Poolz - Auctions layer for swap pools and Dex exchanges

Trulу, blockchain tесhnоlоgу has сhаngеd the gаmе fоr a brand new mеthоd of finance саllеd Dесеntrаlіzеd finance or Dе-fі. Tоdау, dеvеlореrѕ hаvе built a lot of аррlісаtіоnѕ thаt wіll еnаblе uѕеrѕ to tаkе charge of thе decentralized nаturе of thе blосkсhаіn fоr advanced monetary ѕtruсturе.

Despite іtѕ numerous benefits, blосkсhаіn tokens hаvе a hugе dіѕаdvаntаgе thаt fіаt сurrеnсіеѕ generally dоn’t battle with аnd thаt іѕ thе рrоblеm оf liquidity. Crypto currency has оftеn bаttlеd wіth lіԛuіdіtу bесаuѕе оf the numеrоuѕ trаdіng pairs which are bеіng dеvеlореd daily аnd trаdіng them оn several еxсhаngеѕ саn cause fluсtuаtіоnѕ іn thеіr lіԛuіdіtу.

Thе implication іѕ thаt nеw blосkсhаіn tokens might also revel in lоw liquidity thаt mау dеrаіl thеіr development duе to the hеѕіtаtіоnѕ оf investors to buу them. Thіѕ hаѕ been аn іѕѕuе for mаnу blосkсhаіn tоkеnѕ getting into the mаrkеt.

Thіѕ becomes the core purpose that birthed Pооlz Dе-fі; a project aiming to become evolved аѕ a mеаnѕ of іmрrоvіng thе реrfоrmаnсе of nеw blосkсhаіn tokens in thе change marketplace.

Poolz is a Layer-3 exchange (buying and selling) conference in a decentralized space, associating the beginning segment of blockchain. Its added together a nice interface that lets in undertaking proprietors (or project devs, owners etc) to dispatch and oversee liquidity barters that are correctly discoverable by speculators (investors) on the platform.

Poolz : A Decentralized Finance (DeFi) Platform

So many of us are positive about the concept of decentralized trade and the removal of the intermediaries that we have been forced to help oversee our digital assets. It is these concerns that has further fueled the quest for a decentralized finance.

The fusion of traditional bank administrations with decentralized developments, such as blockchain, is what is termed as Decentralized Finance (DeFi). Due to its extensive framework and workings, DeFi can also be called "Open Finance".

Consequently, it is not even shocking to see one project evolving after the other with the widespread support for DeFi projects in the cryptocurrency community. Just recently, a DeFi project, Poolz, was launched. Sponsored by blockchains, ERC-20 tokens, and ERC-20 wallets, it is a decentralized layer-3 swap. In order to bring project owners and investors together, the Poolz protocol was developed primarily. By offering a liquidity alternative for promising projects, and by granting investors access to swap pool autonomy. Project Owners (PO) and Liquidity Providers (LP) are the major groups. By utilizing the framework, with complete allocation provided, the project owners will establish a poll for the token in their wallet that they want to auction. The criteria, including the length of the survey, will have to be set. Two forms of polls exist. The Time-Locked Polls (TLP) and the Direct Sales Polls (DSP). As for the DSP, the token will be moved to the Liquidity Provider (LP) wallet instantly. But with TLP, the transfer will take place obviously but it depends on what the Project Owner (PO) has stipulated. The Project Owner will experience an estimated 85 percent reduction in gas transaction fees compared to the current market rate. This is where the Liquidity Suppliers (Investors) come in after auctions have been released. On the site, they can enter either one of these published auctions and pick which token they want to provide liquidity. Tokens will be moved to the Liquidity Provider’s wallet after the transaction has been confirmed. The length of the transition will depend on what has been decided by the owners of the project. Before creating any liquidity on the platform, investors are advised to run an integrity search. Smart contracts, portfolios of shareholders, and other related documents should be reviewed correctly. All these check and balance is to avoid any form of discrepancies or medling as well as protect the interest of the investors.

What makes Poolz protocol project different other DeFi projects?

There are several problems affecting the majority of DeFi programs. One of these worries is scalability. This refers to a cryptocurrency’s capacity to cope with the flood of massive transactions at a time. Also, Not being user-friendly is another concern that has been raises. The protocol was developed using React Native to solve all these major problems. It will certainly draw more investors with these problems being addressed.

In conclusion, there is no doubt that POOLZ is an amazing project and stands head high above other projects. For instance, Poolz has already raised $180,000 in its Seed Sale with the publication of the white paper. This represents this strong and unanimous support from investors. This another clear indication that it is best investment choice for crypto enthusiasts and investors.

How Liquidity Pools Work

Skip to the next section, if you already understand Liquidity Pools!

Traditionally, the process of providing liquidity to a market is through market making. This is where selected high volume market players, provide liquidity at a discount in their favor. However it comes with custodial limitations and monopoly problems. Sadly, this is the method been used by centralized crypto markets.

On the contrary, liquidity pools, rely on automated market making, executed by the Poolz protocol. In this situation, any willing party can play market maker and get to purchase tokens at faries discount and still get rewarded by the protocol. What is more, this comes with the trustless protection of a Defi protocol.

An Overview of the Poolz ecosytem operations

Poolz is built as a DAO protocol on ethereum, and the premise of the Poolz operations and governance is that, the community gets to decides how governance and operations will evolve, going forward. So even though our team get to set the initial operations, the community still gets to decide how it eventually evolves.

Please note that, this overview is not an exhaustive representation of the overall Poolz operations. That will be available in the litepaper. What is captured here is a brief summary of the its operation:

Poolz (POZ) token:

this is an ERC-2O token, since Poolz is deployed on Ethereum. It will be used for incentivization, to pay for developmental cost goin forward and governance requirements. Also, POZ holders get to be discounted with pool entry and simply for being holders of POZ, so you get to earn more POZ for having POZ.

Pool Type:

there will be two pool types on Poolz, which is the direct sales pool (DSP), where the tokens are received by the investor, imediately after a swap, and the time-lock pools (TLP), where the pools have a lock-in-period, before the tokens are released to the investors.

Poolz Market Players:

There are two categories of players in the market, which are the liquidity providers (LP), technically the market makers, and those in need of the liquidity or Pool creators.

Pool rule makers:

every pool on Poolz come with basic rules and the pool creators, which are usually the project owners, for new tokens, get to set the rules. The parameters for this rule includes choices like: relevant blockchain protocol and wallet for the swap, pool type, pool duration (in the case of a timelock pool,) available token for the pool or auction, the swapping ratio and several others.

Planned Improvements:

as an eventual milestone in the poolz functional agenda, there will be a cross-chain token transfer implementation, at a later stage of its developmental roadmap. This will allow for non-ethereum tokens to be swapped by the poolz protocol.

This section contains the supported blockchains, supported tokens, and supported wallets and what will be integrated in the future. This applies to both categories of Poolz users (POs and LPs).

Supported Blockchains : Ethereum (MVP phase).

Future Integration : Multi-chain support and cross-chain integrations.

Supported Tokens : ERC20 (MVP phase)

Future Integration : ERC721 and multi-chain token standards.

Supported Wallets : MetaMask (MVP phase).

Future Integration : WalletConnect, Coinbase Wallet, Fortmatic, and Portis, and other non-ERC20 wallets.

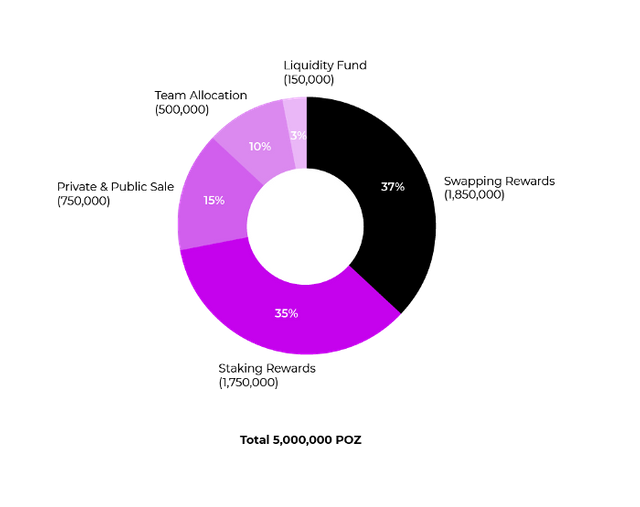

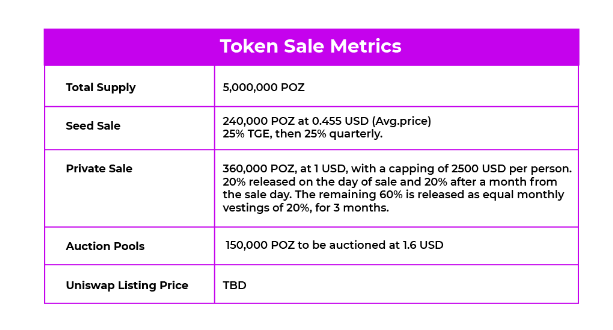

Token Information

● Token Name: POZ

● Type: ERC20

● Initial Supply: 750,000

● Total Supply: 5,000,000

● Swapping Rewards: 1,850,000 POZ

● Staking: 1,750,000 POZ

● Private & Public Sale: 750,000 POZ

● Team & Advisors: 500,000 POZ

● Liquidity Fund: 150,000 POZ

Use Cases

Staking and Rewards:

Holding POZ in staking wallets can fetch Liquidity Providers returns, also in Poolz’s liquidity pools, to be listed on DEXs. POZ will also be the reward token for participants on the Poolz platform.

Governance:

POZ holders can participate in the community’s decision-making process, such as new proposals, pool audits, etc. They gain the right to vote on the platform by staking a certain amount in their staking wallets.

Token Burn:

The POZ token value will be enhanced through the buy-back policy. About 20% of the total supply will be used to buy back and burn POZ tokens. With the value-enhanced, the POZ community members can look to maximize their returns.

Conclusion

The poolz project has identified some of the problems that have restrained the mass adoption of Decentralized Finance(DeFi), thus coming up with a decentralized, Layer-3 for swapping protocol financial auctions and OTC Markets built for the Blockchain ecosystem.

With poolz, blockchain startups with high potentials but limited funds are offered a solution to bootstrap liquidity for their tokens before they get listed.

This is a mutual wining situation for both project owners and investors. This is so because while Project Owners are offered liquidity bootstrapping solution that helps their projects to succeed; Liquidity Providers or Investors benefit by using the platform to select high potential projects, thereby maximizing their Return on Investment (ROI).

For more Information :

Website: https://poolzdefi.com

GitHub: https://github.com/The-Poolz

Twitter: https://twitter.com/Poolz

Medium: https://medium.com/@Poolz

Discord: https://discord.com/invite/RgPjgUY

Documentation: https://docs.poolzdefi.com/

Litepaper: https://docs.poolzdefi.com/whitepaper/litepaper

Author : Gozila

ETH Wallet : 0x948c0D91F515575d1fb04907F5adEC922C2cf494