Spotlight on Poloniex -Accounts , Positions and Margin Trading.

What is POLONIEX?

My own creation

My own creation

Poloniex is more than half a decade old centralised crypto- assets exchange standing as a solid entity in the cryptoaphere. It is a global crpto to crpto exchange. Poloniex supports diverse range of crypoccurrencies. However , it does not allow trading with flat. Mentioning all of them is not mandatory, however just for emphasis, I will. mention some of them like

- Bitcoin

- XRP (Ripple)

- Litecoin

- Ethereum

- Steem.

- Bitcoin Cash

- BitShares

- Zcash

- EOS

- Siacoin

- Bytecoin

- Ethereum Classic

- Peercoin

- Burst

- Syscoin

and many more

Poloniex has very simple and fast verification process for account creation which does not require us to share personnel details other than email and setting a password. Poloniex has simple user interface with diverse and exciting trading features, which we shall discuss here and in forthcoming posts about poloniex. We can explore it, either directly on the web or mobile apps available.

What are different trading options that POLONIEX provide?

Poloniex offers some excellent trading benefits like SPOT trading, MARGIN trading, and LENDING.

I will try to explain all these options to the best of my understanding as for my negligible experience in the field is concerned.

To explain above mentioned features, we must understand different trading accounts of Poloniex. There are three accounts which one should be acquainted with before starting trading on poloniex and they are Exchange accout, Lending account and Margin account.

Exchange Account

It is a sorrt of primary account . When we deposit funds in poloniex, they are credited to exchange account. These funds are used for trading on day to day basis and this type of trading is called SPOT trading.

Lending Account

An outstanding feature of poloniex is lending funds Lending account holds funds which you lend to borrowers for Margin trading for which a lender is paid interest. One point to be taken care of, is the fee charged by poloniex. When interest rate is to be set, care must be taken that out of the Interest earned, 15% will be taken by poloniex. So rate has to be set accordingly.

Margin Account

This account is used for margin trading.The funds that this account holds are called collaterals. Funds to this account are transferred from exchange account to be used as compensation to secure loans.

So it is easy to understand Margin trading now. Spot reading and lending are understood now.

Margin trading is a type of trading which is done with the help of burrowed funds. Important point to understand is that, collaterals are not used for margin trading but they are only used as a security deposit. The amount which you burrow is taken from lending account of one who kept funds for lending purpose.

What is meant by POLONIEX POSITIONS?

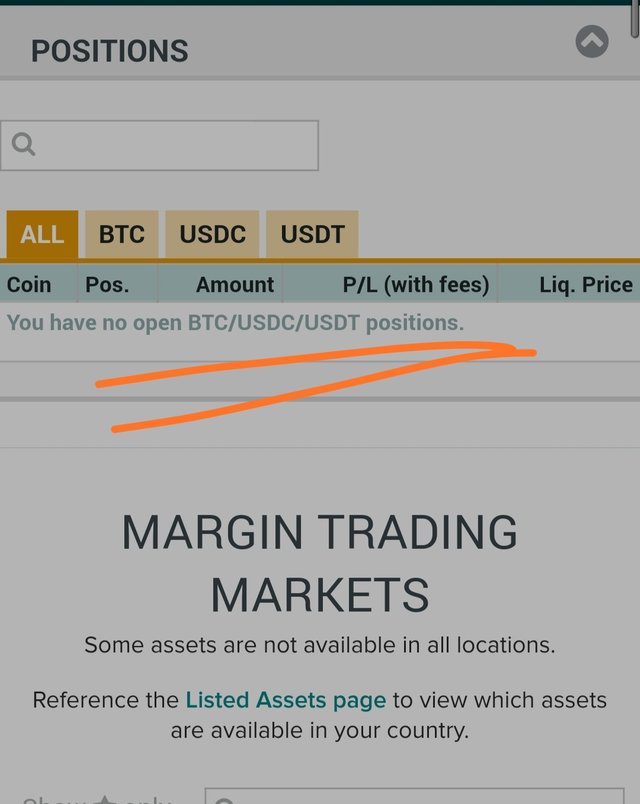

No open positions on my poloniex

No open positions on my poloniex

As you can see in the above screenshot from my account showing You have no open BTC/USDC/USDT positions .

Position opens only after trading with burrowed funds. As I have not burrowed any funds for trading, so no positions opened. Position can be long or short. Long position is opened on buying with burrowed funds and if we sell, short position will open. If we close our position, the burrowed amount will settle down automatically. Now there are two possibilities, either we are in profit or we are in loss at the time of closing our position. If we are in profit, the profitable amount will be credited to the margin account not the Exchange account but if we are in loss that borrowed amount will be taken from the collateral funds present in Margin account.

Trading Fee

Fee charged by poloniex is reasonable. As it does not allow trading with flat , fee charged is therefore less because traditional trading (flat) has many regulatory requirements.

Here both the maker and taker pay transection fee, which is decided by the platform Maker fee is around 0.15%, while taker fee is around 0.05% to 0.25%.Here maker is slighly at adventageous position for paying lesser fee. Fee to be paid has inverse relationship with amount used to trade. It means, higher the amount, lesser is the fee.

Another fee is lending fee, which is the rate of interest set by lender not by platform. Here poloniex takes higher fee from the interest earned and that is about 15 %

Thank you.

To be continued.....

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

Twitter shared

https://twitter.com/Qamran7007/status/1323700508209541120?s=20

STEEM is listed in Poloniex, but SBD is not. For that, you need to convert your SBD to STEEM in Steem internal market, and then you can trade your STEEM in Poloniex.

When both maker fee and taker becomes equal it is called flat trading fees. IN Poloniex, the trading fee at the basic level is 0.125% at the moment. However, you can get a discount of 25% if you have a TRX balance and you want to pay trading fees in TRX. So it's like if you have TRX balance then this fee will become 0.09%.

Thank you.

#twopercent #india #affable

Thank you boss.

Great post a out the lending on poloniex, I think it's actually a great feature that many exchanges lack, this feature makes it possible for both heavy and retail investors to share in the reward pools. This is just great. You did a nice job.

Yes, you are right and thank you.