Anatomy of Pump and Dump Groups in crypto currency

The exchange on which the pump will happen is also selected. Tokens susceptible to P&D are rarely listed on reputable exchanges, so these schemes will usually happen on HitBTC, Cryptopia, Coinexchange, and similar smaller exchanges It’s important to note that no one but the organizers knows which coin is going to be pumped. Phase 2: Countdown and Preparations Once the countdown begins, participants prepare their accounts by loading them up. The accounts are often loaded up only with enough funds to click “max” in the UI so the purchase goes through faster at market value. Reacting quickly is very important so other browsers and programs are generally turned off and the internet connection is freed up as much as possible (no torrents or streaming) to make response times fast. Technical problems can create bagholders. Those most experienced have trading bots ready (scripts for programmatic purchasing without the need for a browser). Once the coin is known, they type in its symbol and the bot takes over, immediately also setting up a limit sell order for 150% – 200% of the purchase price, all within a single second. Phase 3: Pump After the coin has been picked, the organizers buy enough of the coin to take advantage of the price spike, but not so much as to move the price themselves. If they moved the market with their own buys, this would get them accused of a pre-pump, causing them to lose followers. Such a move usually gets executed when the group is at its death throes and most participants have lost trust in the administrators. When only the most naïve remain – those who are unable to recognize pre-pumps – that’s when this last trick is executed to milk the members one last time. After filling their bags, the admins release the coin’s information to the rest. Some use bots, some go manual, but everyone then loads up on the same coin, making it more expensive. Those who completed a purchase then move into hype phase where all chat channels are spammed with the coin, urging bystanders to buy it as well. Phase 4: Dump The purpose of this phase is to get innocent bystanders to buy into the coin because of its rapid rise (which is, by now, visible on the graph). Because of a rapid sell-off by the members who bought early, the dump lowers the price of the coin to its initial value, sometimes lower. In rare cases, the pump will actually permanently raise a coin’s price by 10-15%, depending on the coin. Professional Bagholders When the organizers buy a coin before telling everyone, that’s what’s called a pre-pump. For example, in the group we were watching for this post, the OAX coin was announced with a pump start due at 23:00. But if we look at its graph, the pre-pump is obvious:

The exchange on which the pump will happen is also selected. Tokens susceptible to P&D are rarely listed on reputable exchanges, so these schemes will usually happen on HitBTC, Cryptopia, Coinexchange, and similar smaller exchanges It’s important to note that no one but the organizers knows which coin is going to be pumped. Phase 2: Countdown and Preparations Once the countdown begins, participants prepare their accounts by loading them up. The accounts are often loaded up only with enough funds to click “max” in the UI so the purchase goes through faster at market value. Reacting quickly is very important so other browsers and programs are generally turned off and the internet connection is freed up as much as possible (no torrents or streaming) to make response times fast. Technical problems can create bagholders. Those most experienced have trading bots ready (scripts for programmatic purchasing without the need for a browser). Once the coin is known, they type in its symbol and the bot takes over, immediately also setting up a limit sell order for 150% – 200% of the purchase price, all within a single second. Phase 3: Pump After the coin has been picked, the organizers buy enough of the coin to take advantage of the price spike, but not so much as to move the price themselves. If they moved the market with their own buys, this would get them accused of a pre-pump, causing them to lose followers. Such a move usually gets executed when the group is at its death throes and most participants have lost trust in the administrators. When only the most naïve remain – those who are unable to recognize pre-pumps – that’s when this last trick is executed to milk the members one last time. After filling their bags, the admins release the coin’s information to the rest. Some use bots, some go manual, but everyone then loads up on the same coin, making it more expensive. Those who completed a purchase then move into hype phase where all chat channels are spammed with the coin, urging bystanders to buy it as well. Phase 4: Dump The purpose of this phase is to get innocent bystanders to buy into the coin because of its rapid rise (which is, by now, visible on the graph). Because of a rapid sell-off by the members who bought early, the dump lowers the price of the coin to its initial value, sometimes lower. In rare cases, the pump will actually permanently raise a coin’s price by 10-15%, depending on the coin. Professional Bagholders When the organizers buy a coin before telling everyone, that’s what’s called a pre-pump. For example, in the group we were watching for this post, the OAX coin was announced with a pump start due at 23:00. But if we look at its graph, the pre-pump is obvious:

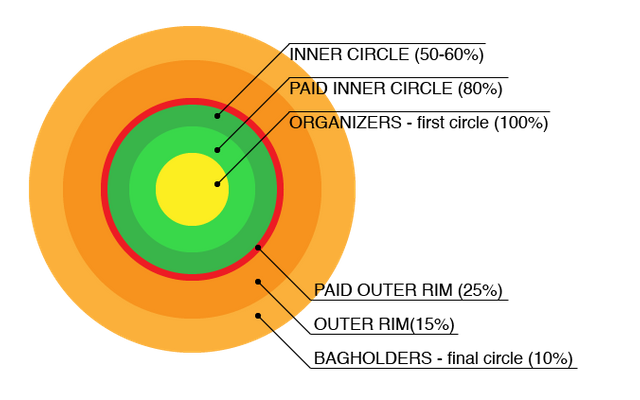

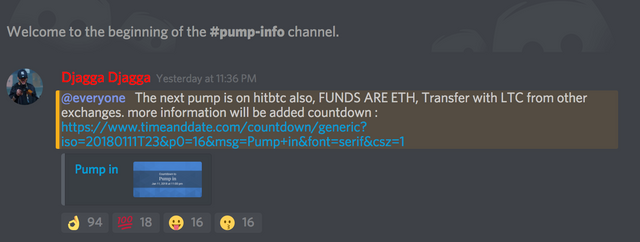

Pump&dump (P&D) schemes are a common occurrence in the cryptocurrency world. They most often happen in Telegram or Discord (chat programs) groups in which several thousand people buy a specific shitcoin (a crypto token without a value or future) at the same time in an attempt to artificially inflate its value. This value increase is called the pump while the selling of this now expensive token to naïve bystanders is the dump phase. In this article, we’ll take a look at the anatomy of one such smaller P&D group. Group New groups are popping up daily, but they’re rarely legit. Most often they’re actually outer rims of already established groups – a secondary layer more intended for the dumping phase. Members of the core layer agree on a coin and inform the outer rim about it. Even inside the core layer there are often several levels – for example, those who paid entry (averaging 1 – 10 BTC) generally get their information 5-6 seconds before others. That’s plenty of time to buy the coin at a lower price. Others join in afterwards and only 10-30 seconds later do the outer rims find out which coin was picked and go into hardcore shopping. Quality core layers accepting new members today are hard to find and expensive to join (north of 15 BTC), and the groups people join today are generally second or third layer groups. The percentage of successful trades decreases as the circle you join is further away from the center. Organizers are always successful because they’re the ones who decide which coin is next and can buy it well in advance – sometimes days to hide their trail. The very next layer already has a lower chance of success. Despite the fact that they paid for access to information, technical difficulties can happen and since the information can’t take too long to reach the outer rims otherwise everything falls apart, a simple glitch in the internet connectivity or the site in question can be enough to miss the train. The next layer is even less successful than the one before it – at this point, it can already be obvious which coin is being pumped judging by the graphs, and sometimes these outer rims use such information to buy before those in internal circles do, thereby beating them to a better price. The situation keeps resolving until it reaches the outermost layers. Phase 1: Announcement How often the pumps happen depends on the group. There are some who pump several times per day, and others who pump once per week or once per month even. The group we’ve been watching for this post is relatively new and does it once per day on average. In phase 1, the time of the pump is announced, often with the help of a link which leads to a countdown to accommodate people from different time zones.

Pump&dump (P&D) schemes are a common occurrence in the cryptocurrency world. They most often happen in Telegram or Discord (chat programs) groups in which several thousand people buy a specific shitcoin (a crypto token without a value or future) at the same time in an attempt to artificially inflate its value. This value increase is called the pump while the selling of this now expensive token to naïve bystanders is the dump phase. In this article, we’ll take a look at the anatomy of one such smaller P&D group. Group New groups are popping up daily, but they’re rarely legit. Most often they’re actually outer rims of already established groups – a secondary layer more intended for the dumping phase. Members of the core layer agree on a coin and inform the outer rim about it. Even inside the core layer there are often several levels – for example, those who paid entry (averaging 1 – 10 BTC) generally get their information 5-6 seconds before others. That’s plenty of time to buy the coin at a lower price. Others join in afterwards and only 10-30 seconds later do the outer rims find out which coin was picked and go into hardcore shopping. Quality core layers accepting new members today are hard to find and expensive to join (north of 15 BTC), and the groups people join today are generally second or third layer groups. The percentage of successful trades decreases as the circle you join is further away from the center. Organizers are always successful because they’re the ones who decide which coin is next and can buy it well in advance – sometimes days to hide their trail. The very next layer already has a lower chance of success. Despite the fact that they paid for access to information, technical difficulties can happen and since the information can’t take too long to reach the outer rims otherwise everything falls apart, a simple glitch in the internet connectivity or the site in question can be enough to miss the train. The next layer is even less successful than the one before it – at this point, it can already be obvious which coin is being pumped judging by the graphs, and sometimes these outer rims use such information to buy before those in internal circles do, thereby beating them to a better price. The situation keeps resolving until it reaches the outermost layers. Phase 1: Announcement How often the pumps happen depends on the group. There are some who pump several times per day, and others who pump once per week or once per month even. The group we’ve been watching for this post is relatively new and does it once per day on average. In phase 1, the time of the pump is announced, often with the help of a link which leads to a countdown to accommodate people from different time zones.