Spotlight on Poloniex Contest: Poloniex#3: Poloniex Futures

Hello Steemian, in the third post on #poloniexspotlight we are going to deal with a very useful service for some Poloniex's users which requires such experience and a lot of advices namely Futures, good reading for all!

Introduction :

Introduction :

Most of the cryptocurrency traders and investors got their first investment in cryptocurrencies through direct or indirect purchase of Bitcoin, which means an immediate transaction, i.e. buying and selling in the simplest form (the simplest type of trading) but there is another type of trading namely futures contracts.

What are futures contracts ?

What are futures contracts ?

From the name it becomes clear that it is a group of futures contracts carrying an agreement between two parties to buy or sell a digital currency at a specific price on some future date. These contracts carry a set of standard criteria such as quantity, price, date ...

Both the buyer and seller are legally obligated to respect the terms of the contract at the time of expiration.

Traders mainly use futures contracts for three reasons:

- Hedging : used against future price changes.

- Price speculation : used to increase profit.

- Trade with Numberx leverage : You don't need to put up Number% of the contract's value amount when trading.

What are "perpetual" futures?

What are "perpetual" futures?

A perpetual contract is a derivative that is similar to a traditional futures contract (an agreement to buy or sell a commodity at a predetermined price at a specific time in the future), but with one major difference : unlike futures contracts, perpetual contracts do not have an expiration date. So you can keep a position as long as you want.

In addition, perpetual contracts mimic the spot market on margin and therefore trade near the price index. This allows you to amplify the outcome of the transaction, but also means that a drop in the price of a commodity equal to your initial margin (the percentage of total funds you have provided as collateral) will automatically liquidate your capital and close.

Futures contracts with Poloniex

Futures contracts with Poloniex

The arrival of Poloniex in the futures market is no surprise: this type of derivative product is particularly popular in recent months.

Poloniex negotiators can use this service on the web, on mobile or via APIs that we will demonstrate its process after.

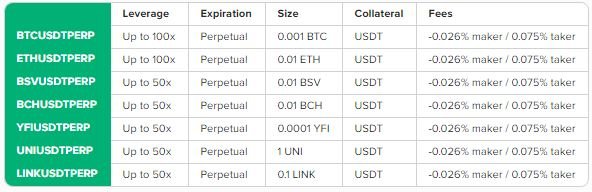

Traders will be able to use Bitcoin (BTC) and Ethereum (ETH) perpetual swaps with leverage up to x100 and 5 other cryptos with leverage up to x50.

Source

Perpetual swaps are forward contracts that do not have an expiration date, so users can open and close a position whenever they want. The guarantee (collateral) of these contracts is paid in Tether (USDT).

Why do these contracts use USDT as collateral?

This will make it easier to calculate profit and loss and, more importantly, allow traders to trade multiple pairs that the exchange will offer using a single collateral instead of having to switch from one coin to another.

Who trades futures?

Users who already have a spot trading, margin trading and lending account will not need to create a new account to take advantage of this service.

However, they will need to have a "level 2" verified account in order to use the futures contracts. The new service is available on the same dashboard where the other derivative products offered are present.

How to Use Poloniex's Futures API Starter Kit

How to Use Poloniex's Futures API Starter Kit

?

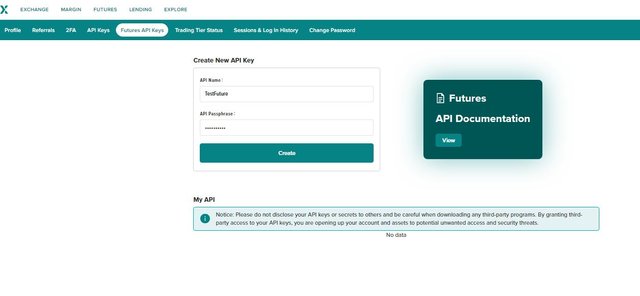

The use of this API kit requires the creation and configuration of a Poloniex Futures API key. To do this we follow the following steps.

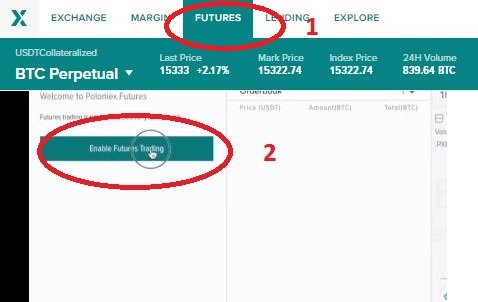

- First navigate to the futures tab , then enable futures training once enabled you understand the risks after which you start to set up the API keys.

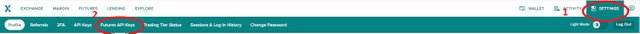

- Navigate to settings select the futures API keys

- Set a name for your futures API keys i put TestFuture, create a password for your

API key

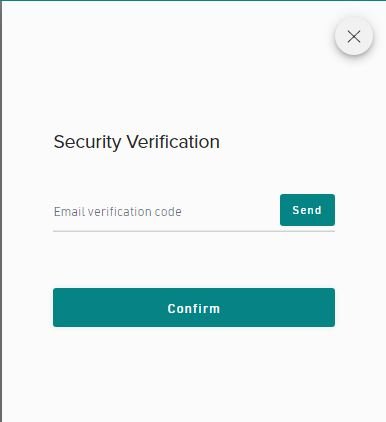

- Create regular Keys confirm your one-time passwords through email one-time password and click confirm your API keys

- Change the settings you would like trading withdrawals remember the trolls require IP address and save.

How to Use Poloniex Futures API Sample Trading Strategies

How to Use Poloniex Futures API Sample Trading Strategies

- After setting up your API keys, you can use the sample API trading kit, starting with an example SDK which can be found on Github.

- Set environment variables that contain your API Key values:

PF_API_KEY,PF_SECRET, andPF_PASS.

- Get the code files with git.

Clone the repository into the path you will be using this code :

git clone https://github.com/poloniex/polo-futures-sdk-python- Run one of the sample scripts with python.

Samples of the wrappers' usage are found inrest_sample.pyandws_sample.py

Conclusion :

Conclusion :

Before jumping into Poloniex Futures, get enough training with spot trading and be well aware of the risks that come with futures contracts. With a sufficient knowledge base, Poloniex Futures will offer you its full potential without you needing to take unnecessary risks.

This post payout set to be 100% power up

Thank you for taking part in the Spotlight on Poloniex Contest.

Keep following @steemitblog for the latest updates.

The Steemit Team

Thanks a lot!!

Twitter promotion

The Twitter link seems to be broken.

Ok i will fix it soon. Thanks