the price you would get if you were to close the trade immediately after opening it), the Borrow Fee and the available liquidity in the pool.

Before confirming the transaction, a pop-up will appear summarizing all the relevant data and giving you the option to set slippage to a higher value.

Tokenomics:

MVX is the Metavault.Trade's governance and utility token.

Token Information

MVX token address: 0x2760E46d9BB43dafCbEcaad1F64b93207f9f0eD7

After staking MVX, you will receive staked MVX:

MVX staked token address: 0xaCEC858f6397Dd227dD4ed5bE91A5BB180b8c430

Staking

Staked MVX generates three reward types:

1.MATIC

2.esMVX

3.Multiplier Points

4.30% of swap and leverage trading fees are converted to $MATIC and distributed to the accounts staking MVX

Supply

The maximum supply of MVX is 10,000,000. Minting beyond this maximum supply is controlled by a 28 day timelock, an eventuality that will only be considered if the demands of the protocol necesitate an increase of the supply.

Circulating supply changes are dictated by the number of tokens that are distributed through other DEXs, vested, burnt and spent on marketing.

MVX allocations are:

1.2 million for marketing, partnerships and community development

6 million reserved for rewards (as esMVX which can be converted over time to MVX)

1 million for liquidity on Uniswap (reserve held in the MVX-Multisig)

300,000 for MetavaultDAO team (linearly vested over two years with a three-month cliff)

1.5 million allocated to presale

Presale

MVX token price at launch: 1 USDC

GMX community sale = 200,000 MVX at 20% discount (0.8 USDC/MVX), 200 slots

Whitelisted public presale = 1,000,000 MVX at 10% discount (0.9 USDC/MVX), 500 slots

Metavault DAO community sale = 300,000 MVX at 20% discount (0.8 DAI/MVX), 300 slots

Total $ to be raised in presale: 1,060,000 USDC + Metavault DAO Treasury allocation from MVD -> MVX sale

-> 500,000 USDC paired with 500,000 MVX initial liquidity V3 Pool

-> 60,000 USDC as marketing budget

-> 500,000 USDC as initial MVLP liquidity (owned by the MVX Treasury)

Liquidity is owned by the Metavault protocol and is stored under the multi-signature wallet.

Website: https://metavault.trade/

Telegram: https://t.me/MetavaultTrade/

Twitter: https://twitter.com/MetavaultTRADE/

Discord : https://discord.com/invite/metavault

Docs: https://docs.metavault.trade/

#Proof of authentication

Forum Username: chayan70

Forum Profile Link (BTT): https://bitcointalk.org/index.php?action=profile;u=2856301

PROOF OF REGISTRATION: https://bitcointalk.org/index.php?topic=5414372.msg60982851#msg60982851

Wallet Address: 0x3F6039662a3B6BE318Aa5f9182D61CB53BFdbE92