Introducing Poolz based on { DeFi }

Introducing Poolz: Decentralized Layer-3 swapping protocol, based on DeFi infrastructure

Visit website: https://poolzdefi.com/

#defi #POOLZ $POZ

A new platform but alot of experience and strong and promising team and alot of expectations in this project and I believe this type of community project are always succeed.

For decentralized finance (Defi) to cross the tipping-point of mass adoption, there must be a solution able to house multiple blockchains under an interactive umbrella, independent of custodial supervision. Such solution will also serve multiple cross-chain interactions, like crypto exchanges.

While there are some token swapping protocols in the Defi space, executing this already; they, however, do not make provision for early-stage projects and are limited in cross-chain exchanging.

🔥Introducing Poolz🔥 ✓ DeFi✓

While there are several pioneering platforms offering liquidity pooling opportunities, the idea with Poolz is to make liquidity pooling available for the pre-listing phase of the project, and for existing assets too. So it takes out that initial barrier to entry hurdle suffocating great solutions without the means for a grand market entrance.

🔥How Do Liquidity Pools Work? DeFi Explained

What are Liquidity Pools? How do they work? And why do we even need them in decentralized finance? Also, what are the differences between liquidity pools across different protocols such as Uniswap, Balancer or Curve? We’ll be going through all of this in this article.

Traditionally, the process of providing liquidity to a market is through market making. This is where selected high volume market players, provide liquidity at a discount in their favor. However it comes with custodial limitations and monopoly problems. Sadly, this is the method been used by centralized crypto markets.

On the contrary, liquidity pools, rely on automated market making, executed by the Poolz protocol. In this situation, any willing party can play market maker and get to purchase tokens at faries discount and still get rewarded by the protocol. What is more, this comes with the trustless protection of a Defi protocol.

✨An Overview of the Poolz ecosytem operations✨

Poolz is built as a DAO protocol on ethereum, and the premise of the Poolz operations and governance is that, the community gets to decides how governance and operations will evolve, going forward. So even though our team get to set the initial operations, the community still gets to decide how it eventually evolves.

Please note that, this overview is not an exhaustive representation of the overall Poolz operations. That will be available in the litepaper. What is captured here is a brief summary of the its operation:

🔥The Poolz🔥

✓POZ✓Token

Poolz is a decentralized on-chain token exchange powered by the Poolz (POZ) token. The project is deployed on the Ethereum virtual machine (EVM), making POZ an ERC-20 standard token. As the native asset of Poolz, POZ will be used for incentivization, governance, ongoing project development, and token burns across the Poolz network.

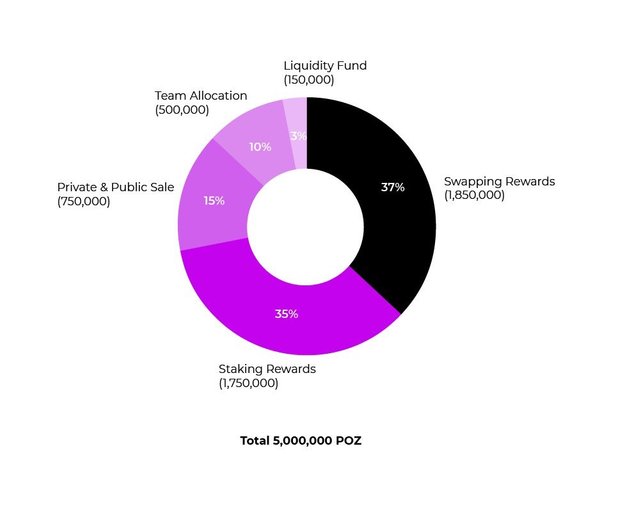

Token Allocation & Circulation

Swapping Rewards: 37% out of the total POZ supply — 1,850,000 POZ tokens — is allocated for swapping rewards for liquidity providers (LP), who will be participating across the various swapping pools on Poolz. The swapping rewards will be distributed over the next 10 years from launch. The Poolz ecosystem will release 185,000 POZ per year, equaling 3,577 tokens per week. The Poolz community may change the vesting ratio rule after the governance protocol launch.

🤑Liquidity Fund🤑

3% of the total POZ supply — 150,000 POZ — is allocated to provide liquidity on external exchanges like Uniswap once the token is listed.

Staking Rewards✓

35% of the total POZ supply, or 1,750,000 POZ, is allocated as staking rewards, which will be circulated as average annual yields (AYY) to users who stake POZ. The staking reward tokens will be locked in a publicly-auditable and secure Multi-Sig Wallet. And the rewards will be released in 10 annual instalments over 10 years at a rate of 175,000 POZ per-year.

Poolz is very high-quality and reliable project. The team was doing an amazing works effectively and implements everything according to its timeline.

This project is excellent project and future biggest project and very interested project I am really impressed this project & join now future biggest project.

Poolz ( DeFi )✓ More information:

Website: https://poolzdefi.com/

Whitepaper: https://docs.poolzdefi.com/whitepaper/litepaper

Medium: https://medium.com/@Poolz

Twitter: https://twitter.com/Poolz__

Telegram: https://t.me/PoolzOfficialCommunity

Telegram Announcements: https://t.me/Poolz_Announcements

Github: https://github.com/PoolzAdmin/Poolz

Our live code on Discord: https://discord.gg/8REVabc

E-mail: [email protected]

Author info:

Bitcointalk username: iamprabhupawar

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2849172

Telegram: https://t.me/iamprabhupawar

Twitter: https://twitter.com/iamprabhupawar

Facebook: https://www.facebook.com/iamprabhupawar

LinkedIn: https://www.linkedin.com/in/iamprabhupawar

Medium: https://medium.com/@iamprabhupawar

My ETH Wallet Address: 0x88899a98495cb16b36F595184872eBa61ff219cC