Predicting Market Directions *The Greer Method*

Predicting Market Directions The Greer Method

Introduction

I have been investing for over 20 years and I have tried multiple methods to predict when is a good time to buy and sell. I have created a method that I have been using with good success and thought I would share it with the rest of my followers.

Hopefully a few people will find some value in this method.

Let's set a few ground rules before we begin

- Use this method at your own risk. This is not investment advise and you should only risk what you can afford to lose.

- This is not a get quick method and is not meant for people interested in day trading. This is about long term investing.

- This method is not the end all be all solution, but it can be used as a powerful tool to help you with your investment journey.

Let's begin: Can you tell me from looking at this chart if the market is going to go Up or Down?

What about now with more indicators (what is your prediction Up or Down)?

Be honest do you really know which way the market is going to go?

If you still don't have the foggiest clue if the market will go up or down then join the club. There are a million different methods out there and people swear by them. At the end of the day no one knows for certain which way a market, stock, crypto coin is going to go. However, with information comes power. The more information you have the better chance you have to make good investment decisions. The following method can be used as an additional tool that you can use going forward and you can determine if it will work for you.

The Greer Method Quick Peek

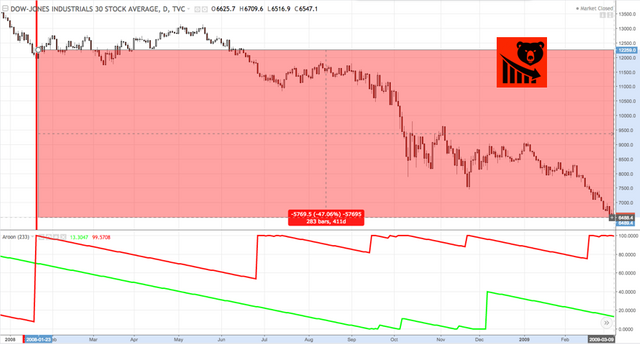

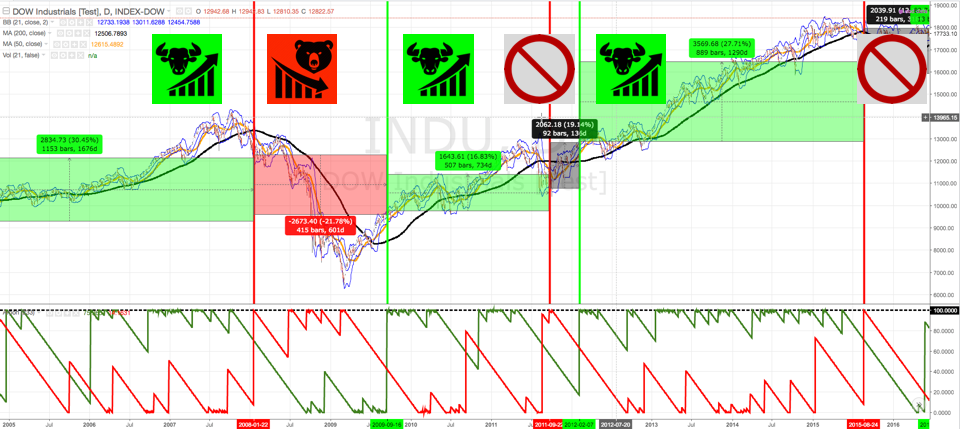

You see that red vertical line over the chart? On January 22nd 2008 the Greer Method told you that the Dow Jones was entering into a Bear Market

And here is what happened

In 2008 the market drop from 12,259 to 6,547 at it’s low (-47% Loss)

Now for some good news! The Greer Method also told you when the Bull market started back up.

You see the vertical Green Line. That told you that on Sept 18th 2009 the market was entering into a Bull. It went on a bull run from 9,822 to 12845 at it’s high (30% Gain)

So What! We all know about 2008!

Everyone can go back to 2008 and make that prediction. So I went back to the beginning and back tested this method. All the way back to 1915.

This method predicted

- The Great Depression

- The Boom after the world wars

- 1970s crash

- the 1990s boom

- The 2000 dot bombs

- The 2008 financial crises

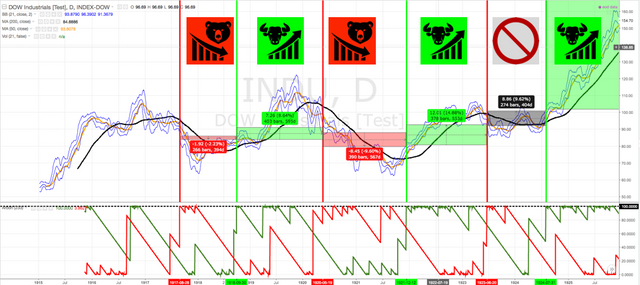

Dow from 1915-1925

You can see from this chart the method was correct 5/6 times. The one time it predicted a bear market it turned out to be a bull. If you are a glass half full investor you would have not lost any money but you wouldn't have gained either.

Dow from 1925-1935

Look at this! In 1929 in Oct 29th this method would have told you to get out of the market! The Great depression started on the same day.

But when do you get back into the market?

Look at the green line on March 11th 1933. If you got back in you would have made over 100% in the next 4 years.

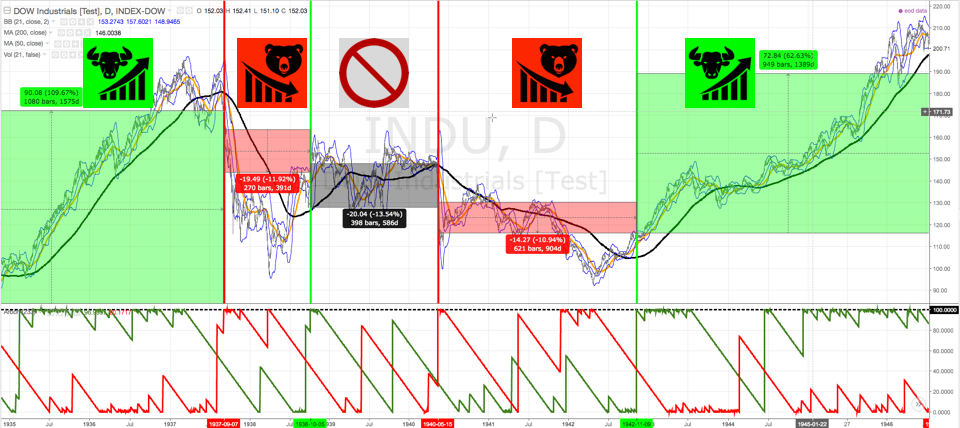

Dow from 1935-1945 World Wars

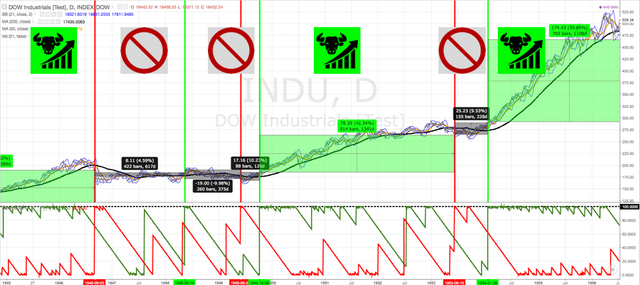

Dow from 1945 - 1955 Happy Days

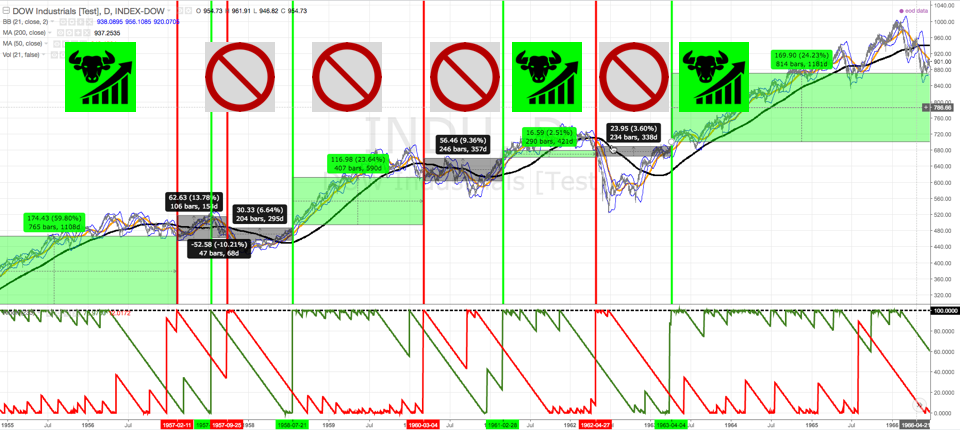

Dow from 1955 - 1965 Free Love and Hippies

Dow from 1975 - 1985 Disco

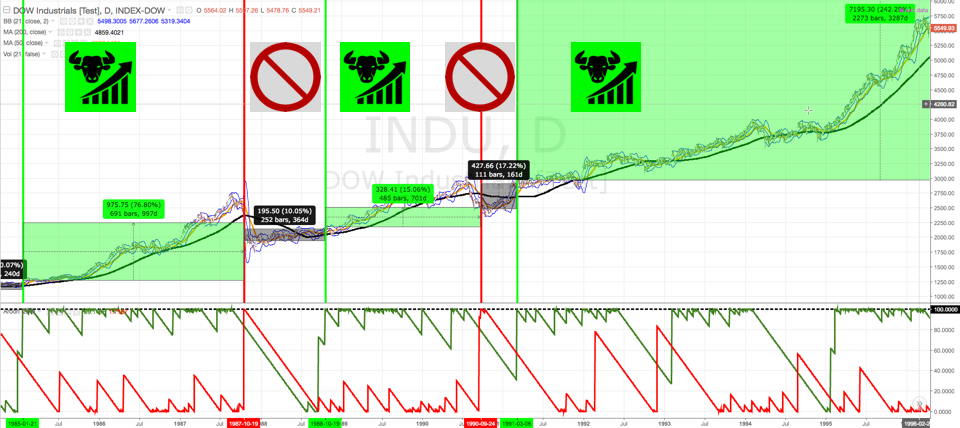

Dow from 1985 - 1995 Boom

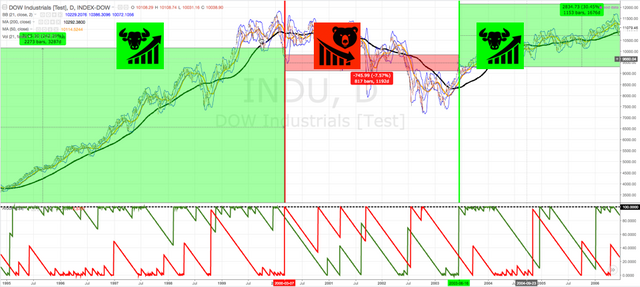

Dow from 1995 - 2005 Y2K

Dow from 2005 - 2015 Too Big To Fail

Dow from 2015 - Present

Here is the Present day Chart. As you can see we entered into a bull market back on July 11th 2016.

Final Thoughts

If you are interested in more details on this method I will write up a Part 2. If I find enough interested I'll publish the actual method.

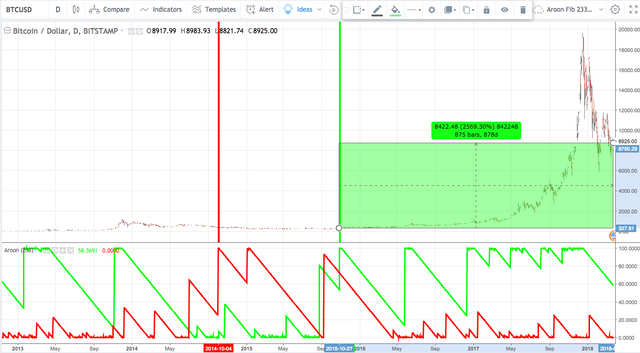

This method works on any stock, market or crypto Not just the Dow Jones.

Disclaimer:

The Author of this Guide is not responsible for, and expressly disclaims all liability for, damages of any kind arising out of use, reference to, or reliance on any information contained within document. While the information contained within the document is periodically updated, no guarantee is given that the information provided in this guide is correct, complete, and up-to-date.

Although the guide may include links providing direct access to other Internet resources, including Web sites, The Authors are not responsible for the accuracy or content of information contained in these sites.

I tried to play around with Aroon indicator. Need to polish and get used to it. Thanks!

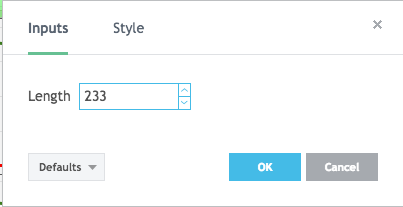

let me know if you need help setting it up in trading-view. Make sure to set you length to 233

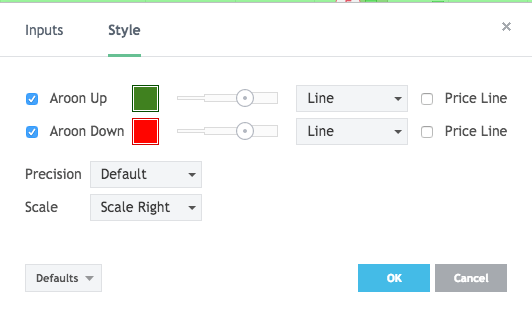

then set your aroon up to green and aroon down to red

Yeah, I noticed that your length is set to 233. However, for BTC it is useless and shows no signs of a trend change. It think that BTC is too volatile. I tested with settings lower than 14 days and they look more usable.

agreed but if you are looking for longterm trends it works

That's really great man! I'm new to that! Good to learn something new though!