AbaCore Capital Holdings, Inc. (ABA)

As I rebuilding my portfolio, my exposure in ABA is 29% of these asset classes. To view my portfolio, click it here.

Why Investing ABA?

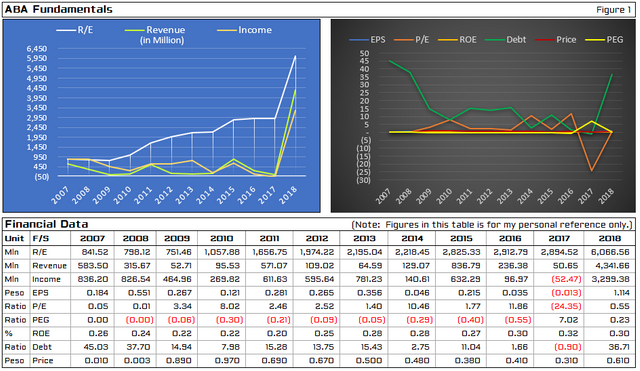

Fundamental views

I’m watching this ticker since it became a holding company in 1989 but was not able to pour money into it as so many companies who standing well in the same industry. As I’m the process of rebuilding this asset class into my portfolio and lately AbaCore was exemplary performing well among its peers at least in my opinion, let’s examine why.

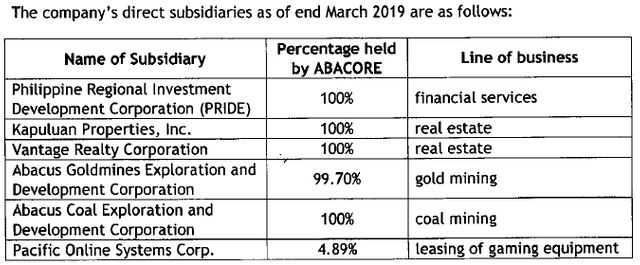

AbaCore has the business interests in financial services, real estate, gold mining, coal mining, and leasing of gaming equipment.

Financial services, ABA owns a 100% controlling interest in Philippine Regional Investment Development Corporation (PRIDE). Incorporated in 1979, PRIDE is a duly-licensed investment house and a member of the Investment House Association of the Philippines. PRIDE is mostly engaged in arranging project financing for a variety of real estate, logistics and infrastructure projects. PRIDE has two financial services subsidiaries, namely, Philippine International Infrastructure Fund, a mutual fund, and Phil. Star Development Bank, Inc., a private development bank.

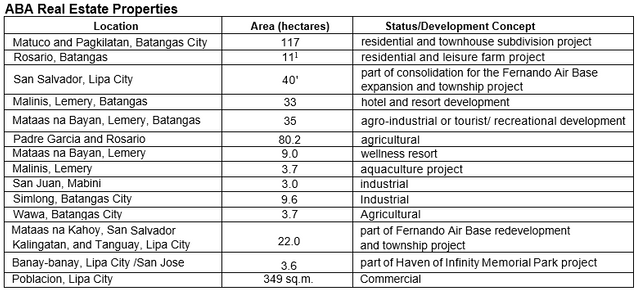

Real estate, the real estate activities of ABA are lodged mainly under Omnicor Industrial Estate and Realty Center, Inc. (Omnicor), a fully owned real estate subsidiary of PRIDE. Omnicor’s main real estate project is a residential, pilgrimage and recreation complex located in a 100- hectare plus property located in Matuco Point, Batangas City. Matuco Point lies at the southwest tip of Batangas Bay, 30 minutes drive from Batangas City proper. With a peak elevation of 180 meters above sea level, Matuco point slopes down toward white-sand beaches facing Verde Island Passage, a very special strip of sea that is home to spectacular reef formations of more than 300 species of coral and underwater rock canyons and hosts nearly 60 percent of the world's known shorefish species. On a quiet spot of Matuco Point, a pilgrimage site called Montemaria is under construction. Montemaria includes a giant 'statue of the Blessed Virgin Mary, chapels, auditoriums, retreat houses, meditation gardens, condotels and other facilities.

Gold mining, ABA holds 102 gold mining claims in San Franciso and Rosario, Agusan del Sur, and Barobo, Surigao del Sur, which are covered by Exploration Permit Application No. 000028-XIII. ABA is at present working to complete all the requirements and has assigned its gold mining rights to Abacus Goldmines Exploration and Development Corporation in exchange for P500 million worth of shares of the latter at P1.00 par value. The exchange transaction was effected in accordance with Section 40(c)(2) of the National Internal Revenue Code.

Coal mining, the company has spun off its coal mining rights per its Coal Operating Contract No. 148 with the Department of Energy (DOE) by organizing Abacus Coal Exploration and Development Corporation (Abacus Coal), a fully owned subsidiary. The coal contract covers Coal Block Nos. L38-84 to -89 and L38-249, located in Tago and Marihatag, Surigao del Sur and containing coal generally of the sub bituminous type. Production in Block No. L38-85 up to 1990 yielded 3,024 metric tons. On April 12, 2011 the Department of Energy approved the conversion of COC No. 148 from Exploration Phase to Development and Production Phase. On April 20, 2015 AbaCoal entered into a Development and Exploration Agreement with Oriental Vision Mining Philippines Corporation (ORVI) involving the development of Coal Block 85 and the exploration of Blocks 84 and 86. Upon signing of the agreement ORVI paid AbaCoal advance royalty of Ten Million Pesos (Php10,000,000). On March 16, 2016 Environmental Compliance Certificate (ECC) was received only for the proposed South Surigao Coal project located within COC No. 148 at Sitio Mimi, Barangay Layog, Tago, Surigao del Sur. For the other projects, AbaCoal is still completing the post-approval requirements prior to actual operation, namely, the ECC and the Clearance from the National Commission on Indigenous Peoples.

Leasing of gaming equipment, at present ABA owns a 4.89% stake in Pacific Online Systems Corporation (POSC), a publicly listed lessor of online betting equipment for lotto operations. POSC and PCSO have entered into a Supplemental Agreement to their Equipment Lease Agreement (ELA) to extend the term of the ELA by one (1) year from August 01, 2018 to July 31, 2019. POSC currently leases to PCSO an online network of approximately 4,500 betting terminals selling various lottery games operated by PCSO. Total Gaming Technologies Inc, POSC's 99-percent owned subsidiary, leases to PCSO an online network of approximately 1,500 betting terminals which the latter uses for its Keno games. POSC has been a systems provider for the PCSO since 1996.

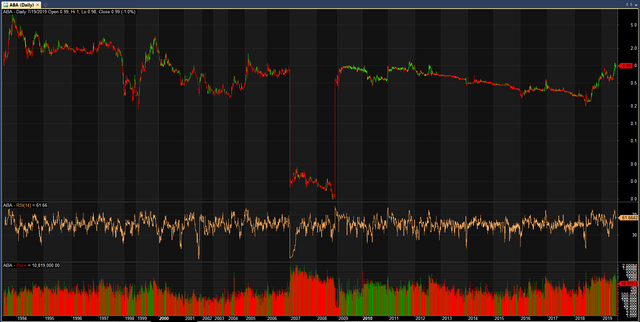

My Technical Views

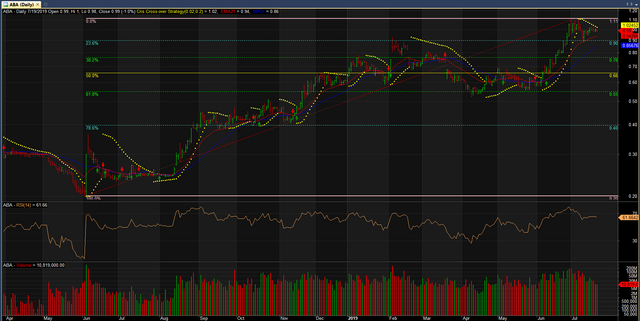

Based on the charts above, my current support price at 0.20 on 5-Jun-2018 and resistance at 1.11 on 01-Jul-2019 is a decent upward trend in the span of a year. The parabolic SAR pointing downward although RSI14 at 61.66% seems to me that the correction is underway. It is wise to accumulate at 0.55 – 0.76 price range as after all the hypes this stock might touchback in my second support level at 0.52.

Conclusion: With the landbank of more than 371 hectares and ABA’s so diversified real estate portfolio like the residential/commercial buildings, warehouse, agricultural and entertainment amenities that gives additional and sustainable future value to one’s long-term investment.

DISCLAIMER: I'm not a Certified Financial Planner. Published herein is my personal opinion and should not be construed as a recommendation, an offer, or solicitation for the subscription, purchase or sale of this security.